The Iridium Market

Iridium price drivers

An introduction to iridium

Iridium demand is highly diversified, led by electrochemical (chloralkali process electrodes), with crucibles for melting electronic materials, catalysis and alloys with other PGMs in jewellery and medical products significant too.

Iridium has recently performed strongly and the metal is well established in several processes and components where it will be quite difficult to substitute out. However, prospective end-users remain wary of committing to a metal perceived as having limited long-term supply and a track record of volatile prices.

SFA (Oxford) is the only company in the world to have derived iridium mine production volumes and developed detailed demand modelling of all major end-uses to provide an authoritative view of the current and future iridium market.

Iridium price news and insights

SFA's expert view on the palladium price spike

18 December 2023 | Dr Ralph Grimble

The palladium price surged last week due to a convergence of positive factors. The Fed acknowledged the peak in US inflation during its press conference, leading to a more dovish outlook for interest rates and a weaker US dollar, supporting commodity prices.

What does Heraeus’ new catalyst do for Ir and Ru markets?

15 November 2023 | Dr Jenny Watts

On 14 November, Heraeus and Sibanye-Stillwater launched a new electrocatalyst for green hydrogen production by PEM electrolysis. This ruthenium-based catalyst aims to overcome PEM electrolyser industry scaling-up concerns.

Stalling BEV market share and political shifts put the EU’s ICE vehicle ban at risk

17 June 2024 | SFA (Oxford) & Heraeus

Platinum catches a tailwind from stronger rand

21 May 2024 | SFA (Oxford) & Heraeus

Solar silver demand growth to moderate this year but still hit a new record

15 April 2024 | SFA (Oxford) & Heraeus

Palladium demand supported for longer after new US emissions law changes

25 March 2024 | SFA (Oxford) & Heraeus

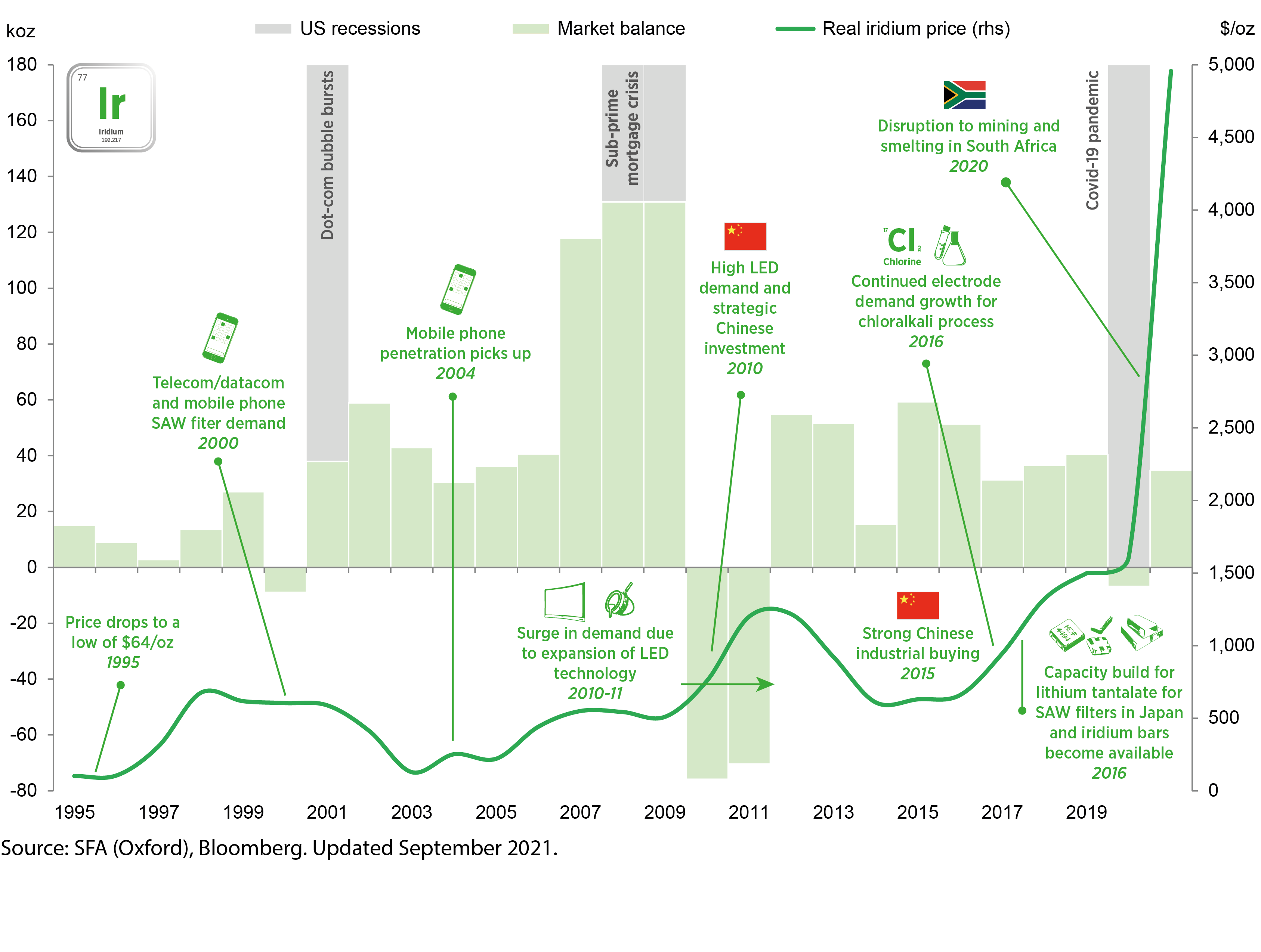

Iridium price in context, 1995 to 2021

Iridium market balance

| koz | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021f | |

| Primary iridium supply | |||||||||

| South Africa | |||||||||

| Russia | |||||||||

| Zimbabwe | |||||||||

| Other | |||||||||

| Total iridium supply | 210 | 280 | 275 | 275 | 275 | 280 | 225 | 295 | |

| Iridium demand |

|||||||||

| Jewellery | |||||||||

| Hydrogen | |||||||||

| Automotive | |||||||||

| Chemical | |||||||||

| Electrical | |||||||||

| Other | |||||||||

| Total iridium demand | 190 | 210 | 225 | 235 | 230 | 240 | 235 | 255 | |

| Iridium market balance | |||||||||

| Iridium balance | 20 | 70 | 50 | 40 | 45 | 40 | -10 | 40 | |

| Iridium price history | |||||||||

| Iridium price (USD/oz) | 555 | 544 | 575 | 896 | 1,283 | 1,480 | 1,629 | 5,075 | |

| Iridium price (GBP/oz) | 337 | 356 | 429 | 694 | 967 | 1,160 | 1,268 | 3,862 | |

| Iridium price (EUR/oz) | 419 | 490 | 521 | 792 | 1,092 | 1,322 | 1,425 | 4,288 | |

| Iridium price (CNY/OZ) | 3,424 | 3,414 | 3,829 | 6,044 | 8,536 | 10,225 | 11,220 | 32,751 | |

| Iridium price (ZAR/oz) | 6,017 | 6,917 | 8,413 | 11,934 | 17,195 | 21,379 | 26,757 | 74,685 | |

| Iridium price (JPY/oz) | 58,714 | 65,782 | 62,480 | 100,445 | 141,993 | 161,354 | 173,688 | 557,847 | |

Source: SFA (Oxford). Updated November 2021.

Linked iridium market reports

In response to requests for more regular iridium market intelligence, we now produce a bespoke quarterly iridium market report that allows you to keep up to date with this market.

Meet the Iridium team

Trusted advice from a dedicated team of experts.

Dr Jenny Watts

Head of Clean Energy & Sustainability

Lee Hockey

Precious Metals Expert

Alex Biddle

Senior Mining Analyst

Jamie Underwood

Principal Consultant

Dr Sandeep Kaler

Market Strategy Analyst

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.