Iridium and Ruthenium Market Outlook

Five-year forecast

Our latest iridium and ruthenium price risk analysis

Stay up-to-date with a quarterly 5-year view forecast report on iridium and ruthenium as SFA (Oxford) utilises its extensive expertise and knowledge of these PGMs to provide an independent quarterly view, allowing you to keep up to date with this market and highlighting technological developments and the underlying evolution of demand and end-use applications to help you make the right strategic decisions. We derive iridium and ruthenium mine production volumes and have developed detailed demand modeling of all major end-uses to provide an authoritative view of the current and future market trends.

Listen to our latest podcast episode

SFA (Oxford)'s Head of Clean Energy and Sustainability, Dr Jenny Watts, and Senior Mining Analyst, Alex Biddle, discuss the latest trends and events impacting the iridium and ruthenium markets.

The only independent iridium and ruthenium price report

In response to requests for more regular market intelligence, we produce a quarterly iridium and ruthenium market report, keeping you up-to-date with these markets. The Iridium & Ruthenium Quarterly Market Report offers an independent five-year metal price outlook to 2028 with both near-term risks and longer-term drivers of supply and demand.

Our Q3 report will augment your strategic decision-making, considering both the established industrial markets and the rapidly evolving opportunities and risks in the green hydrogen sector.

We assess the supply risks from falling PGM prices, ongoing power shortages in South Africa, and the geopolitical issues affecting Russian output, as well as opportunities for thrifting and recycling to relieve supply constraints. On the demand side, our analysis includes the influence of the worsening global macro situation, a slowdown in the growth of the hydrogen sector, and the impacts on consumer demand for iridium and ruthenium-based products and prices. In contrast, we also examine the poised return for growth in the electrical sector and how that may impact the price of these metals.

Released four times a year on a subscription basis, this is a risk-focused iridium and ruthenium market report that details on-the-horizon, price-impacting factors, offering analytical charts and scenarios providing you with a competitive edge. The report contains SFA’s hands-on, forward-looking commentary and analysis on the events and trends currently impacting supply, demand and pricing, and their market implications.

The content of each market report varies according to iridium and ruthenium industry events, market developments, and demand updates by end-use but typically, the reports will include:

-

Demand impacts and new market threats.

-

Macroeconomic outlook and impact on supply and demand fundamentals and technology, with assessments of monthly trade flow statistics of iridium and ruthenium exports and imports.

-

Highlighting positive and negative metal demand implications by end-use.

Iridium demand impacts and new market threats:

-

Iridium catalysts in proton exchange membrane (PEM) technologies are used in electrolysers to produce hydrogen from water (using electricity from renewable energy). As the market for green hydrogen develops, tracking iridium's use in PEM electrolysers and iridium loadings innovations will be critical for the cost-effective uptake to meet long-term national decarbonisation goals to cut global CO2 emissions.

-

Tracking and reporting on the evolution of iridium crucible (crystal growing) end-uses and iridium tooling equipment markets.

-

Tracking and reporting on the usage of iridium in the catalysis, biomedical, jewellery, electrical and automotive sectors.

Ruthenium demand impacts and new market threats:

-

Monitoring ruthenium catalyst demand in PEM fuel cells is also critical as this helps to deliver power from hydrogen for industry and transport, vital for high conversion rates and efficient operation. Tracking ruthenium loadings developments is critical for the cost-effective transportation uptake of fuel cells to meet as the world begins to reduce its dependence on fossil fuels, and the upcoming hydrogen economy takes off.

-

Relevant processes and technological developments in the chemicals sector from the production of chlorine, chlor-alkali and water purification.

-

Assessment of future demand opportunities in applications such as aerospace turbine blades, where superalloys are widely used, and next-generation semiconductors.

-

The impact of technology shifts and electrical application developments (higher density data storage), chip resistors (thick film, thin film) and 3D microchips on ruthenium demand.

-

Future evolution and development of industrial technologies, both emerging and in decline, and identifying where new technology may substitute or thrift current iridium and ruthenium demand.

Who should read this report?

-

Iridium and Ruthenium-/PGM-focused end-users and fabricators in need of a quarterly independent picture of the supply, demand, stocks and pricing of the iridium and ruthenium market and its evolving technologies and new applications.

-

Producers and fabricators requiring a quarterly independent review of end-use evolution, including opportunities, threats and substitutes, as well as an understanding of price risks.

Live Q&A with analysts

- Each quarterly report is supported by a video call, most often hosted through MS Teams and led by Dr Jenny Watts, to run through our latest report, and address any further questions your team may have.

Smaller end-use application impacts:

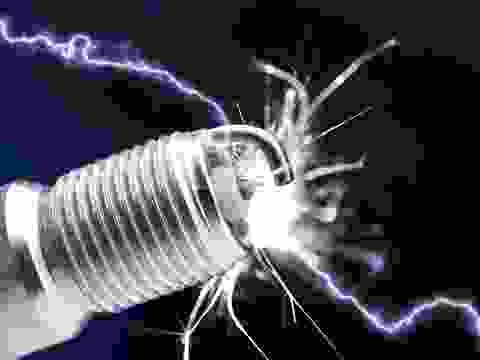

-

Other industrial end-use markets which use iridium and ruthenium such as electrical, medical alloys, reforming catalysts, spark plugs and glow plugs, fine chemicals and pharmaceuticals.

-

Legislation as a driver of demand, where it affects certain processes.

-

Companies identifying mergers and acquisitions, joint ventures and any other activities that may influence technology choices.

Mine supply and mining economic impacts:

-

Updates on the present and future stability and growth of primary iridium and ruthenium supply from the leading producers, the implications of metal supply, and estimates of above-ground iridium and ruthenium stocks.

-

The economics of primary iridium and ruthenium supply, including factors influencing cost inflation and exchange rate and volume impacts.

-

Commentary on the political and socio-economic risks impacting primary supply, including politically sensitive iridium-producing regions (South Africa, Zimbabwe and Russia).

Iridium and ruthenium price forecasts:

-

Price history and performance drivers of metal prices with a five-year outlook to 2027.

-

'What if' scenario analysis and threats to current prices (substitution and new technologies).

Request a call

To have a call with the SFA team please contact us so we can discuss your strategic needs.

Contact our iridium and ruthenium team

Dr Jenny Watts

Head of Clean Energy & Sustainability

Alex Biddle

Senior Mining Analyst

Jamie Underwood

Principal Consultant

Dr Sandeep Kaler

Market Strategy Analyst

Other PGM market reports

Explore other reports our clients use regularly.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.