Mexico’s lithium nationalisation

Contract-based model is unlikely to repel industry participation in Latin America

02 March 2023

Public-private joint ventures sought to lead lithium value chain development

In April 2022, the Mexican president, Andrés Manuel López Obrador, introduced a law to nationalise lithium in Mexico. On 18 February 2023, the president signed a decree to accelerate the nationalisation process, giving responsibility to the Energy Ministry.

The law includes the formation a decentralised State company, LitioMX, commissioned to develop the value chain of lithium supply to battery materials in Mexico. LitioMX will formally enter into operations on 24 February 2023 by a decree signed in August 2022. LitioMX is designed to function through partnerships with public- and private-sector companies. It is expected that partnership agreements will include at least 51% ownership to LitioMX.

In the February announcement, the Mexican president established 234,855 hectares in Sonora, where the vast majority of known lithium resources in Mexico are located, as mining reserve zone under control of the Energy Ministry. The only advanced lithium mining project in Mexico is Ganfeng Lithium’s Sonora project, which has a total resource estimate of 8.8Mt LCE resources, out the total known 9Mt LCE resources in Mexico. The decree will not affect rights and obligations of existing mining concessions in the mining reserve zone.

A key aspect of Mexico’s lithium supply business cases lays in the United States (US) Inflation Reduction Act (IRA) and Mexico’s membership to the United States-Mexico-Canada agreement (USMCA). A trade dispute between the US and both Mexico and Canada resulted in January this year in favour of Mexico and Canada to be considered within US car-content rules and to benefit from duty-free shipping, giving incentives to manufacturers to make auto parts in USMCA member States. For instance, Tesla’s announced Gigafactory in Nuevo León involves a host of Tesla suppliers locating in Nuevo León all with the intention to supply a plant that could provide auto-parts to Tesla’s Austin Gigafactory, which includes batteries, or sell a share of its output in the US EV market without any hindrance to IRA-related benefits.

Furthermore, Mexico is implementing considerable infrastructure changes in its northern region. Within its ‘Sonora Plan’, the government deployed a 1 TWh/y solar energy plant, is assessing another five solar energy plant projects, and is upgrading two ports and the electricity transmission grid. Cost reduction is also supported by Mexico’s labour costs that are a fraction of those in the US.

Dr Emilio Soberón

Principal Consultant

Source: SFA (Oxford)

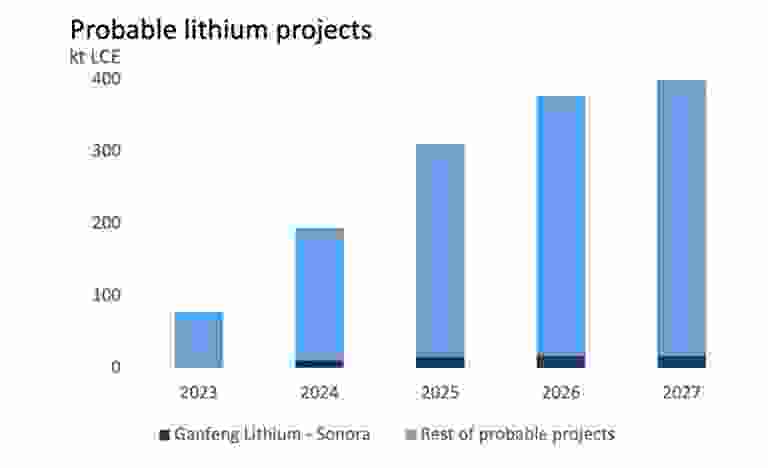

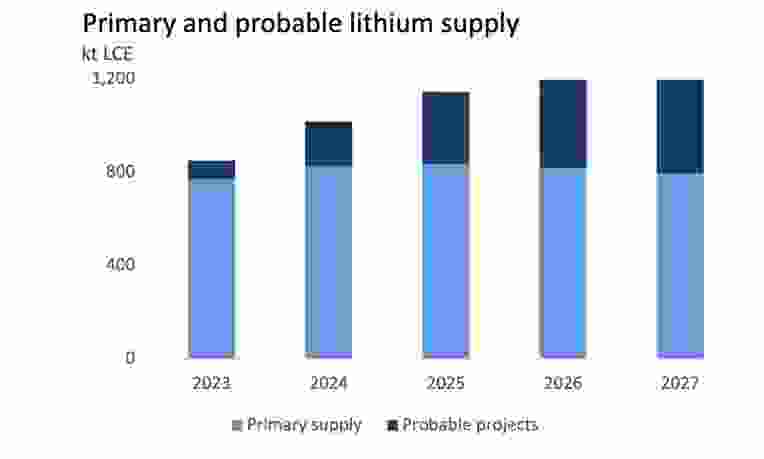

Note: SFA estimates that Ganfeng Lithium’s Sonora project will account for 4.5% of probable projects in 2027. Probable projects will represent a third of likely supply in 2027, which in SFA evaluations exclude higher-risk projects.

Public-private partnerships

The minority stake in partnerships with LitioMX, who is expected to retain 51% ownership in joint-ventures developed with private-sector companies or foreign governments is a key concern for the development of Mexico’s lithium value chain. De-risking measures as selection rights in board of directors or contract-clauses that establish operational governance control over stake ownership levels need to be considered to mitigate governance volatilities induced by national politics, and to ensure that expertise and knowledge from parties joining LitioMX in a JV is transferred and utilised optimally.

Even with a minority stake in JVs, entrants will benefit from effects brought by the US IRA. Duty-free exports to US and Canada and a strategic look on the automotive industry within the USMCA agreement, means that components of batteries can be considered in US car-content rules and thereby be attractive for US automotive OEMs. In this regard, US National Laboratories are assisting the Mexican government in developing its lithium resources. The scope of this relation is likely to revolve on technology transfer for exploring and processing clay resources. Clay resources in Mexican northern states have the same geological formation than resource found in Nevada, where US National Laboratories have R&D projects for commercial production of lithium materials.

The range of segments that LitioMX is expected to operate in the value chain is not yet fully detailed. Automotive OEMs will not be considered in the partnership scheme and will be left untouched. However, further clarification of how further downstream the involvement of LitioMX goes remains to be announced. It is expected that red-lining will comprise at least lithium exploration, lithium raw materials production and lithium materials conversion and refining. SFA considers that pCAM and CAM manufacturing is likely to fall within the LitioMX partnership scheme as long as facilities are not integrated in automotive OEM plants. LitioMX is expected to provide tax incentives and other forms of benefits as capex and production incentives to lure companies – however, these are not confirmed and are not expected to be in the position to compete with the US IRA.

South American parallels

The Chilean case for lithium mining concessions is in some instances similar to the approach that Mexico is taking on its lithium resources. In Chile, lithium is not eligible for mining concessions since 1979. SQM and Albemarle, having obtained mining concessions before the 1979 law, remain unaffected. For other players, the route for extracting lithium is through a contract called CEOL, or Special Contract for Lithium Operation, which is tendered by the government and signed by the president. Provisions of CEOLs are unclear and the only one given until 2021 when congress aimed to deblock the sector fell in the hands of the State copper company CODELCO. Hence, a partnership with CODELCO is the simplest way to mine lithium in Chile. The most advanced junior in the country, Salar Blanco in the Maricunga Salt Flat, is a JV between Lithium Power International and CODELCO.

Bolivia’s governance scheme differs by giving all lithium ownership to the State. Bolivia requires private-sector companies to partner with the State, who retains ownership and control over lithium assets. Recently, a CATL-led consortium was awarded a tender for the production of lithium materials in Bolivia, with close involvement of the Bolivian State.

These two examples show that even with strong State presence and delegation, industry is willing to engage with Latin American governments for the production of lithium resources through joint ventures. SFA estimates that the current high lithium prices and the IRA umbrella over Mexican trade prospects, will incentivise players to seek developments in Mexican lithium assets.

Challenges and prospects

Barriers to Mexican lithium supply remain in exploration processes led by LitioMX, qualities of lithium clay resources and industry sentiments to minority stakes in partnerships with a public-sector company. SFA considers that the majority of private-sector investments in lithium mining and refining and battery component manufacturing in Mexico will namely come from Asian players in attempts to tap into the US EV market via nearshoring. Price corrections can affect cost-benefit of producing lithium materials from clay resources, but its overall effect will depend on the evolution of costs for clay processing technologies balanced with tax benefits in US and Mexico and lower energy and labour costs in Mexico.

Brought to you by

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.