Spent Autocatalyst Recycling

In-depth research and analysis from experts

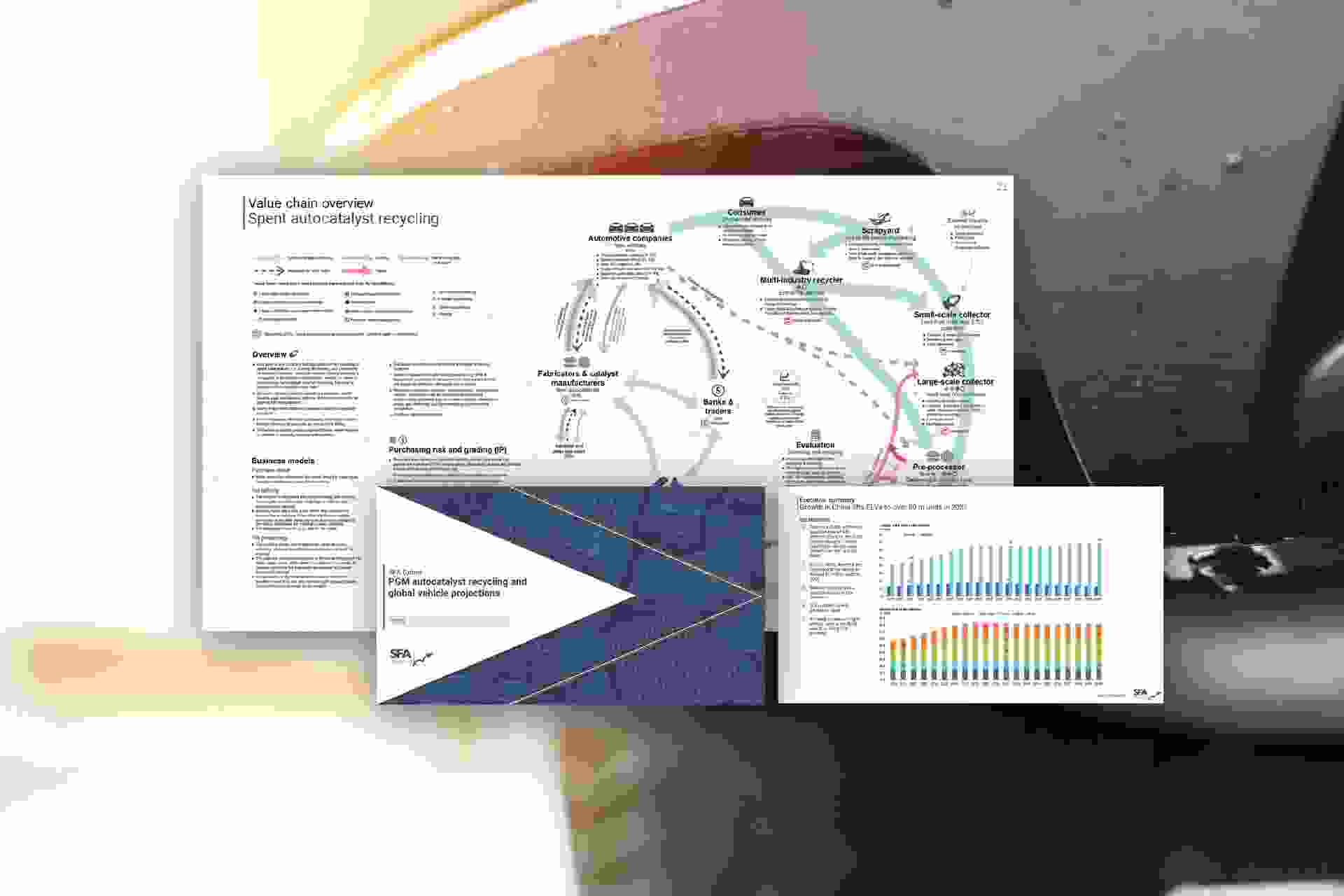

SFA (Oxford) can provide unrivalled business intelligence and market analysis of the spent autocatalyst recycling market. The team has completed a comprehensive evaluation of recycled autocatalysts from scrapyards, collection, decanning, smelting and refining players, new technology developments and business economics. For more than a decade, we have tracked the development of PGM usage and subsequent PGM scrap generation in the autocatalyst (as well as jewellery, electrical and electronic) sector, enabling us to provide a comprehensive independent review.

Spent autocatalyst recycling mapped and analysed: 2022 Update

This new edition updates SFA (Oxford)’s previous ground-breaking PGM autocatalyst recycling report with our latest analysis and commentary on:

-

Discussion of the current market situation.

-

Indicative splits of costs and margins.

-

Forecasts of global and regional autocatalyst recycling.

-

Description of major players.

Furthermore, the report includes:

-

End-of-life vehicle projections by region.

-

Scrapped autocatalyst PGM loading projection to 2040.

-

A more detailed look at autocatalyst configurations as emissions legislation has tightened.

-

Projection of global SiC catalyst volumes fitted to vehicles to 2040.

-

Latest forecasts of global and regional autocatalyst recycling out to 2040 for platinum, palladium, and rhodium.

-

China’s PGM recycling potential.

-

Examination of USA autocatalyst imports by company and source of autocatalysts (region).

Contact us for a discussion on your specific requirements and how SFA can augment your strategy

+44 (0)1865 784 373

info@sfa-oxford.com

Spent autocatalyst recycling mapped and analysed

Our understanding of the regional and global recycling infrastructure, the main players in the value chain, new vehicle production rates, scrappage and collection rates, and current and future emissions legislation enables us to effectively model the secondary PGM supply from autocatalysts. This allows us to contextualise both the risks and opportunities for the PGM recycling sector.

SFA's analysis of autocatalysts and our assumptions are underpinned by data on vehicle production, sales, trade, age distribution, collector locations and vehicle parc, as well as an understanding of historical, regional catalyst introduction and associated changes in loadings. This analysis has enabled us to model and define, by region, the existing and potential future volumes of PGMs and associated ceramic components available for recovery and recycling out to 2040.

Who should read this report?

-

Scrap yards, collectors, decanners, smelters and refineries seeking to gain a competitive lead and source new spent autocatalyst recycling feeds.

-

New business entrants that require business strategy, investment timing, long-term risks and opportunities, and an independent view of the global spent autocatalyst recycling market.

Live Q&A with the analysts

-

Our PGM recycling report is supported by a video call, most often hosted through MS Teams, which is led by Beresford Clarke, along with our team of expert PGM analysts to highlight the key market aspects and address any further questions you may have.

Contact one of our team for more details

Beresford Clarke

Managing Director: Technical & Research

Dr Ralph Grimble

Operations Director

Lee Hockey

Precious Metals Expert

Jamie Underwood

Principal Consultant

Alex Biddle

Senior Mining Analyst

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Other PGM market reports

Explore other reports our clients use regularly.

Attend our next PGM event

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.