Decarbonisation drives PGM demand

The hydrogen society

15 May 2020

The hydrogen society: Decarbonisation drives long-term PGM demand

Introduction

Interest in hydrogen as a source of clean energy is growing globally, with applications in land transport, heavy industry, stationary power, aviation, shipping, and beyond. Used as a fuel in a fuel cell system, the only by-products of the reaction are electricity, heat and water, so it can play a substantial part in improving local air quality and helping to avert global warming. To decarbonise these downstream end-uses, the carbon intensity of hydrogen production upstream must be cut substantially from today’s levels.

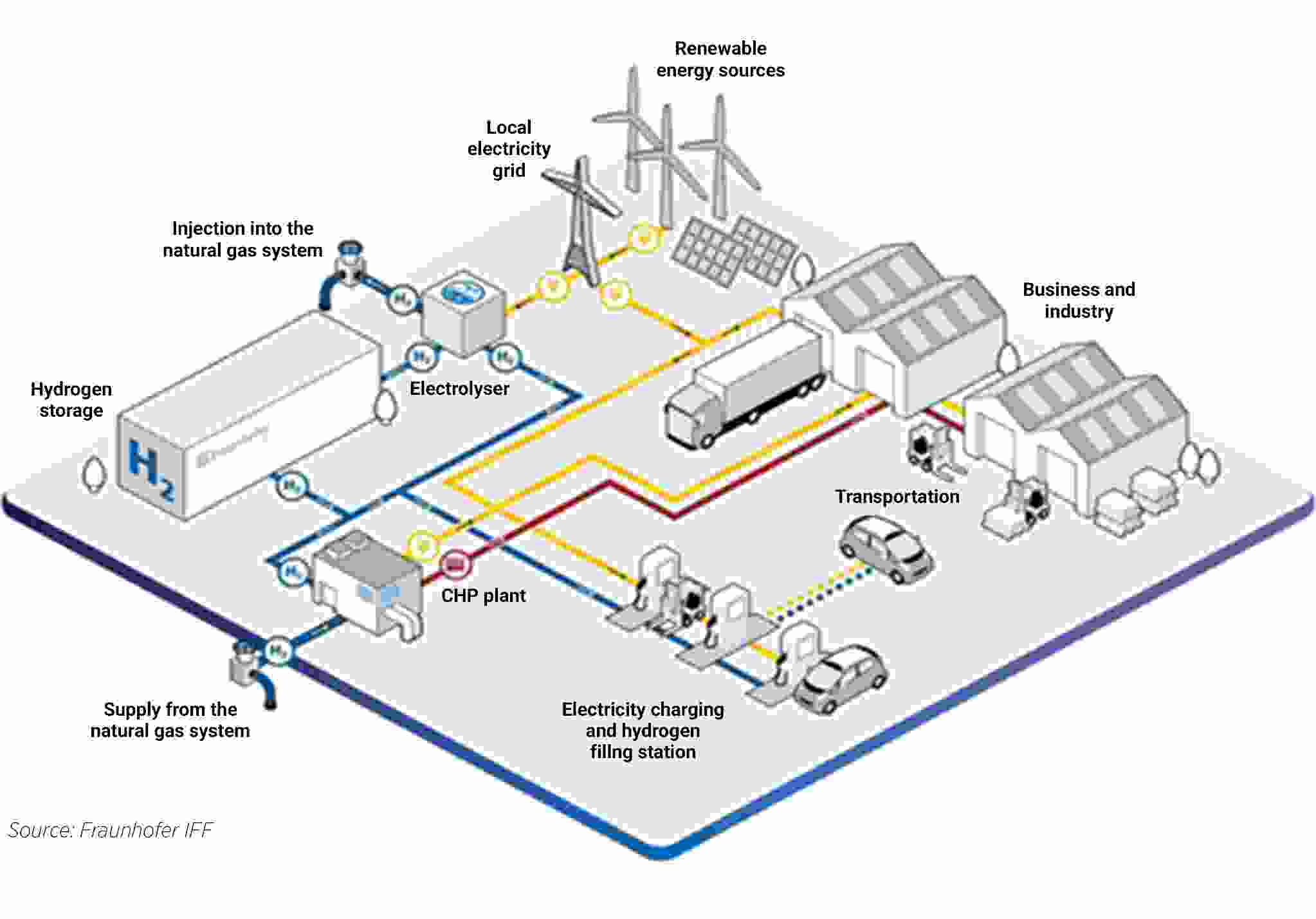

Using renewable electricity, such as from wind or solar, to power an electrolyser is one of the leading ways to achieve this. Electrolysis uses electricity to split water into hydrogen and oxygen. The hydrogen can then be stored and used to power a fuel cell vehicle, a stationary fuel cell system, or for power-to-other applications, such as power-to-heat, power-to-liquid fuels. Hydrogen shows great promise as a way of getting the most out of abundant but highly variable and intermittent renewable energy sources. Ever-closer integration of renewable energy and electrolysers is expected going forward.

Author: Dr Jenny Watts

Head of Hydrogen and Clean Energy

SFA (Oxford)

Fuel cell electric vehicles (FCEVs) are co-existing, not competing, with battery electric vehicles (BEVs). Uptake is driven by emissions legislation, covering greenhouse gases such as CO2 and criteria pollutants such as NOx. Within the next ten years, many countries and cities will enact legislation that bans, or at least severely limits, the sale or use of internal combustion engine (ICE) vehicles.

CO2-neutral transport will only be realised through either BEVs or FCEVs using zero-carbon electricity and hydrogen produced via ‘green’ electricity. Both have advantages and disadvantages, depending on customer use patterns, distances travelled, loads carried, and access to fuelling infrastructure by region, and are expected to remain complementary to meet global transport needs.

Electrolyser capacity is essentially the enabling technology that needs to be in place – to provide green hydrogen fuel – before FCEV sales can grow significantly.

SFA (Oxford) now includes electrolyser demand modelling with other fuel cell applications, by taking a view of electrolyser capacity in place and under construction, along with estimates of the capacity needed to contribute to energy policy targets.

The graphic representation below gives an impression of the integrated, networked nature of the ‘hydrogen society’.

This is the decade for establishing hydrogen technologies

Many countries and regions are setting targets for 2030, with correspondingly detailed action plans from numerous companies – production capacity build, investment from public and private sources – that aim to take advantage of the opportunities to deliver on these targets.

Many countries also have rather more ambitious, if less specific, plans to completely decarbonise by 2050, which provides the electrolyser and fuel cell industry with a long-term goal and supports ongoing government and private funding of development projects.

PGM demand in the hydrogen society is likely to be driven in the near term by the need to build electrolysers, some of which rely on PGM catalysts, to produce zero-carbon hydrogen, which can then be used as the fuel in PGM-catalysed fuel cells to power light- and heavy-duty vehicles, and in stationary and other industrial end-uses.

Electrolysers (some technologies of which use PGMs) can be used to produce hydrogen for several industry sectors: transport (where there is already a strong PGM connection), industry (steel, chemical) and the gas supply grid (heating, commercial and domestic use).

Building the hydrogen fuelling infrastructure

The importance of this technology from a PGM perspective is expected to come initially from electrolysers, then increasingly from heavy-duty vehicles, and finally from rapid growth in the market for fuel cell light vehicles, once the fuelling infrastructure is in place. Current forecasts, even for heavy-duty vehicles where there is more near-term potential than there is for light-duty vehicles, suggest a very small market during the 2020s. For FCEVs to become credible, they must achieve the same fast fuelling and long range as fossil-fuelled vehicles and the same low emissions at the point of use as BEVs, all at a competitive cost. Automakers need a viable hydrogen fuelling infrastructure before they can fully resource the development of such competitive fuel cell vehicles.

PGMs are used as catalysts in some electrolysers and some fuel cells, for the same reason as in autocatalysts and industrial chemical processes, to ensure more efficient chemical reactions. As these technologies travel the long road from limited-scale prototypes to high-volume commercial production, their potential impact on PGM demand will be closely watched, along with any news of reduced PGM loadings, or even partial substitution, which will help to achieve cost-effectiveness.

Put simply, electrolysers are essentially the reverse operation of a fuel cell, whereby passing an electric current through water, a membrane and an electrolyte separates the water into hydrogen and oxygen. There are likely to be considerable economies of scale, certainly in the production of components that can be used in both electrolysers and fuel cells, and this may favour the adoption of the technologies that can be used in electrolysers and fuel cells, such as proton exchange membrane (PEM), which is the leading user of PGMs in this sector. Indeed, some of the promising technologies under development are reversible, increasing flexibility and lowering costs.

The highly dispersed fuelling infrastructure required for personal mobility in fuel cell light vehicles is very different to the much more concentrated infrastructure required to fuel heavy vehicles such as delivery wagons, buses and trains. These vehicles typically run on much more limited, defined routes and hence they can rely on far fewer, though perhaps larger, fuelling stations, initially tipping the cost and scale balance in hydrogen’s favour for heavy-duty vehicles ahead of light-duty vehicles.

Longer term, automaker competitiveness may depend on the regional strategies around the hydrogen fuelling infrastructure. As automakers seek to establish a lead in technologies such as fuel cell powertrains that are currently emerging but with great future potential, they will locate R&D and production facilities where there is already some hydrogen production and a robust plan for expansion. At present, a very limited number of fuel cell light vehicles are being produced by automakers, and there is competition between some of the leading markets – Japan, Korea, Germany, the UK, California – for deliveries of these desirable vehicles.

Hydrogen as a fuel

Hydrogen contains more energy per unit of mass than natural gas or gasoline, so it is attractive as a transport fuel. However, hydrogen has a low energy density per unit volume (it is the lightest element), so compared with other fuels, higher volumes of hydrogen must be moved to satisfy the same energy demands. Fortunately, hydrogen can readily be compressed, liquefied, or transformed into practical hydrogen-based fuels that have a higher energy density.

Hydrogen significantly extends our ability to make use of globally abundant wind and solar resources, which puts hydrogen in a strong position compared to other sustainable options such as energy conservation, electrification (non-hydrogen), the use of biomass and bio-based fuel sources, geothermal energy, and fossil fuels in combination with the re-use and storage of CO2. New infrastructure and the adaptation of existing networks will be needed in parallel.

Green hydrogen – and all the other colours

Hydrogen, like electricity, is an energy carrier, rather than an energy source. While there are no harmful emissions at the point of use (if hydrogen is used to power a fuel cell), both hydrogen and electricity can come with a high CO2 footprint from upstream if they are produced using fossil fuels – natural gas, coal or oil. These associated CO2 emissions can only be mitigated by using renewable (e.g. solar, wind, tidal) or nuclear power, or fossil fuels with appropriate carbon capture, utilisation and storage (CCUS). A high proportion of the nuclear energy currently produced goes directly to electricity supply, but there is some interest in nuclear hydrogen production.

Hydrogen produced from renewable electricity is often termed ‘green’, while production of hydrogen from fossil fuels with CO2 emissions mitigated by using CCUS is termed ‘blue’. ‘Black’, ‘grey’ or ‘brown’ are used to denote production of hydrogen from coal, natural gas and lignite, respectively, each with varying environmental footprints. At this stage, ‘green’ hydrogen is still generally the most expensive, but the Hydrogen Council states that once the installed capacity of water electrolysis exceeds 70 GW, estimated to be in the mid- to late 2020s, then ‘green’ hydrogen will be as cheap as ‘brown’ hydrogen.

Hydrogen society costs will fall rapidly with electrolyser capacity scale-up

Hydrogen can be more cost-competitive with fossil-based fuels if more financial value is given to environmental benefits, particularly to climate-change mitigation (source: IEA, 2017/2020). One of the key levers to unlocking the hydrogen economy is producing large-scale, low-carbon hydrogen at a reasonable cost.

Before hydrogen costs can come down, so must electrolyser equipment costs; electrolyser manufacturers are now gearing up fast to increase their production capacity. Electrolyser production costs have a high elasticity. Producing ten times the capacity is estimated to reduce the price to half, while producing 100 times the capacity will reduce the cost by 75% or more, according to estimates from Hydrogen for Climate Action (EU).

Electrolyser installations, producing hydrogen commercially, are ramping up fast in early markets, with installed capacity sub-100 MW but expected to reach around 1 GW by 2025. The picture overleaf shows a typical PEM electrolyser in a modular format which can conveniently be scaled to meet end-users’ needs.

Source: ITM Power

Most estimates of electrolyser capacity are ‘top-down’, based on national/sub-continent government studies attempting to forecast the electrolyser capacity required to meet decarbonisation targets and the cost at which this hydrogen must be produced to compete with incumbent fossil fuels. In such plans, there is generally little detail on the technological approach to achieve this. The energy input is not always detailed either; while some of the electrolyser capacity addition will come from zero-carbon renewables, much of it, certainly in the earlier years, is likely to involve carbon-capture activities to mitigate the CO2 emissions from fossil fuels involved in the production of hydrogen. Hydrogen for Climate Action (EU) even describes its own 80 GW target as “an arbitrary, but very substantial figure”. Such numbers tend to come from modelled estimates of bringing the cost of green hydrogen down to a level competitive with other fuels, and modelled estimates of the cuts to CO2 output required to reduce the threats of global warming.

Coming from a ‘bottom-up’ approach, individual company contract awards and installations are proudly announced, often with substantial investor involvement and frequently involving a consortium of companies providing production and market expertise. Some electrolyser companies are single-technology, while others are running multiple technologies, so announcements may sometimes be ambiguous on the technology to be deployed.

SFA’s first platinum demand forecast in electrolyser and fuel cell market – growing fast in the late 2020s

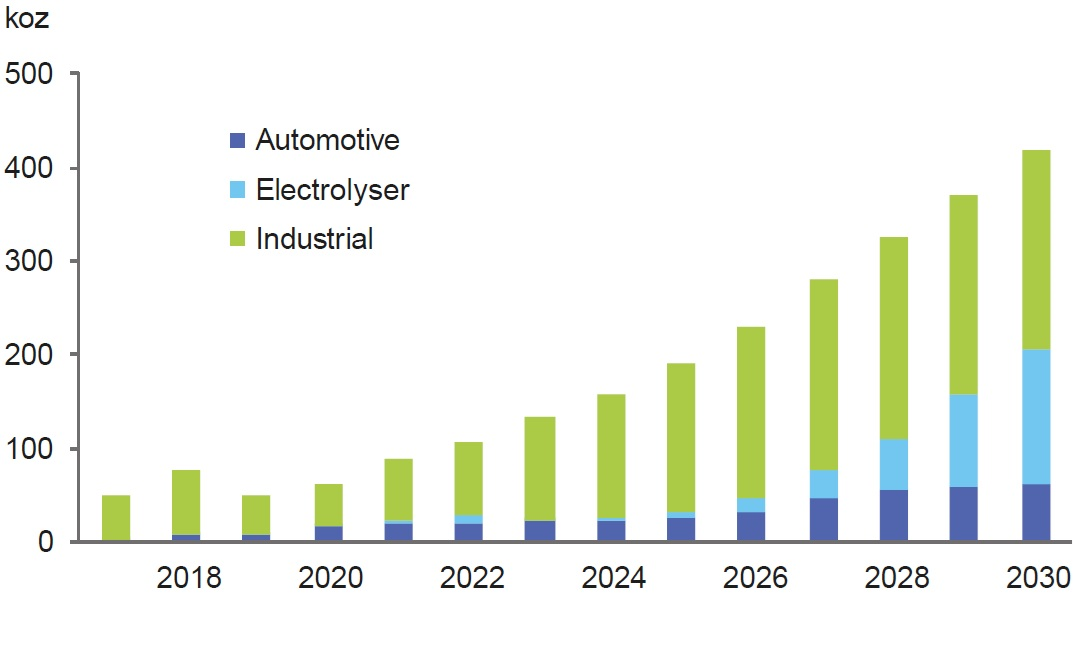

Over the next five years, we expect to see a steady building of the foundations for demand, leading to fast growth in the late 2020s. Overall platinum demand in all electrolyser and fuel cell technologies is estimated to be around 60 koz in 2020, but to reach significant levels, compared to other areas of industrial demand, approaching half-a-million ounces by 2030.

The chart below shows the estimated size of the fuel cell vehicle (on-road, light- and heavy-duty), electrolyser for hydrogen production and industrial (including non-road vehicles such as trains and materials-handling equipment, plus stationary) platinum demand over the next ten years.

The automotive estimate is based on vehicle production forecasts, fuel cell technology choices, currently known loadings, and expectations of substantial thrifting as vehicle production increases.

SFA’s approach to electrolyser demand modelling is to look at ‘bottom-up’ installed capacity/order books and ‘top-down’ views from the energy policy world of the capacity needed to avert global warming. That gives a very wide range of possible demand and growth, with a middle way taken for this summary chart, to which an estimate of the PEM share of electrolyser is applied, and then estimates applied of the current platinum loadings and expected thrifting ahead.

Platinum demand: fuel cells

Source: SFA (Oxford)

Disclaimer, copyright & intellectual property

SFA (Oxford) Limited has made all reasonable efforts to ensure that the sources of the information provided in this document are reliable and the data reproduced are accurate at the time of writing. The analysis and opinions set out in the document constitute a judgement as of the date of the document and are subject to change without notice. Therefore, SFA cannot warrant the accuracy and completeness of the data and analysis contained in this document. SFA cannot be held responsible for any inadvertent and occasional error or lack of accuracy or correctness. SFA accepts no liability for any direct, special, indirect or consequential losses or damages, or any other losses or damages of whatsoever kind, resulting from whatever cause through the use of or reliance on any information contained in the report. The material contained herewith has no regard to the specific investment objectives, financial situation or particular need of any specific recipient or organisation. It is not to be construed as a solicitation or an offer to buy or sell any commodities, securities or related financial instruments. The recipient acknowledges that SFA is not authorised by the Financial Conduct Authority to give investment advice. The report is not to be construed as advice to the recipient or any other person as to the merits of entering into any particular investment. In taking any decision as to whether or not to make investments, the recipient and/or any other person must have regard to all sources of information available to him. This report is being supplied to the recipient only, on the basis that the recipient is reasonably believed to be such a person as is described in Article 19 (Investment professionals) or Article 49 (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005.

© Copyright reserved. All copyright and other intellectual property rights in any and all reports produced from time to time remain the property of SFA and no person other than SFA shall be entitled to register any intellectual property rights in any report or claim any such right in the reports or the information or data on the basis of which such reports are produced. No part of any report may be reproduced or distributed in any manner without written permission of SFA. SFA specifically prohibits the redistribution of this document, via the internet or otherwise, to non-professional or private investors and accepts no liability whatsoever for the actions of third parties in reliance on this report.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.