The Platinum Market

Platinum price drivers

An introduction to platinum

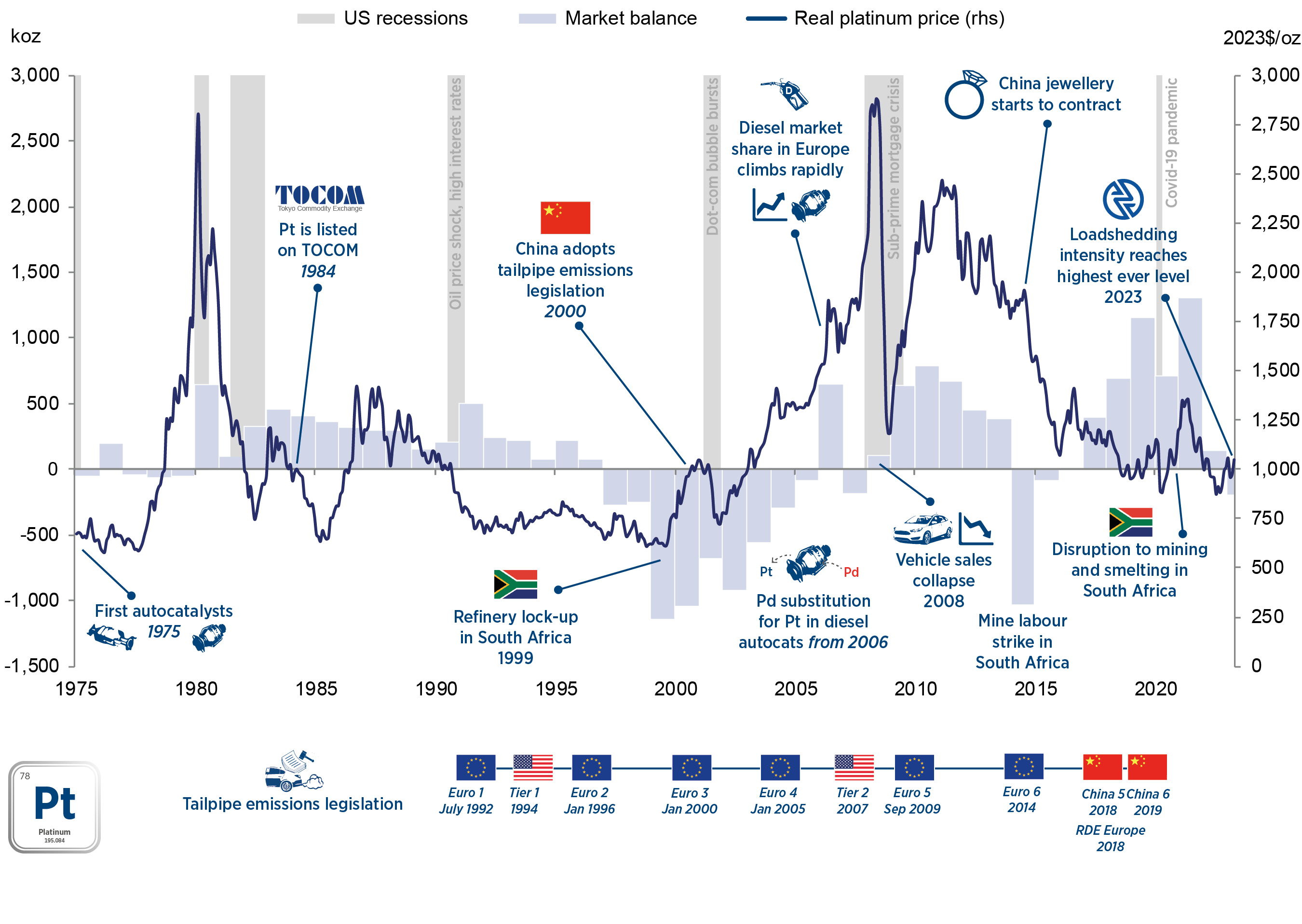

Platinum is the primary revenue driver for South African mines. The metal was used extensively in catalytic converters to control toxic emissions from both gasoline and diesel cars, but over time palladium has increasingly become the metal of choice in gasoline vehicles and has also replaced some of the platinum in diesel cars. Platinum jewellery has become popular in China and its popularity is growing in India, while the use of platinum has continued to be critical in oil refining, glass manufacturing and medical applications. The commercialisation of fuel cells and production of green hydrogen is also a key end-use for platinum.

Platinum price news and insights

The autocatalyst and it's potted history

10 May 2024 | Daniel Croft

As autocatalyst recycling volumes have suffered a decline, Daniel Croft examines the current state-of-play of autocatalyst recycling, as part of SFA's annual publication The Platinum Standard.

SFA's expert view on the palladium price spike

18 December 2023 | Dr Ralph Grimble

The palladium price surged last week due to a convergence of positive factors. The Fed acknowledged the peak in US inflation during its press conference, leading to a more dovish outlook for interest rates and a weaker US dollar, supporting commodity prices.

Stalling BEV market share and political shifts put the EU’s ICE vehicle ban at risk

17 June 2024 | SFA (Oxford) & Heraeus

Platinum catches a tailwind from stronger rand

21 May 2024 | SFA (Oxford) & Heraeus

Solar silver demand growth to moderate this year but still hit a new record

15 April 2024 | SFA (Oxford) & Heraeus

Palladium demand supported for longer after new US emissions law changes

25 March 2024 | SFA (Oxford) & Heraeus

Platinum price in context, 1975 to 2023

Platinum market balance

| koz | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023f | |

| Primary platinum supply | |||||||||

| Regional | |||||||||

| South Africa | 4,265 | 4,385 | 4,470 | 4,405 | 3,260 | 4,715 | 3,980 | 4,105 | |

| Russia | 715 | 720 | 665 | 710 | 700 | 640 | 655 | 610 | |

| Zimbabwe | 490 | 480 | 465 | 460 | 480 | 470 | 495 | 515 | |

| North America | 390 | 360 | 345 | 350 | 330 | 255 | 250 | 260 | |

| Other | |||||||||

| Total | 6,045 | 6,125 | 6,130 | 6,105 | 4,950 | 6,210 | 5,500 | 5,615 | |

| Platinum demand and recycling |

|||||||||

| Platinum autocatalyst demand | |||||||||

| Gross Pt autocatalyst demand | 3,365 | 3,305 | 3,110 | 2,830 | 2,390 | 2,715 | 2,940 | 3,330 | |

| Platinum autocatalst recycling | 1,210 | 1,325 | 1,420 | 1,495 | 1,300 | 1,415 | 1,160 | 1,135 | |

| Net Pt autocatalyst demand | 2,150 | 1,980 | 1,690 | 1,335 | 1,090 | 1,295 | 1,780 | 2,195 | |

| Platinum jewellery demand | |||||||||

| Gross Pt jewellery demand | 2,510 | 2,450 | 2,245 | 2,090 | 1,560 | 1,780 | 1,650 | 1,620 | |

| Platinum jewellery recycling | 625 | 560 | 505 | 500 | 410 | 400 | 345 | 345 | |

| Net Pt jewellery demand | 1,885 | 1,890 | 1,740 | 1,595 | 1,150 | 1,380 | 1,305 | 1,275 | |

| Industrial platinum demand | 1,970 | 1,845 | 1,965 | 2,010 | 1,990 | 2,215 | 2,235 | 2,275 | |

| Hydrogen platinum demand | 45 | 50 | 70 | 45 | 45 | 50 | 90 | 110 | |

| Other platinum recycling | 25 | 30 | 30 | 30 | 30 | 45 | 40 | 40 | |

| Gross platinum demand | 7,890 | 7,650 | 7,385 | 6,975 | 5,985 | 6,760 | 6,910 | 7,330 | |

| Platinum recycling | 1,860 | 1,915 | 1,955 | 2,020 | 1,745 | 1,860 | 1,545 | 1,520 | |

| Net platinum demand | 6,030 | 5,735 | 5,435 | 4,950 | 4,235 | 4,900 | 5,365 | 5,810 | |

| Platinum market balance | |||||||||

| Platinum balance (before ETFs) | 15 | 390 | 695 | 1,155 | 710 | 1,310 | 135 | -195 | |

| Platinum ETFs (stock allocation) | -10 | 100 | -240 | 995 | 505 | -265 | -565 | ||

| Platinum balance after ETFs | 20 | 295 | 935 | 160 | 210 | 1.575 | 705 | -195 | |

| Platinum price history | |||||||||

| Platinum price (USD/oz) | 1,053 | 988 | 948 | 879 | 864 | 884 | 961 | ||

| Platinum price (GBP/oz) | 689 | 732 | 737 | 658 | 677 | 688 | 778 | ||

| Platinum price (EUR/oz) | 948 | 892 | 842 | 744 | 772 | 774 | 912 | ||

| Platinum price (CHF/oz) | 1,012 | 972 | 934 | 859 | 858 | 829 | 996 | ||

| Platinum price (CNY/oz) | 6,609 | 6,560 | 6,046 | 5,805 | 5,92 | 6,091 | 6,461 | ||

| Platinum price (ZAR/oz) | 13,355 | 14,480 | 12,620 | 11,579 | 12,488 | 14,458 | 15,699 | ||

| Platinum price (INR/oz) | 67,359 | 66,328 | 61,767 | 59,954 | 60,833 | 65,449 | 80,538 | ||

| Platinum price (JPY/oz) | 127,334 | 107,056 | 106,347 | 96,998 | 94,166 | 94,371 | 125,939 | ||

Source: SFA (Oxford). Updated September 2022.

Linked platinum market reports

SFA (Oxford) provides regular bespoke market intelligence reports on platinum as well as in-depth studies on recycling, metal flows and price setting.

Meet the PGM team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Dr Ralph Grimble

Operations Director

Lee Hockey

Precious Metals Expert

Dr Jenny Watts

Head of Clean Energy & Sustainability

Jamie Underwood

Principal Consultant

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Adele Rouleau

ESG and Critical Minerals Lead

Oksan Atilan

Consulting Automotive Analyst

Alex Biddle

Senior Mining Analyst

Dr Sandeep Kaler

Market Strategy Analyst

Alexandre Toufic Zard

Analyst

Daniel Croft

Commodity Analyst

David Mobbs

Head of Marketing

Joel Lacey

Sales and Marketing Specialist

Platinum market balance

| koz | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022f | |

| Primary platinum supply | |||||||||

| Regional | |||||||||

| South Africa | 4,480 | 4,265 | 4,385 | 4,470 | 4,405 | 3,255 | 4,625 | 4570 | |

| Russia | 710 | 715 | 720 | 665 | 710 | 705 | 590 | ||

| Zimbabwe | 405 | 490 | 480 | 465 | 460 | 480 | 495 | ||

| North America | 365 | 390 | 360 | 345 | 350 | 330 | 365 | ||

| Other | 200 | 185 | 185 | 180 | 185 | 175 | 160 | ||

| Total | 6,160 | 6,045 | 6,130 | 6,125 | 6,110 | 4,945 | 6,235 | ||

| Platinum demand and recycling |

|||||||||

| Platinum autocatalyst demand | |||||||||

| Gross Pt autocatalyst demand | 3,250 | 3,360 | 3,300 | 3,105 | 2,835 | 2,320 | 2,745 | ||

| Platinum autocatalst recycling | 1,180 | 1,220 | 1,325 | 1,420 | 1,490 | 1,300 | 1,395 | ||

| Net Pt autocatalyst demand | 2,070 | 2,140 | 1,975 | 1,685 | 1,345 | 1,020 | 1,350 | ||

| Platinum jewellery demand | |||||||||

| Gross Pt jewellery demand | 2,840 | 2,505 | 2,460 | 2,245 | 2,095 | 1,560 | 1,775 | ||

| Platinum jewellery recycling | 510 | 625 | 560 | 500 | 500 | 415 | 440 | ||

| Net Pt jewellery demand | 2,330 | 1,880 | 1,900 | 1,745 | 1,595 | 1,145 | 1,335 | ||

| Hydrogen platinum demand | 25 | 45 | 45 | 70 | 40 | 40 | 75 | ||

| Industrial platinum demand | 1,805 | 1,905 | 1,760 | 1,940 | 2,025 | 1,900 | 2,210 | ||

| Other platinum recycling | 10 | 5 | 10 | 10 | 10 | 10 | 10 | ||

| Gross platinum demand | 7,920 | 7,815 | 7,560 | 7,360 | 6,990 | 5,820 | 6,805 | ||

| Platinum recycling | 1,700 | 1,850 | 1,930 | 1,930 | 2,000 | 1,725 | 1,845 | ||

| Net platinum demand | 6,220 | 5,965 | 5,665 | 5,430 | 4,990 | 4,095 | 4,960 | ||

| Platinum market balance | |||||||||

| Platinum balance (before ETFs) | -60 | 80 | 465 | 695 | 1,110 | 850 | 1,175 | ||

| Platinum ETFs (stock allocation) | -240 | -10 | 100 | -240 | 995 | 505 | |||

| Platinum balance after ETFs | 180 | 90 | 365 | 935 | 125 | 345 | |||

| Platinum price history | |||||||||

| Platinum price (USD/oz) | 1,053 | 988 | 948 | 879 | 864 | 884 | 1,090 | ||

| Platinum price (GBP/oz) | 689 | 732 | 737 | 658 | 677 | 688 | 792 | ||

| Platinum price (EUR/oz) | 948 | 892 | 842 | 744 | 772 | 774 | 921 | ||

| Platinum price (CHF/oz) | 1,012 | 972 | 934 | 859 | 858 | 829 | 996 | ||

| Platinum price (CNY/oz) | 6,609 | 6,560 | 6,406 | 5,805 | 5,972 | 6,091 | 7,033 | ||

| Platinum price (ZAR/oz) | 13,335 | 14,480 | 12,620 | 11,579 | 12,488 | 14,458 | 16,092 | ||

| Platinum price (INR/oz) | 67,359 | 66,328 | 61,767 | 59,954 | 60,833 | 65,449 | 80,538 | ||

| Platinum price (JPY/oz) | 127,334 | 107,056 | 106,347 | 96,998 | 94,166 | 94,371 | 119,574 | ||

Source: SFA (Oxford). Updated November 2021.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.