The squeeze is on: Managing the margins

Chrome, basket price and all things nice

10 September 2024

Managing the margins

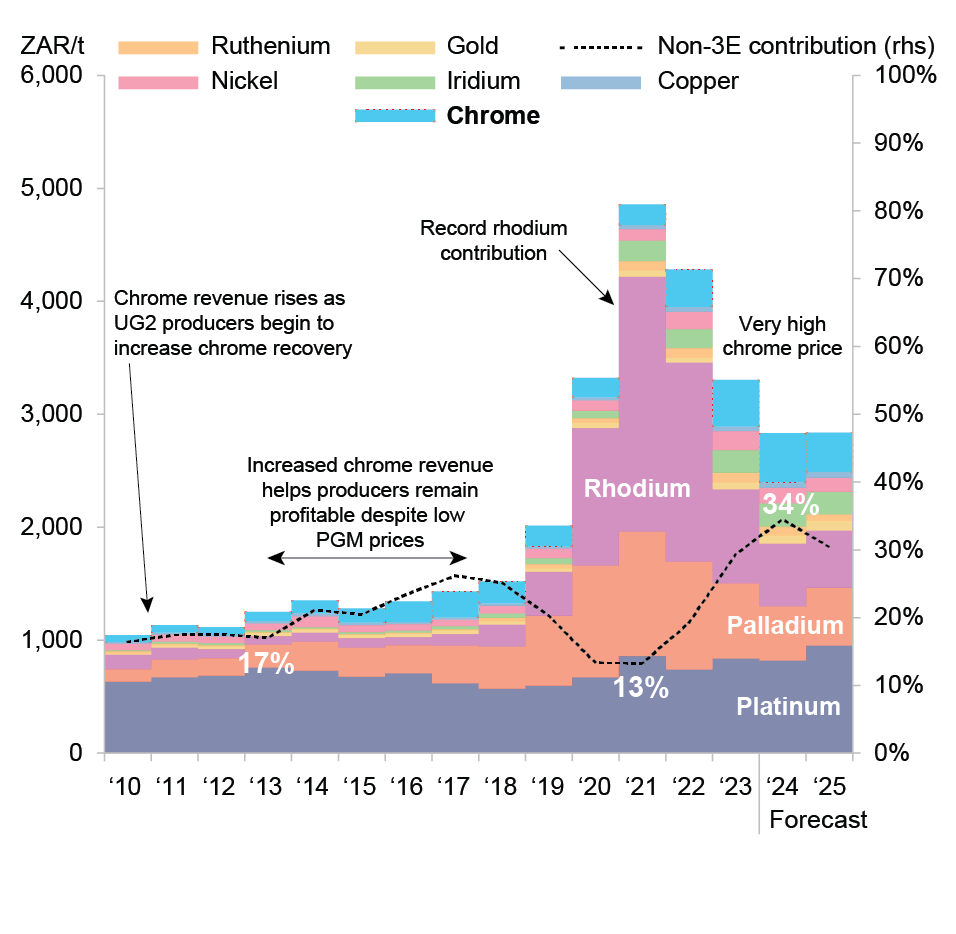

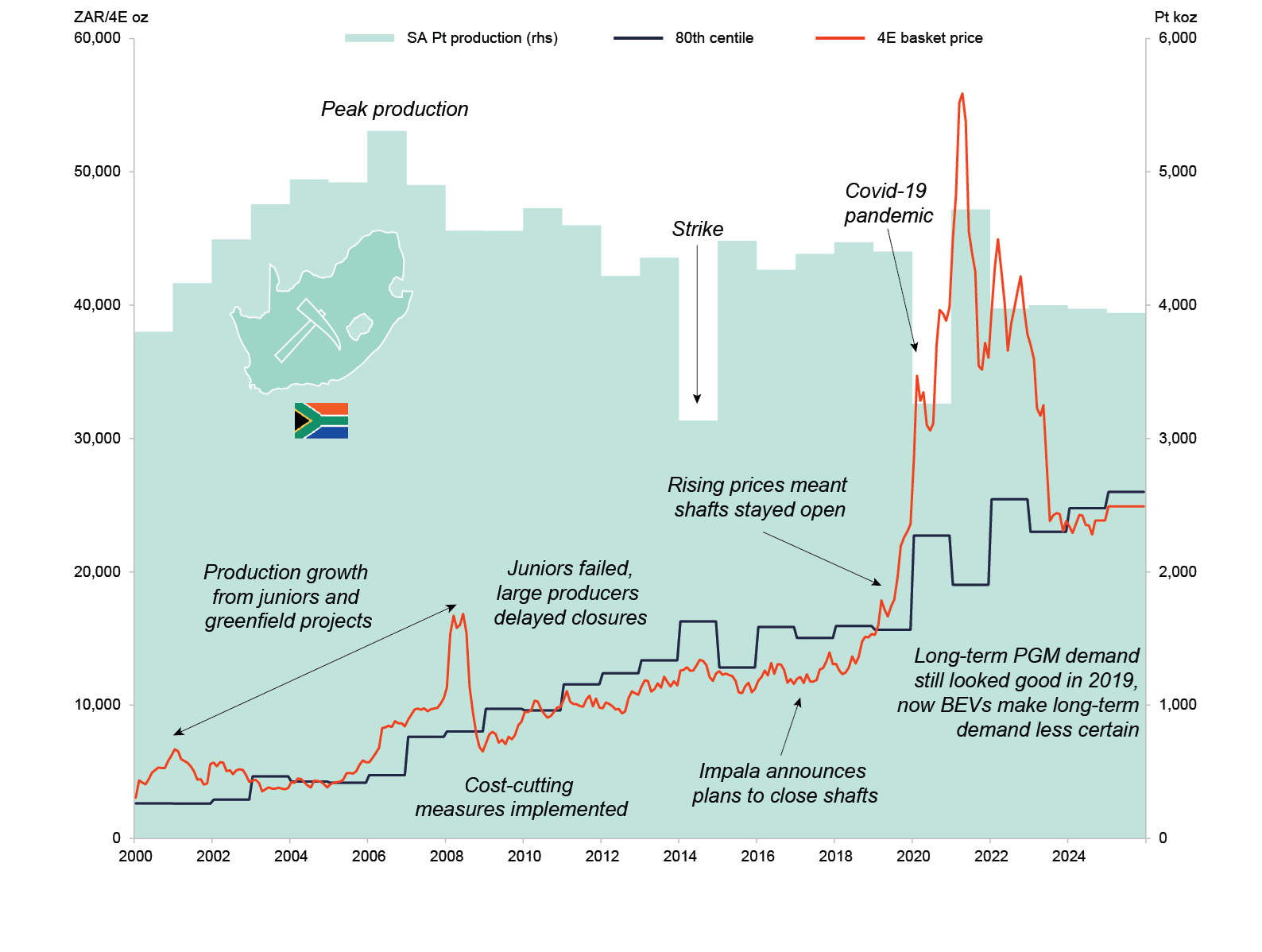

PGM miners’ revenues have collapsed with the fall in palladium and rhodium prices and this, combined with steep mining cost inflation over the past five years, has dramatically reduced margins and made the highest-cost mining areas loss-making. For South African miners, the bulk of the revenues come from the three main PGMs, platinum, palladium and rhodium. However, the ore bodies mined host a variety of precious metals and base metals in varying proportions. The little-mentioned chrome that is recovered from UG2 ore and UG2 tailings has become an increasingly important contributor and is now the fourth-largest source of revenue.

South Africa PGM mine revenues per tonne 2010-2025

Source: SFA (Oxford). Note: 3E is platinum, palladium & rhodium.

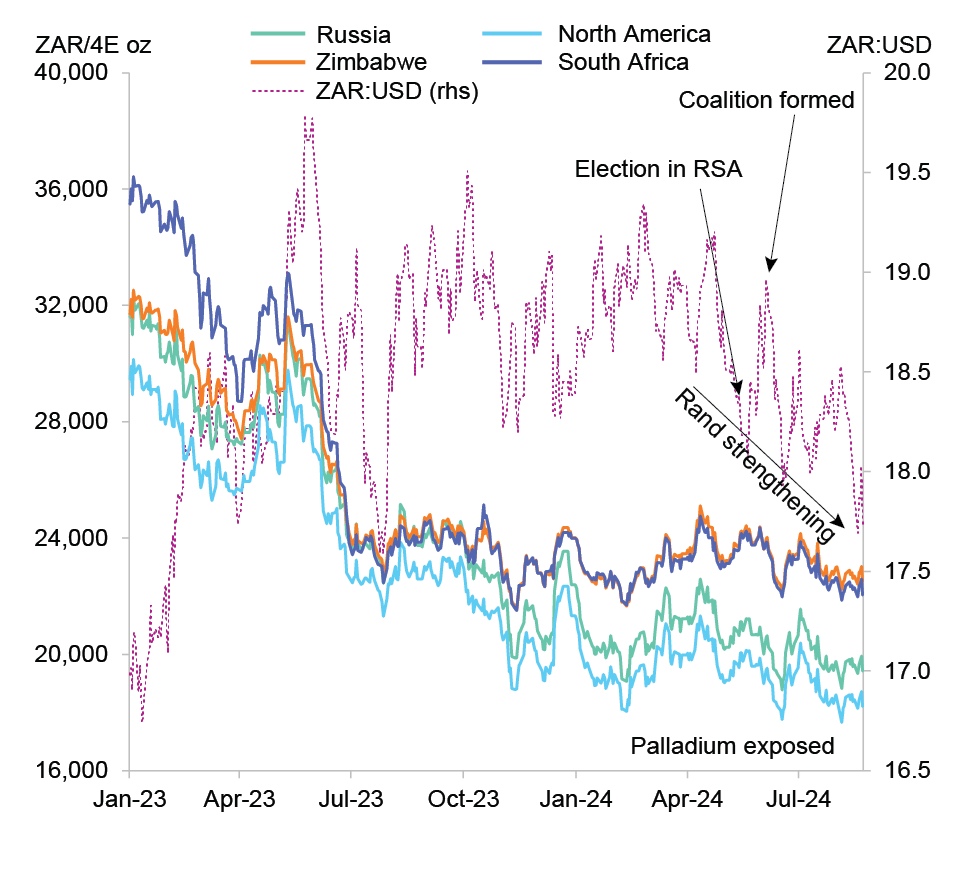

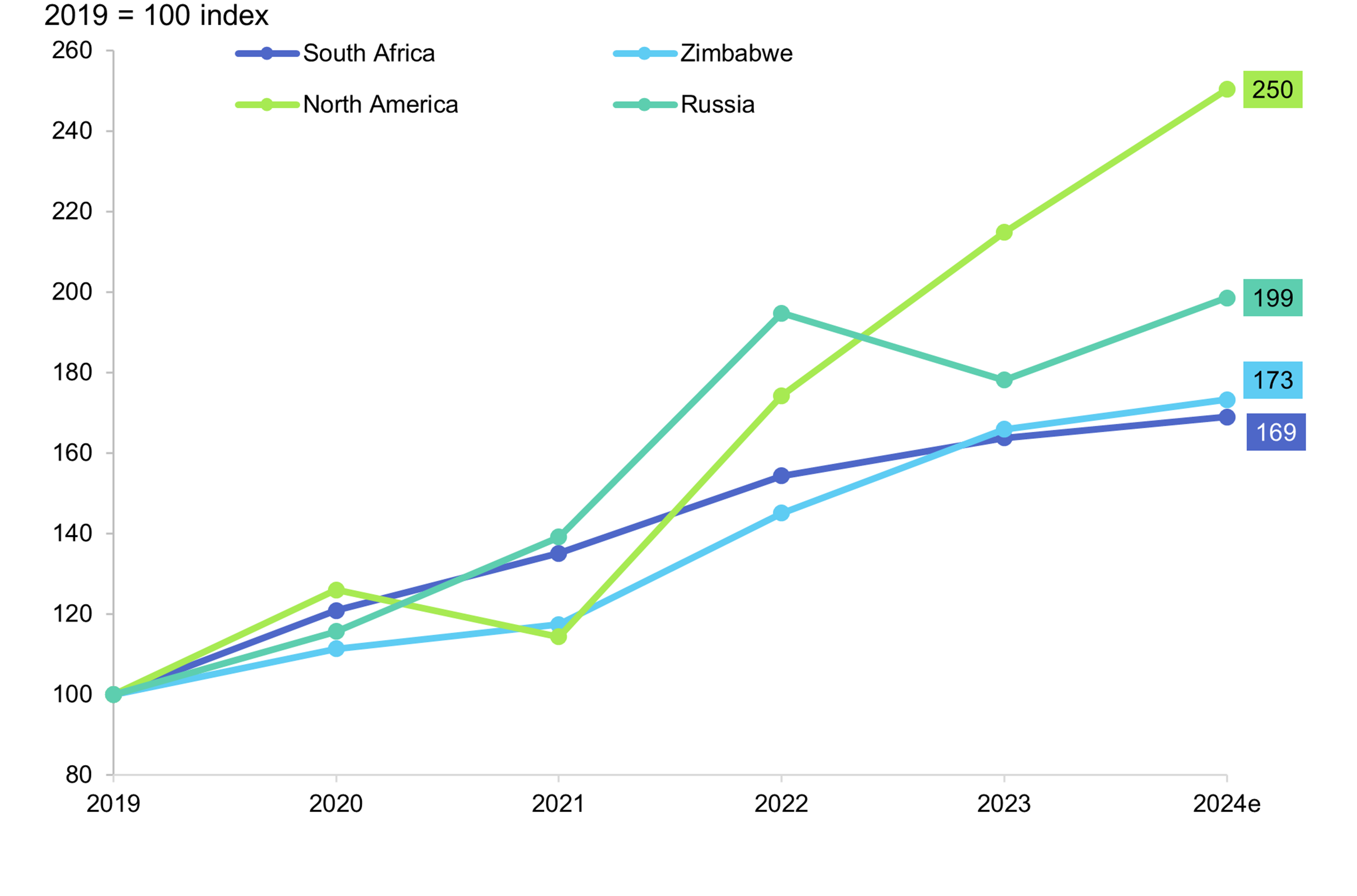

Producers in South Africa have begun to implement cost-cutting measures which have had a limited impact on mine output so far, with most efforts being directed at reducing capital expenditure, overheads and other business costs, with natural labour attrition and voluntary retrenchments where possible. North American production is heavily weighted towards palladium (almost 80%) and cost inflation has been significant there as well. Some cost-saving initiatives have been implemented but with little impact on near-term production. However, if prices continue to languish, further action may need to be taken.

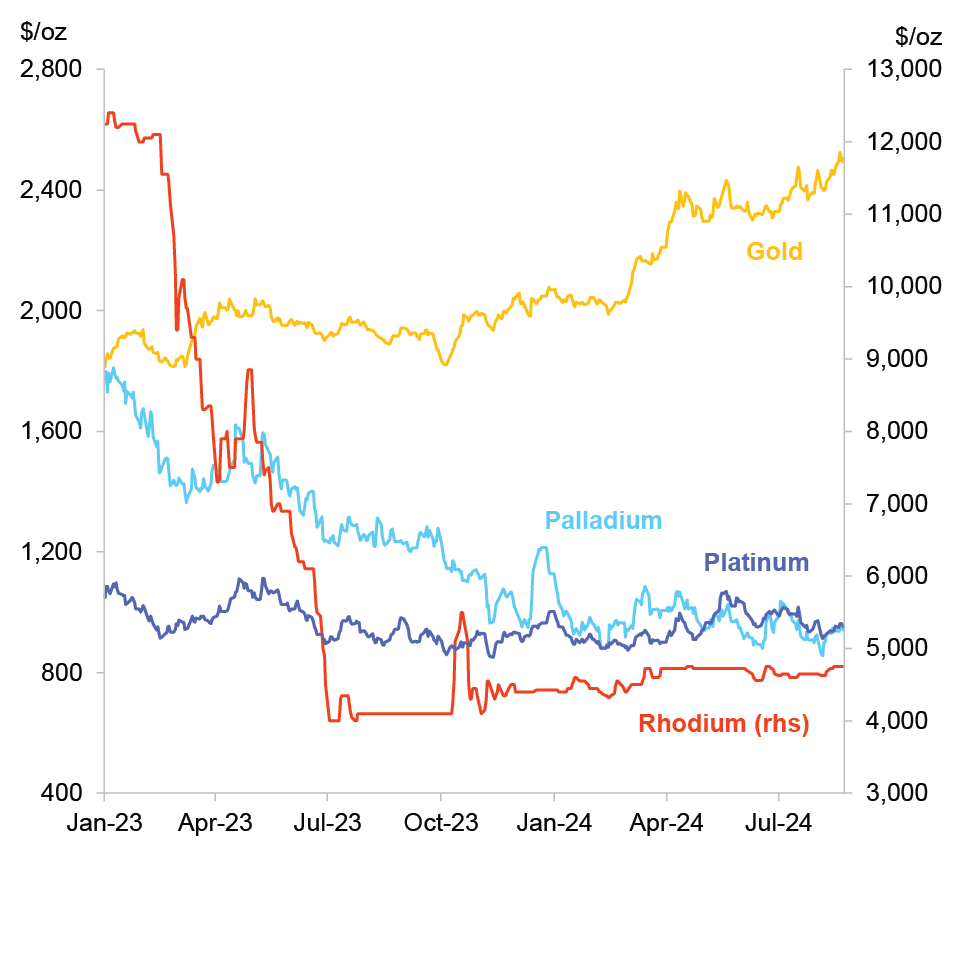

It is hard to see which metals might rally and lift revenues in the short term. PGM prices have been moving sideways to lower, and base metal prices are also falling. The economic outlook is subdued in China, with the US and European economies slowing and still at risk of recession. Automotive PGM demand may have peaked and, despite negative headlines on BEV sales momentum and rapidly rising hybrid sales, BEVs are still taking market share from combustion engine powered light-vehicles. The copper price remains relatively high but it makes too small a contribution to overall revenues to help, and chrome is also not far from historical highs with perhaps more downside potential than upside. Gold may be best positioned to make further gains but, unfortunately, a record gold price offers only marginal help since gold represents ~2% of total revenues.

South African mine production is almost two-thirds UG2 ore by tonnage. The UG2 Reef is more exposed to palladium and particularly rhodium prices than the Merensky Reef and, hence, has seen a relatively larger revenue decline on a 4E basis. Strong chrome prices have, however, assisted some of the miners that recover chrome concentrate as a by-product.

PGM 4E basket price trends 2023-2024

Source: SFA (Oxford), Bloomberg

4E constituents' price trends 2023-2024

Source: SFA (Oxford), Bloomberg

Rhodium prices have stabilised at around $4,700/oz, but that is a drop of 61% since 1 January 2023 and 84% from the record $29,800/oz in March 2021. Palladium prices have fallen by 47% over the same period, and by 70% from the peak of $3,177/oz in March 2022. At the same time, the platinum price is down by just 5% since the start of 2023. A weaker rand is typically accompanied by a lower platinum price, but over the last two years while the rand has weakened the platinum price has held up much better than this relationship would imply. The rand has strengthened somewhat over the last few months helped by the formation of a coalition government, which included the more business-friendly Democratic Alliance, as well as a much more stable electricity supply situation. As the link to the platinum price has weakened, this may not offer much support.

The gold price is at a record high and could go higher based on the economic and geopolitical backdrop. With ongoing wars in the Middle East and Eastern Europe, the situation is more fraught than usual. Economic fragility remains a factor, with the Chinese economy struggling with the aftermath of a real-estate bust, low growth in Europe and an uncertain situation in the US which is likely to prompt the Federal Reserve to cut interest rates at its September meeting. That could weaken the dollar and continue to support the gold price.

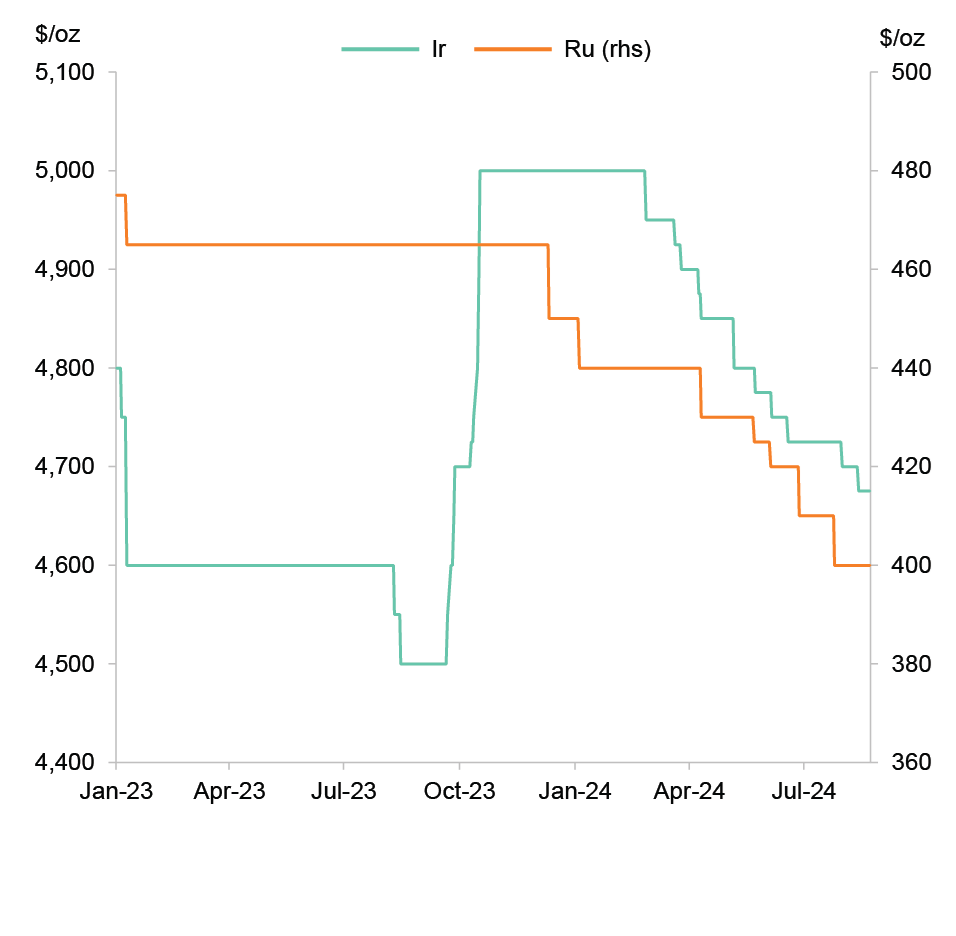

Iridium and ruthenium are minor contributors to revenues even at what are relatively high prices by historical standards. Iridium prices have been slipping this year as the expansion of the hydrogen economy and green hydrogen production using PEM electrolysers has been slower than anticipated. Economic conditions may need to improve for OEMs to enter the market to secure metal for the hydrogen economy, tighten the market and lift the price.

A recovery in electronics demand and growth in data storage is supporting ruthenium demand in hard disks as the transition to non-ruthenium-containing technologies continues to be quite gradual.

Ruthenium and iridium prices 2023-2024

Source: SFA (Oxford), Bloomberg

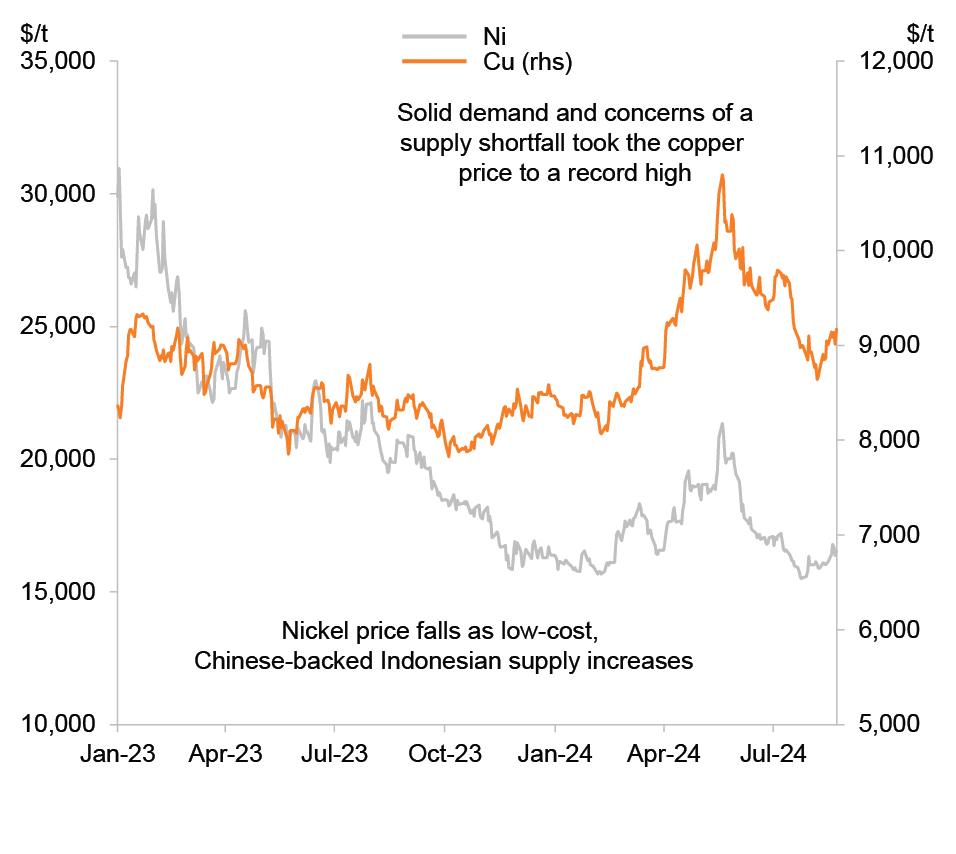

Chinese investment in Indonesian nickel production has turned Indonesia into the largest producer of nickel. The surge in lower-cost nickel from Indonesia has flooded the market and led to a decline in the nickel price. Even with some loss-making production in other countries being shut down, the market looks likely to be in surplus for some time which could keep the price subdued.

Concerns over market deficits saw copper prices reach record levels earlier this year. However, with lacklustre growth in China amid an ongoing slowdown in real estate construction, the price has fallen back but remains high relative to historical real prices ($5,000-6,000/t).

Nickel and copper prices 2023-2024

Source: SFA (Oxford), Bloomberg

Chrome is the final by-product that can be produced from the UG2 Reef but it often receives less attention than the other metals. However, it has become an increasingly important source of revenue for South Africa’s PGM miners, now being the fourth-largest contributor to revenues.

This contribution can vary considerably per operation however, depending on chrome offtake contract terms and chrome recovery plant ownership structures. At over $300/t, chrome ore prices are at a historically high level. China is the largest producer of ferrochrome in the world, having overtaken South Africa, whose historically large ferrous smelting industry has shrunk significantly following years of steep electricity price increases. Consequently, South African exports of chrome ore to China have increased and the Chinese market plays a significant role in setting the price. Chrome ore imports by China have grown by over 50% in a decade, from 12,062 kt in 2013 to 18,333 kt in 2023, with South Africa its most important supplier.

Chrome ore prices and Chinese port stocks typically have an inverse correlation. Chrome ore stocks hit a low point in mid-2023 which helped to support a price above $300/t. However, stocks have been rebuilt and are in the middle of their typical range, while the price is still above $300/t, suggesting there could be some more price downside. If prices were to fall, UG2 production relying on chrome revenue to stay profitable could become even more marginal.

Chrome Ore Price

Source: SFA (Oxford), Bloomberg

80th centile net total cash costs incl. SIB vs. SA 4E basket price

Source: SFA (Oxford), Bloomberg. Note: SIB is stay-in-business capital expenditure.

Since 2019, total operating costs for mines have increased by 69% in South Africa. Cost pressures will continue so even if there were to be a recovery in the basket price next year, producers could still have loss-making output from the highest-cost areas. If the chrome price were to fall, that would reduce the viability of the higher-cost UG2 areas on the Western Limb. The question then is: how much longer will losses continue before companies have to address loss-making production?

Taking Impala Platinum as an example, with revenues under pressure from falling PGM prices in the mid-2010s, it took several years to progress from cutting CAPEX to announcing major shaft closures that would occur in two to three years' time. Luckily, PGM prices recovered before the closures were made. However, at that point BEVs were a novelty with tiny sales figures and the outlook for PGM demand appeared robust as emissions standards continued to be tightened. Now, however, BEVs are a significant and growing part of light-vehicle sales and the future of continued growth in palladium and rhodium demand from gasoline autocatalysts is now much less certain. Whether that will induce a faster response this time remains to be seen, as all producers are acutely aware of the impact on unit costs of having to cover a large fixed-cost base with fewer production ounces.

North American operations could be under more immediate pressure as palladium is around 80% of production and still represents over 70% of revenue at the current price. North American mines saw very high cost inflation of 30.9% year-on-year in 2023, mainly at Stillwater, while at Impala Canada costs also increased significantly. In 2023, Stillwater mine was just profitable on an operating basis, but a large SIB component resulted in losses during a challenging year. Impala Canada has had its mine life shortened and Sibanye-Stillwater is taking steps to reduce capital and operating costs at Stillwater. The situation has not improved in 2024 with the palladium price falling further, meaning additional action will be required to stop the cash burn.

Compound regional y-o-y cost inflation TCC/4E oz

Source: SFA (Oxford)

What would it take for PGM prices to rise and improve profitability? If primary supply cuts at scale are not forthcoming, then demand needs to improve. Apart from what has already been legislated, significant further tightening of vehicle emissions standards appears unlikely, so the sales of combustion engine-powered vehicles need to increase. A soft economic landing with lower interest rates, more affordable cars, higher consumer confidence and a continued shift in the recent trend to purchasing PHEVs over BEVs might do it. However, this also requires continued subdued PGM supply from the recycling sector, which is not a given if PGM prices start rising again.

The Palladium Standard

The article above is an extract from SFA's annual publication The Palladium Standard. In alignment with New York Platinum Week, this year's edition has just been released. The full publication can be downloaded via the link below.

Discover more PGM market intelligence

At the core of SFA (Oxford)'s business is bespoke consulting. SFA has for over 20 years held a reputation as a platinum group metals industry authority. Our understanding of the dynamics of PGM supply and demand is unrivalled, having fostered relationships with its most significant players across the globe, working alongside each one in partnership to enrich its individual business case, independently and in complete confidence. We provide detailed, tailored assessments of strategic investment opportunities using our extensive industry knowledge to evaluate the impact of the challenges affecting the industry.

Brought to you by

Dr Ralph Grimble

Operations Director

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.