PGM Market Outlook Report to 2040

Platinum, palladium and rhodium

Our latest long-term PGM market view to 2040

As the energy transition continues, powertrains jostle for consumer adoption, but in the current tough retail environment, understanding the timing and scale of the recovery of PGM demand is critical for confident strategic decision-making. Furthermore, the global average PGM basket price received by mining companies is now more than 50% below the peak of 2022, leaving mines having to adapt to survive. With producers undergoing a tough economic climate, what is the long-term impact on PGM supplies? As EV battery and hybrid vehicle performance develops further, what does SFA expect the powertrain landscape to look like, and how might this impact PGM suppliers and metal prices?

Listen to SFA's view on the PGM markets out to 2040

Senior Mining Analyst, Alex Biddle, and Head of Clean Energy, Dr Jenny Watts, discuss the trends and events impacting the PGM markets and their possible long-term effects. The themes discussed are explored in-depth in SFA's PGM Market Outlook to 2040, which includes supply, demand, and price forecasts to 2040, supported by our expert commentary and analysis.

Discover new long-term market trends

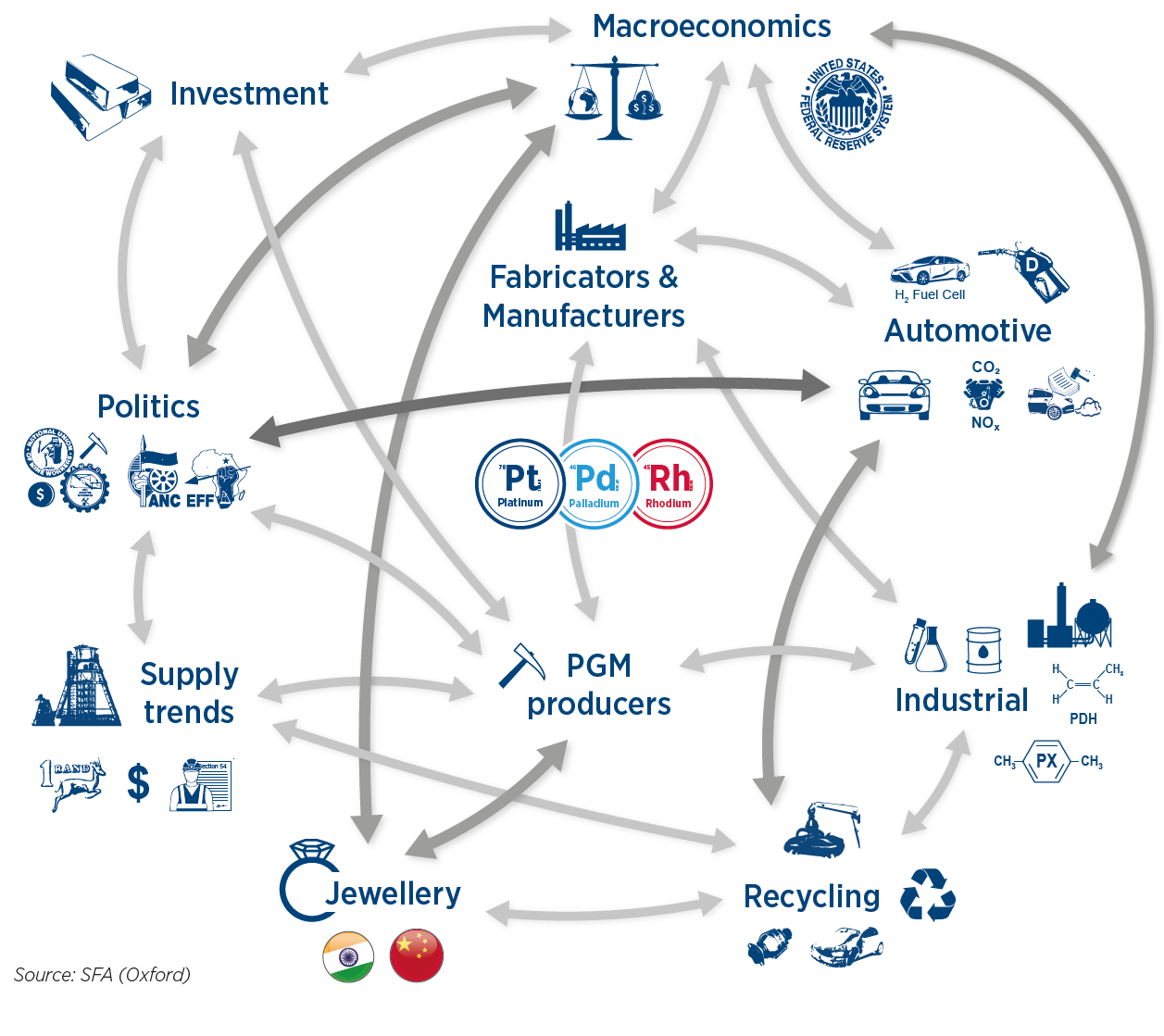

SFA (Oxford)’s PGM Market Outlook to 2040 is an in-depth, forward-looking report on the current and long-term trends and influences acting on the global platinum, palladium, and rhodium markets; it provides price direction and market trends to 2040 and is vital to understanding price risk. It outlines 2040 powertrain projections and their implications for PGM demand and examines economic strain on mining companies, and recycling volumes. It also explores hydrogen economy growth and its effects on platinum, iridium, and ruthenium, and provides alternative future scenarios for supply and demand variables.

Our report provides the necessary granular details on the trends and events influencing future supply, demand, and pricing, with insights into how falling PGM prices, stricter emissions standards, metal substitutions, electrification of powertrains, and recycling will impact demand. We also examine global supply shifts, long-term production trends, and provide detailed forecasts, including price impacts on key sectors like jewellery, industrial, chemical, petroleum, and investment.

The report addresses the following key areas:

Demand and pricing

-

Robust, economically derived, PGM price forecasts out to 2040 based on fundamental global and regional supply-demand market developments and relevant macroeconomic factors. The Board note offers an explanation of the influence of both the project incentive price and mine closure inducement price on the long-term average price, along with assumptions and calculations used to derive such logic, including an associated incentive price by project.

-

An analysis of global demand trends on a regional basis, covering the major PGM end-use sectors (autocatalysis, jewellery, glass, petroleum, electronics, chemical, nitric acid, and medical/dental) and including the investment sector (such as exchange-traded funds).

-

An analysis of global autocatalyst demand, with special attention, applied to environmental legislation affecting global emission standards, gasoline, diesel and hybrid trends, PGM loadings (thrifting) and the substitutability of platinum and palladium in this end-use sector. Future automotive developments and opportunities for PGM demand growth are also commented on, including fuel cell technology, hybrid vehicles and other alternative fuels. A breakdown of autocatalyst history/forecasts by region and associated assumptions (automobile volume and associated intensity of PGM loadings) is included.

Primary supply

-

Reports of historical, current and future producer mine supply trends for PGMs, referencing recent expansions and their deliverability, other new projects, including the junior sector coming online, and projects shelved or postponed. PGMs produced as by-products of base-metal mining are also considered.

-

A comprehensive explanation of the long-term cost of producing virgin metal, considering regional cost and profit dynamics (South Africa, Zimbabwe, USA, Canada, Russia). Production profiles, costs, and margins are projected to assess short-, medium-, and long-term profitability. Mines that do not have PGMs as their primary output but which are, nevertheless, substantial PGM producers are also included in our analysis.

-

Producer profiles, using a consistent framework for comparison based on cash costs and excluding capital, financing and depreciation/amortisation charges. The basic cost measurement reflects primarily physical production costs and includes other cash costs incurred, being mainly corporate overheads, marketing and royalties, etc. Costs are calculated net of the credits arising from the sale of by-products (Net TCC/4E oz). Rand currency sensitivity comments are included and key components/assumptions for the cash cost curve are defined.

Secondary supply

-

An assessment of the future potential volumes of recycling, including autocatalyst, electronics and jewellery scrapping rates. The analysis covers collection rates, types and age of scrap supply, timing, contained metal and ratios, and the business case to recycle, as well as incentive prices and impacts from price volatility.

Our detailed analysis and valuable industry insight is backed up by eleven analysts working discreetly with the industry in all areas of the value chain, whether at South African mines, valuing projects and plants around the world, working with fabricators to assess the impact of new end-uses, visiting China and Japan to investigate their jewellery markets or with corporate Boards conducting price risk analysis for multi-million dollar business decisions.

Who should read this report?

-

Commodity risk managers from fabricators, car companies, petroleum companies and other end-users, for help with assessing price volatility, price direction, or the economics and security of supply.

-

Financiers, pension funds, investors and other financial institutions needing to understand the long-term risks and opportunities in the industry, future costs of production and long-term prices for project and business valuation.

-

Miners, refiners and juniors that require long-term prices and market justification for project appraisal, investment timing, business strategy, and an independent view on the markets.

-

New business entrants.

Live Q&A with the analysts

-

Each biannual report is supported by a video call, most often hosted through MS Teams, which is led by Beresford Clarke, along with our team of expert PGM analysts to highlight the key market aspects and address any further questions you may have.

Register Your Interest

How can we help you?

Beresford Clarke

Managing Director: Technical & Research

David Mobbs

Head of Marketing

Joel Lacey

Sales and Marketing Specialist

Other PGM market reports

Explore other reports our clients use regularly.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.