Long-term PGM supply appraisal

In-depth PGM supply analysis from experts

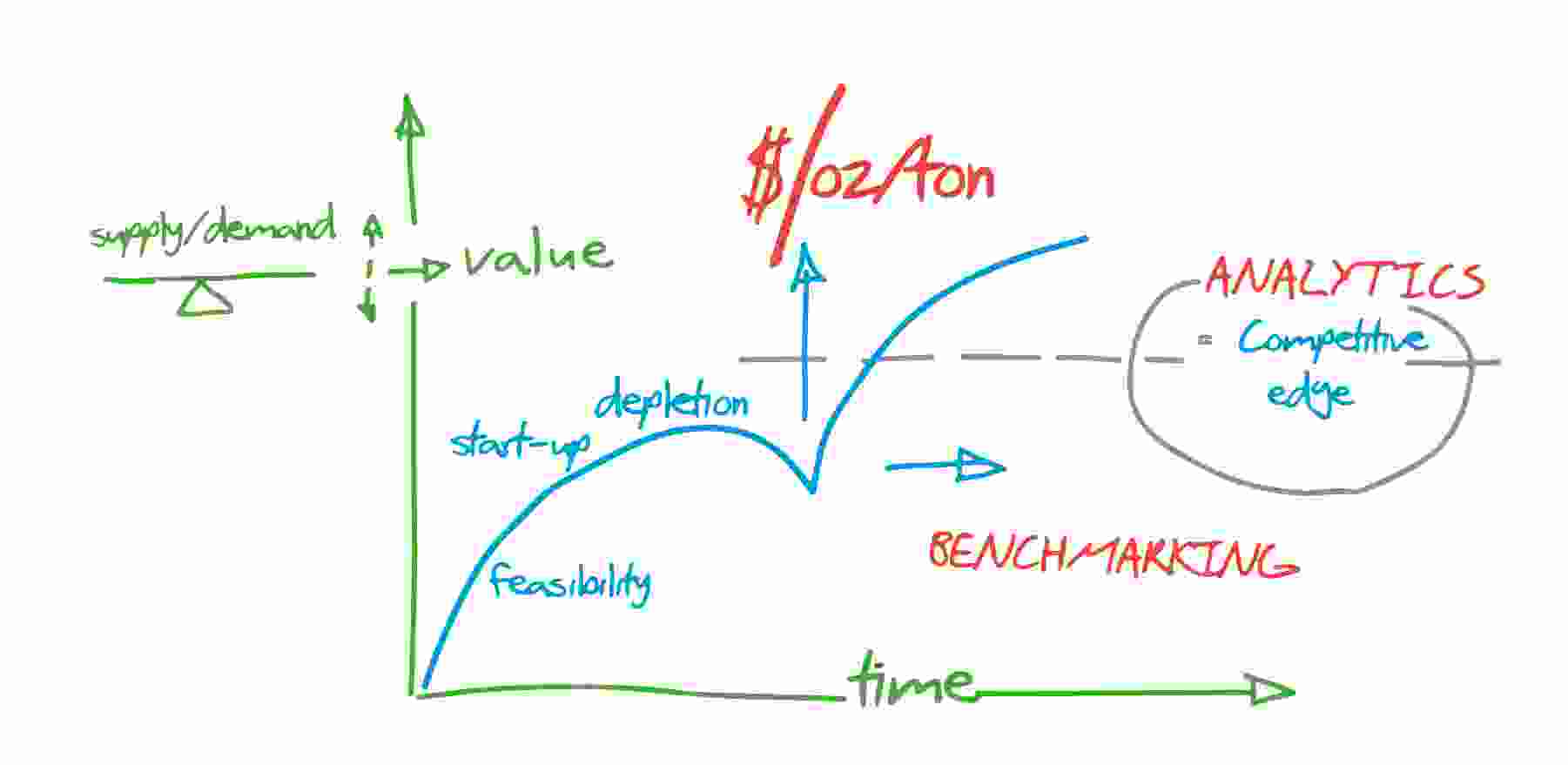

SFA (Oxford) can provide an evaluation on future supply risk from mines and projects around the world, and the economic cost of production. We can supply you with historical PGM production and supply forecasts out to 2050 by mine, for PGM products, probable and possible projects including tonnes milled and head grade. We can build a full picture of investment appeal using project incentive pricing per metal and give a detailed strategic assessment of PGM supply within both today and tomorrow’s operating environment against other global industry players and projects (majors and juniors). A multitude of factors is appraised spanning asset quality, investment appeal, value creation, future industry challenges and risks to projects going forward. SFA is highly experienced in analysing future production profiles and quantifying the long-term market impacts to the industry. Let us help you support your investment decision making and strategic optionality.

Addressing PGM supply security

SFA is highly experienced to appraise mines and projects. Our long-term supply outlook evaluates:

-

Asset quality: Ore resource potential, prill split, grade, expansion potential and life of mine.

-

Investment appeal: Critical mass, regional advantages.

-

Value creation: Production timeline, by-product yield, mining risk, operational bottlenecks and environmental risk.

-

Future industry challenges such as energy costs, wage negotiations, decarbonisation etc.

-

Favourable mining jurisdictions.

-

Risks to projects going forward.

-

Conventional and mechanised mining cost trends (OPEX and CAPEX costs).

-

Metal price forecasts.

-

NPV and cashflow analysis.

-

Identifying future economic windows for mine start-ups.

- Long-term market trends for platinum, palladium, rhodium, ruthenium and iridium.

Who should read this report?

-

Commodity risk managers from fabricators, car companies, petroleum companies and other end-users, for help with assessing price volatility, price direction, or the economics and security of supply.

-

Financiers, pension funds, investors, traders and other financial institutions needing to understand the key upside and downside price influences and trends.

-

New business entrants.

Contact one of our team for more details

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

David Mobbs

Head of Marketing

Yoshi Mizoguchi Owen

Marketing Associate: Japan

Jamie Underwood

Principal Consultant

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Lakshya Gupta

Senior Market Analyst: Battery Materials and Technologies

Thomas Chandler

Principal Lithium Supply Analyst

Ismet Soyocak

ESG & Critical Minerals Lead

Dr Jenny Watts

Head of Clean Energy & Sustainability

Dr Sandeep Kaler

Market Strategy Analyst

Other PGM market reports

Explore other reports our clients use regularly.

Attend our next PGM event

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.