Russian action in Ukraine

The impact on Nickel

09 March 2022

Nickel parabolic as conflict leads to colossal short squeeze and suspension of trading

Initial takeaways:

-

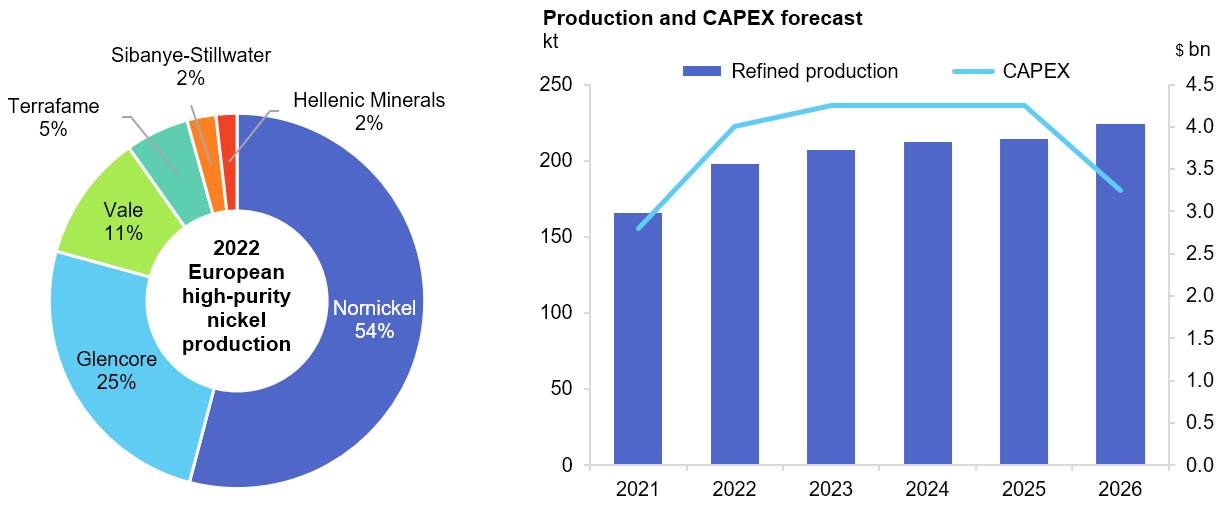

Russia is the largest producer of nickel in Europe with refined output predicted to be ~200 kt this year (26% of global Class I primary production). Curtailment of Russian supply would have significant ramifications, particularly in Europe as Nornickel produces 54% of the regions high-purity nickel and EU countries import 54 kt (50%) of the company’s Kola MMC production and 13 kt (38%) of production from Harjavalta.

-

Previous US sanctions on Russia have not been aimed at Nornickel or nickel. So far in response to Russian actions regarding Ukraine, the US, the UK and EU have not targeted Nornickel or nickel. However, the next escalation of sanctions from the West could target nickel in some form.

-

China will likely still purchase nickel from Russia, for use in both stainless-steel and batteries. In theory, in the event of sanctions from Western countries impacting nickel exports from Russia, China could absorb all of Russia’s nickel output.

-

No fundamental impact on the market balance is expected, as Nornickel continues to supply metal to established customers. The impacts are more geographical, with a re-routing of trade flows.

-

The LME suspended trading yesterday until 11 March 2022 at the earliest, after the nickel price hit $100,000/t in Asian hours this morning, with it being evident that the situation in Russia and Ukraine has directly affected the nickel market. The LME later said it would cancel all nickel transactions that had taken place earlier in the day.

-

Tsingshan is rumoured to have built a short position of c.200kt, which, if true, means the company lost up to $3bn yesterday. Jinchuan and Vale are also rumoured to hold large short positions, all of which were covered yesterday.

-

The price surge has been exaggerated by this short squeeze with a very big short (Tsingshan) and a very big long “sparring”. We expect trading to calm down again once the short squeeze has run its course, with the nickel price falling significantly, but where it falls to is another matter.

-

Institutions have been trading a price range with options, and the forced unwinding of positions has also supported the rally, with no one believing that the nickel price could go beyond $30,000/t.

-

Credit lines for some clients have been cancelled as banks have got more selective and terms for clients have become more stringent.

Russia is the largest producer of class I refined nickel, with output predicted to be ~200 kt this year (26% of global Class I primary production). Production comes from Nornickel which mines are in the Kola and Taimyr peninsulas. The processing route takes it through the Nadezhda Metallurgical Plant in the Norilsk division before matte is delivered to the nickel refinery (KGMK) in the Kola peninsula where full plate and cut cathodes are produced and service the stainless-steel, plating and alloy applications. Some of the nickel matte is delivered to the Harjavalta refinery in Finland where products that are suitable for the battery value chain are produced (briquettes and nickel sulphate), as well as full plate and cut cathodes.

Nornickel refined production forecast in 2022:

|

Product |

Kola MMC |

Harjavalta |

Battery chain suitability |

|

Cathodes |

135 kt |

18 kt |

|

|

Briquettes |

− |

37 kt |

|

|

Sulphate |

− |

10 kt |

|

Source: SFA (Oxford)

As much as 78% of Nornickel’s refined production is unsuitable for use in batteries as full plate cathodes are not cost-effective to dissolve in sulphuric acid to produce battery-grade nickel sulphate. That being said, an unknown quantity of cathode production is cut cathodes, which according to Nornickel is utilized in batteries and the chemical industry.

Nornickel produces 54% of Europe’s high-purity nickel; production is expected to grow +35% on 2021 levels.

Source: SFA (Oxford), Nornickel

Sanctions could put expansions at risk as access to capital is stifled. Planned capital expenditure is forecast at $4bn in 2022 and an average of $4.0-4.5bn per annum between 2023 and 2025. It is unclear at this time how/if sanctions will impede the planned expansions. Capital from Russian banks could be limited, but China could provide capital as it needs offtake to feed EV value chain and there could be scope for FCF to service some CAPEX requirements.

SFA forecast production (from Russian feed) to grow +35% to 224 kt in 2026. It must be noted that production in 2021 was severely affected by both flooding at two mines and a temporary shutdown of the concentrator following an incident. Production of 166 kt in 2021 was down -22% on 2020 levels. The increase on 2020 levels is approximately +5%.

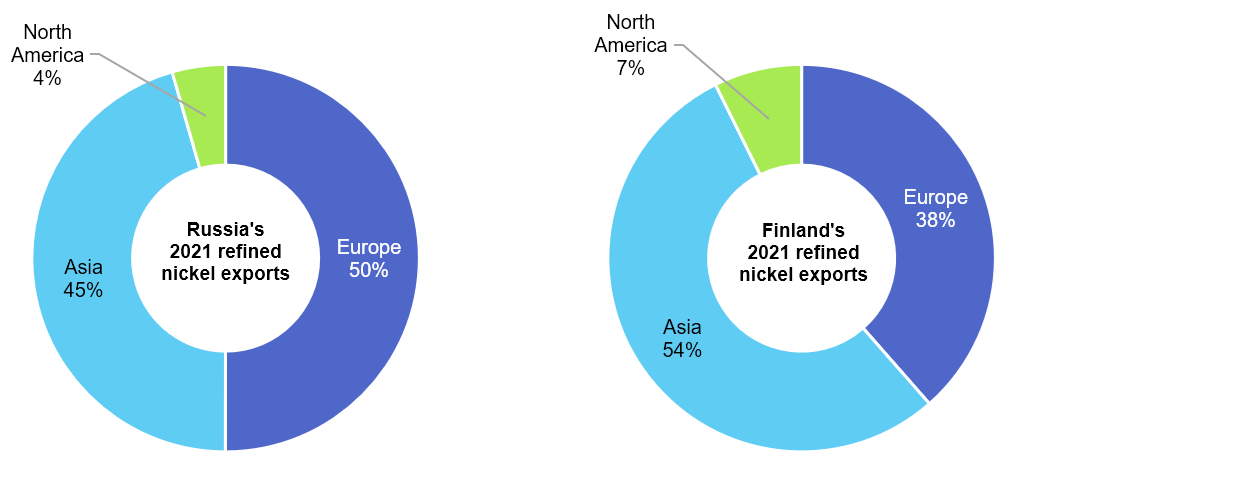

Asia and the EU are the main destinations for production from both Harjavalta and Kola

Source: SFA (Oxford)

54% of production from Harjavalta in 2021 went to clients in Asia, reflecting the fact that the majority of global pre-cursor manufacturing capacity is in this region. At present Nornickel continues to supply metal to established customers and therefore we do not see a change to our market balance forecast. The next escalation of sanctions from the West would likely target nickel in some form, but we are confident that metal would be easily re-routed. Exports to China are expected to remain unaffected and therefore metal will eventually enter the EV value chain, as most pre-cursor, PCAM/CAM and battery production is situated in China.

The strict ESG procurement protocols of Western OEM’s could cause a headache for market participants. The OEMs potential unwillingness to use Russian nickel could see increased efforts to trace the origin of the nickel back through the value chain. Fortunately, new battery-suitable supply is ramping up during 2022 in Finland (Terrafame) and Australia (BHP) which could provide nickel sulphate to Asia if clients in Japan and South Korea are unwilling to purchase products that have had any Russian involvement (we anticipate China to continue purchasing).

Due to the opaque nature of the battery supply chain it would be difficult to certify your battery “Russia free” if China is involved at any point of the chain. The alternative is to switch to LFP batteries, which would also negate the impact of elevated battery metal prices that we are seeing at present. This is highly likely to occur in base model ranges if the current market dynamics persist.

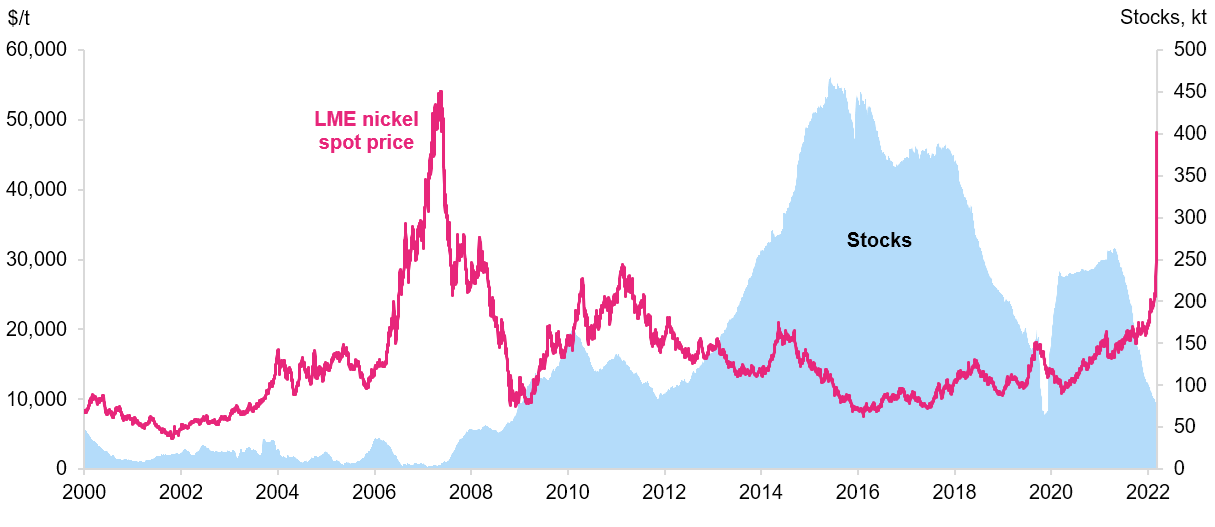

Nickel price briefly reached an all-time high, stocks at lowest levels since 2019

The nickel price has surged on concerns around Russian supply. Given Russian actions in Ukraine, the worry is that sanctions could curb nickel availability, especially nickel that is suitable for use in batteries. So far in response to Russia’s invasion of Ukraine, US and European sanctions have targeted financial institutions, defense and technology companies, and people in government and close to Putin. Energy companies have been banned from raising capital in the US and UK, but their products have not been targeted. Neither Nornickel, nor nickel, have been targeted by sanctions previously, and currently there is no suggestion that they would be included in any further sanctions. It seems unlikely that sanctions would ultimately prevent metal from leaving the country, but there is evidence to suggest that the market has become concerned.

Credit lines for some clients have been cancelled as banks have got more selective and terms for clients have become more stringent. Although there are no sanctions against it at present, there are concerns about the morality surrounding the use of metal derived from Russia and the logistics of exporting it from the country. This may force market participants to look elsewhere for metal.

LME nickel spot price and stocks

Source: SFA (Oxford), Bloomberg

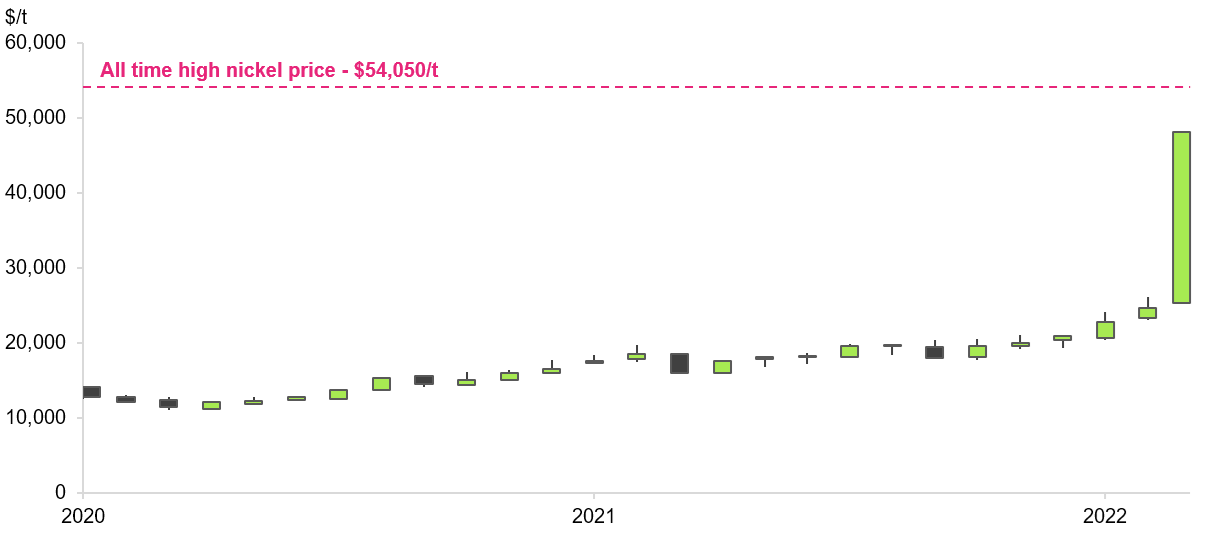

The LME has halted nickel trading after an unprecedented 250% spike in price which saw trades briefly above $100,000/t early Tuesday. The LME later said it would cancel all nickel transactions that had taken place earlier in the day. Nickel had pared some gains to trade 66% higher at $80,000 a ton before the suspension. Prices initially rallied on concerns about supply from Russia, increasing +20% across the previous week and closing on Friday at $29,609/t. The price jumped a further +163% closing Monday at $48,201/t. The 250% spike on Tuesday morning (the largest-ever on the LME) came as industrial users who had sold the metal scrambled to buy the contracts back. LME said it was considering “a possible multi-day closure, given the geopolitical situation which underlies recent price moves.” Margin calls would be calculated based on Monday’s closing price of around $48,000/t.

Monthly variance in spot LME nickel price (including high and low)

Source: SFA (Oxford), Bloomberg

Chinese entrepreneur Xiang Guangda is rumoured to have built a short position of c.200 kt through his company Tsingshan Holding Group Co., a large stainless-steel and nickel producer. If true, the company is now facing billions of dollars (~$3bn) in losses because of the surge in prices. Base metal producers Jinchuan and Vale are both rumoured to hold large short positions, of which all were covered yesterday. Financial players were net long on the LME with extremely low short positions, which has led to one large long “sparring” with Tsingshan and exaggerating the short squeeze.

In our opinion, the key driver behind the squeeze is those market participants with short positions were forced to close them out because they couldn’t meet margin calls. Tsingshan had been under growing pressure from its brokers to meet margin calls on its positions. A unit of China Construction Bank Corp., which is one of Tsingshan’s brokers, was given additional time by the LME to pay hundreds of millions of dollars of margin calls it missed Monday, and the necessary payment has now been made.

SFA (Oxford) expects trading to calm down again once the short squeeze has run its course, with the nickel price falling significantly at the same pace it has risen, but where it falls to is another matter. We suggest the price goes back to the $25-30,000/t range once the shorts’ problems are worked out. After that, it will depend on the fundamental metal demand vs supply drivers.

Disclaimer, copyright & intellectual property

SFA (Oxford) Limited has made all reasonable efforts to ensure that the sources of the information provided in this document are reliable and the data reproduced are accurate at the time of writing. The analysis and opinions set out in the document constitute a judgement as of the date of the document and are subject to change without notice. Therefore, SFA cannot warrant the accuracy and completeness of the data and analysis contained in this document. SFA cannot be held responsible for any inadvertent and occasional error or lack of accuracy or correctness. SFA accepts no liability for any direct, special, indirect or consequential losses or damages, or any other losses or damages of whatsoever kind, resulting from whatever cause through the use of or reliance on any information contained in the report. The material contained herewith has no regard to the specific investment objectives, financial situation or particular need of any specific recipient or organisation. It is not to be construed as a solicitation or an offer to buy or sell any commodities, securities or related financial instruments. The recipient acknowledges that SFA is not authorised by the Financial Conduct Authority to give investment advice. The report is not to be construed as advice to the recipient or any other person as to the merits of entering into any particular investment. In taking any decision as to whether or not to make investments, the recipient and/or any other person must have regard to all sources of information available to him. This report is being supplied to the recipient only, on the basis that the recipient is reasonably believed to be such a person as is described in Article 19 (Investment professionals) or Article 49 (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005.

© Copyright reserved. All copyright and other intellectual property rights in any and all reports produced from time to time remain the property of SFA and no person other than SFA shall be entitled to register any intellectual property rights in any report or claim any such right in the reports or the information or data on the basis of which such reports are produced. No part of any report may be reproduced or distributed in any manner without written permission of SFA. SFA specifically prohibits the redistribution of this document, via the internet or otherwise, to non-professional or private investors and accepts no liability whatsoever for the actions of third parties in reliance on this report.

Brought to you by

Beresford Clarke

Managing Director: Technical & Research

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.