The Palladium Market

Critical Minerals and The Energy Transition

Navigating the Palladium Market

Palladium is a rare, lustrous transition metal renowned for its exceptional catalytic performance, hydrogen absorption capacity, and chemical stability under reductive conditions. As a key member of the platinum group metals (PGMs), it plays a central role in emissions control technologies, precision electronics, hydrogen purification systems, and fine chemical synthesis. While historically associated with jewellery and investment, palladium has become indispensable to the functioning of low-emission transport, advanced defence systems, and high-reliability electronic components. Its widespread use in catalytic converters for gasoline vehicles, combined with constrained supply, geopolitical concentration in Russia and South Africa, and limited substitution options, has elevated palladium to a position of strategic importance in global critical minerals policy. As industries and governments work to decarbonise mobility, safeguard digital infrastructure, and navigate rising geopolitical risks, palladium is increasingly recognised not just as a valuable metal but as a vital input to clean energy systems, resilient manufacturing, and national security. SFA (Oxford)'s explores many of palladium’s end-uses, highlighting its growing relevance in the transition to a connected, secure, and sustainable global economy.

Palladium price news and insights

SFA's latest podcast: PGM markets out to 2040

11 November 2024

The latest SFA podcast episode examines how evolving trends in transportation and energy are reshaping the platinum group metals markets.

The squeeze is on: Managing the margins

10 September 2024 | Dr Ralph Grimble

PGM miners’ revenues have collapsed with the fall in palladium and rhodium prices. The little-mentioned chrome has become an important contributor.

Iridium’s outlook linked to hydrogen economy wariness

21 October 2024 | SFA (Oxford) & Heraeus

Chinese heavy-duty vehicle platinum demand could be ready for a rise

7 October 2024 | SFA (Oxford) & Heraeus

Where does the palladium market go from here?

23 September 2024 | SFA (Oxford) & Heraeus

The Chinese car market in 2024 – PHEVs, subsidies and palladium

19 August 2024 | SFA (Oxford) & Heraeus

An introduction to palladium

Palladium demand and end-uses

Palladium, a critical member of the platinum group metals (PGMs), plays a central role across modern emissions control, electronics, and emerging clean energy technologies. With a unique combination of high catalytic efficiency, chemical stability, and excellent hydrogen absorption capacity, palladium is indispensable in a wide array of industrial and strategic applications. As nations pursue net-zero targets, cleaner transport, and resilient manufacturing systems, palladium continues to gain prominence as both a functional material and a supply-critical commodity.

The dominant end-use for palladium remains in automotive catalytic converters, where it is used to convert toxic emissions including carbon monoxide, hydrocarbons, and nitrogen oxides into less harmful gases. Palladium has almost entirely displaced platinum in gasoline-powered vehicles due to its strong performance under reductive conditions and, historically, lower cost. Its use spans light-duty passenger cars to heavy-duty commercial vehicles in major markets including China, the United States, and the European Union. As emissions regulations tighten globally, particularly in emerging economies, demand for palladium remains robust despite broader shifts toward electrification. The rise of hybrid vehicles further extends palladium’s relevance, given their continued dependence on internal combustion engines for part of their operation.

In addition to autocatalysts, palladium demand is growing in hydrogen-related technologies. Palladium’s ability to selectively absorb and diffuse hydrogen makes it a key material in hydrogen purification membranes, fuel cell components, and hydrogen sensors. While not as central as platinum in proton exchange membrane (PEM) electrolysers and fuel cells, palladium-based alloys and membrane systems are essential in hydrogen separation processes used in ammonia production, refineries, and clean hydrogen storage. These roles are expected to expand as the global hydrogen economy matures, particularly in sectors where high purity and gas stream integrity are critical.

In the chemical sector, palladium is widely used as a catalyst in fine chemical synthesis, particularly in the pharmaceutical, agrochemical, and specialty chemical industries. It plays a vital role in cross-coupling reactions such as Suzuki and Heck reactions, which are fundamental to complex molecule formation. With increasing demand for high-performance, low-impact catalytic systems, palladium’s role in green chemistry is expanding. However, due to its high cost and sensitivity to poisoning, catalyst recovery and reuse have become essential for maintaining cost-effectiveness, driving additional demand for high-purity recyclable material.

Palladium also plays an important role in the electronics sector. It is used in multilayer ceramic capacitors (MLCCs), connectors, and plating materials for circuit boards and semiconductors. Its excellent conductivity, corrosion resistance, and bonding characteristics make it valuable in miniaturised and high-performance electronic components. As consumer electronics, electric vehicles, and Internet of Things (IoT) devices continue to scale, palladium demand from the electronics sector is expected to rise steadily, especially in Asia’s manufacturing hubs.

In dentistry, palladium is used in dental alloys for crowns, bridges, and partial dentures due to its strength, biocompatibility, and tarnish resistance. While its use has declined in favour of ceramics and base-metal alternatives, it remains relevant in markets prioritising durability and clinical performance. Similarly, in jewellery, palladium has served as both an alloying agent and as a primary metal in white gold substitutes and stand-alone pieces. Its light weight and bright white finish make it attractive, though demand fluctuates with pricing dynamics and fashion preferences.

In defence and aerospace, palladium is used in multilayer ceramic capacitors, strategic sensors, and electrical contacts within high-reliability systems. Its resistance to corrosion and stable electrical properties under thermal and mechanical stress make it valuable in avionics, satellite communications, and missile systems. While often overshadowed by platinum and rhodium in these sectors, palladium’s strategic relevance has grown, particularly in countries looking to diversify their PGM inputs across multiple military and space platforms.

Palladium also finds application in a range of niche and emerging technologies. It is used in high-performance brazing alloys for aerospace, medical, and vacuum applications, in addition to decorative and functional electroplating across luxury goods, watches, and high-end components. Palladium membranes are deployed in ultra-pure gas separation systems, including deuterium-tritium separation in fusion research. In optical technologies, palladium coatings are used in photonic devices and precision reflectors. Early-stage research is exploring palladium’s role in thermoelectric conversion and catalytic drug delivery systems, particularly for implantable biosensors and smart medical platforms. While these areas represent a smaller share of overall demand, they reinforce palladium’s functional versatility and its relevance in frontier innovation.

Palladium’s role in high-reliability electronics, defence systems, clean transport, and hydrogen purification is increasingly being recognised through national critical minerals strategies. Its supply is heavily concentrated, with Russia and South Africa accounting for the vast majority of primary production, which poses a clear risk to downstream industries during times of geopolitical instability or trade disruption. As supply tightens and strategic sectors grow more reliant on palladium-containing components, governments and industrial stakeholders are re-evaluating its classification within defence readiness and industrial resilience frameworks. Enhanced recycling, transparent sourcing, and materials efficiency will be critical to safeguarding availability in light of its rising value to national security and economic competitiveness.

Investment demand for palladium has risen alongside its constrained supply and geopolitical exposure. It is held through exchange-traded funds (ETFs), coins, and bars, often as a hedge against inflation or industrial disruption. Its price volatility, driven by fluctuations in demand and the concentration of supply in Russia and South Africa, makes it both an opportunity and a risk for investors. As with platinum, ESG-conscious buyers are increasingly favouring secondary palladium recovered through ethical recycling streams and certified refining networks.

Palladium supply

Palladium supply is highly concentrated, with Russia and South Africa together accounting for the majority of global primary production. Russia, through Norilsk Nickel’s operations in the Norilsk-Talnakh region, has traditionally been the single largest source, contributing over 40 percent of global mined output. South Africa follows closely, producing palladium as part of the broader platinum group metals (PGM) basket from the Bushveld Complex. Secondary sources include Zimbabwe, Canada, and the United States, while minor volumes are produced in Finland and Australia. This concentration exposes palladium supply chains to significant geopolitical and logistical vulnerabilities.

Primary palladium is typically recovered as a by-product of platinum or nickel mining, depending on the geological setting. In South Africa and Zimbabwe, it is co-extracted with platinum and rhodium in PGM-dominant ores. In Russia and Canada, palladium is primarily derived from nickel-copper sulphide deposits, with Norilsk Nickel and Vale among the leading producers. This by-product dependence complicates supply forecasting, as production volumes are often tied to the economics of other metals rather than to standalone palladium demand.

Secondary palladium supply has grown in importance, particularly through the recycling of spent automotive catalytic converters. This open-loop recycling stream recovers palladium alongside platinum and rhodium using thermal pre-treatment and hydrometallurgical extraction. Closed-loop recycling systems, especially in the electronics and chemical sectors, also contribute to high-purity palladium recovery. With increasing reliance on autocatalyst scrap and circuit board refining, secondary palladium now accounts for more than 25 percent of annual supply.

Russia’s central role in palladium supply poses strategic challenges. The country’s dominance through Norilsk Nickel exposes the market to geopolitical disruption, particularly in light of recent sanctions, currency restrictions, and limitations on refining infrastructure. South Africa, while equally vital, faces domestic constraints including unreliable electricity supply, labour unrest, and social licence to operate issues. Zimbabwe’s palladium potential remains underexploited due to infrastructural and policy barriers. These supply-side pressures are heightening the urgency of developing resilient recycling systems and diversifying upstream sources.

Environmental and regulatory factors are also influencing palladium supply dynamics. Although palladium mining is less energy-intensive than some other critical minerals, the environmental footprint of smelting and refining remains a concern. ESG compliance, particularly around tailings management, water use, and air emissions, is becoming increasingly important as investors and end-users demand more traceable and responsibly sourced material. Certification frameworks and third-party audits are being adopted to meet the rising expectations of automotive and electronics manufacturers.

With global demand driven by automotive emissions control, hydrogen purification, and precision electronics, securing reliable palladium supply has become a strategic priority for OEMs and national governments alike. Recycling will remain essential to offset primary supply constraints, but technological barriers and collection inefficiencies limit short-term scalability. Substitution efforts, particularly with platinum in autocatalysts, may ease demand pressures but are not universally applicable. As such, long-term palladium supply security will depend on an integrated strategy involving primary production diversification, expanded secondary recovery, and policy-driven efforts to build transparent, ESG-aligned supply chains.

Current primary palladium producers

Small-scale and less-known minor palladium supply

Palladium substitution

In automotive catalytic converters, palladium can be partially substituted with platinum or rhodium depending on engine configuration, fuel type, and regulatory requirements. As palladium prices surged over the last decade, substitution back to platinum has gained renewed attention, particularly in gasoline-powered vehicles where palladium had previously displaced platinum due to cost and performance parity. Modern catalyst formulations increasingly use tailored PGM ratios to balance cost with emissions compliance. However, complete substitution is limited by differences in oxidation-reduction kinetics, particularly under cold-start conditions, where palladium demonstrates superior hydrocarbon conversion. Rhodium remains essential for nitrogen oxide reduction and cannot fully replace palladium’s oxidative functions. Substitution strategies must also consider catalyst ageing behaviour, sulphur tolerance, and long-term durability in varied driving cycles.

In chemical catalysis, palladium is extensively used in fine chemical synthesis, including cross-coupling reactions like Suzuki and Heck processes, which are critical for pharmaceutical and agrochemical production. While nickel, copper, and iron-based catalysts have been explored as substitutes, they often require more severe reaction conditions, generate higher waste streams, or exhibit reduced selectivity. Although some base metal systems show promise in academic research, commercial adoption has been limited due to regulatory standards and the high purity demands of pharmaceutical manufacturing. In hydrogenation reactions, ruthenium and platinum can serve as alternatives, but differences in substrate scope and product yields restrict broad substitution.

In electronics, palladium’s use in multilayer ceramic capacitors (MLCCs), connectors, and plating is driven by its excellent conductivity, corrosion resistance, and solderability. Silver and nickel can partially substitute in certain MLCC layers or contact finishes, especially in consumer-grade electronics. However, these alternatives typically compromise long-term reliability and miniaturisation performance, which are critical in automotive, medical, and aerospace-grade components. Furthermore, the substitution of palladium in high-reliability electronics often introduces additional material compatibility and thermal expansion issues, making complete replacement impractical for mission-critical systems.

In dentistry, palladium is used in alloys for crowns, bridges, and dental frameworks. Alternatives include high-nickel alloys, cobalt-chromium systems, and ceramics. While these materials offer cost advantages, they may pose higher allergenic risks or require different manufacturing techniques. For patients with metal sensitivities or in regions with stringent biocompatibility standards, palladium remains a preferred option due to its stability and tarnish resistance. However, its dental use has declined overall due to material cost and the growing adoption of all-ceramic prosthetics.

In jewellery, palladium has long been used both as a primary metal and as an alloying agent in white gold. Substitution with platinum or rhodium offers higher durability and polish, but at a greater cost and density. White gold can substitute in lower-end jewellery, though it requires rhodium plating to match palladium’s visual properties. Substitution also depends on regional consumer preferences, hallmarking standards, and brand positioning within the luxury market.

For hydrogen-related technologies, palladium is used in purification membranes and hydrogen sensors, particularly in industrial-scale reforming and gas separation processes. Alternatives such as ceramic membranes, silver-based alloys, and engineered polymer systems are being trialled, but these lack the permeability, selectivity, or thermal stability that palladium offers. In ultra-high purity applications, particularly in nuclear, aerospace, and medical gas systems, palladium remains functionally irreplaceable. However, research into membrane miniaturisation and composite materials may enable reduced palladium loadings over time.

In defence and aerospace, palladium is used in multilayer ceramic capacitors, satellite communication components, and electromagnetic shielding systems. Alternatives such as tantalum and silver-palladium blends can reduce palladium content in some applications, but substitution often compromises reliability in high-frequency, radiation-exposed, or thermally unstable environments. Given the stringent performance thresholds for avionics and missile guidance systems, full substitution would typically require design revisions, extensive requalification, and risk reassessment. In this context, reducing palladium intensity through component redesign and recovery from end-of-life systems is currently more feasible than outright substitution.

Overall, palladium substitution is highly context-dependent. While technical pathways exist in several sectors, these often require trade-offs in performance, longevity, or compliance. In many cases, substitution introduces system-level changes or escalates lifecycle costs. As such, the most effective strategy remains focused on load reduction, recycling, and selective displacement, rather than complete elimination. Future substitution will be shaped by material science breakthroughs, regulatory flexibility, and advances in catalyst and component design, but for now, palladium continues to play a critical role in emissions control, electronics, hydrogen systems, and defence technologies.

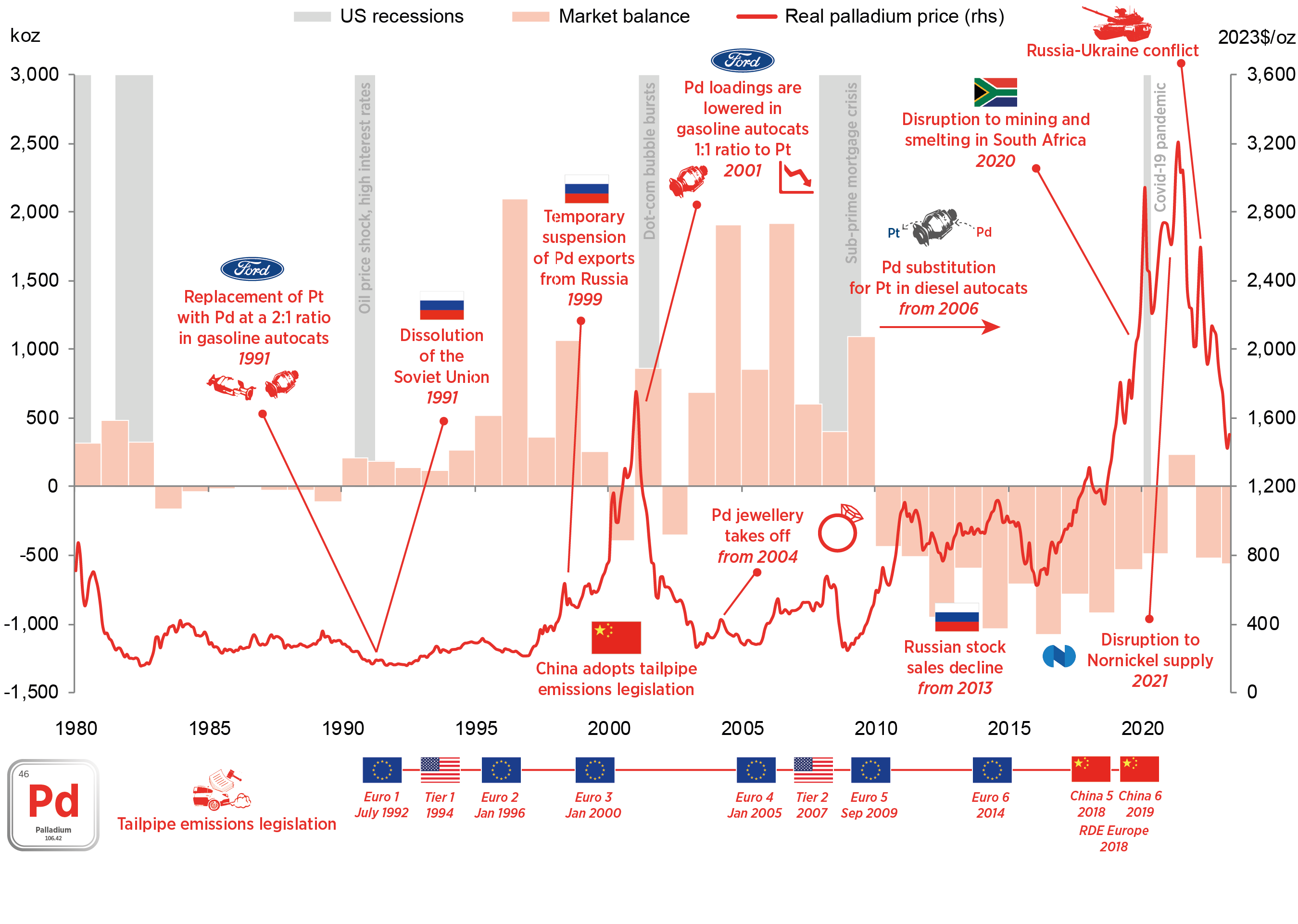

Palladium price in context, 1980 to 2023

Palladium market balance

| koz | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025f | |

| Primary palladium supply | |||||||||

| Regional | |||||||||

| South Africa | 2,500 | 2,555 | 1,845 | 2,775 | 2,240 | 2,255 | 2,290 | 2,165 | |

| Russia | 2,670 | 2,870 | 2,810 | 2,585 | 2,790 | 2,690 | 2,760 | 2,755 | |

| Zimbabwe | 380 | 385 | 405 | 395 | 410 | 430 | 420 | 420 | |

| North America | 1,035 | 975 | 950 | 950 | 740 | 785 | 740 | 560 | |

| Other | 395 | 395 | 385 | 265 | 270 | 270 | 265 | 265 | |

| Total | 6,975 | 7,180 | 6,395 | 6,955 | 6,450 | 6,430 | 6,470 | 6,165 | |

| Palladium demand and recycling |

|||||||||

| Palladium autocatalyst demand | |||||||||

| Gross Pd autocatalyst demand | 8,455 | 8,590 | 7,545 | 7,820 | 7,810 | 7,820 | 7,435 | 7,080 | |

| Pd autocatalyst recycling | 2,410 | 2,565 | 2,395 | 2,840 | 2,670 | 2,215 | 2,200 | 2,320 | |

| Net Pd autocatalyst demand | 6,050 | 6,025 | 5,145 | 4,985 | 5,140 | 5,605 | 5,235 | 4,765 | |

| Palladium jewellery demand | |||||||||

| Gross Pd jewellery demand | 220 | 210 | 195 | 155 | 140 | 130 | 125 | 130 | |

| Pd jewellery recycling | 60 | 55 | 50 | 40 | 35 | 30 | 40 | 40 | |

| Net Pd jewellery demand | 155 | 155 | 145 | 115 | 105 | 100 | 90 | 95 | |

| Industrial palladium demand | 1,840 | 1,715 | 1,640 | 1,500 | 1,485 | 1,375 | 1,375 | 1,385 | |

| Hydrogen palladium demand | 0 | 0 | 10 | 20 | 20 | 25 | 30 | 30 | |

| Other palladium recycling | 370 | 365 | 335 | 415 | 365 | 350 | 345 | 350 | |

| Gross palladium demand | 10,515 | 10,520 | 9,385 | 9,495 | 9,455 | 9,355 | 8,965 | 8,625 | |

| Palladium recycling | 370 | 365 | 335 | 415 | 365 | 350 | 345 | 350 | |

| Net palladium demand | 7,670 | 7,530 | 6,610 | 6,200 | 6,385 | 6,760 | 6,385 | 5,920 | |

| Palladium market balance | |||||||||

| Palladium balance (before ETFs) | -695 | -350 | -210 | 755 | 65 | -330 | 85 | 245 | |

| Palladium ETFs (stock allocation) | -560 | -90 | -115 | 50 | -90 | 80 | 245 | ||

| Palladium balance after ETFs | -130 | -265 | -95 | 705 | 155 | -405 | -160 | 245 | |

| Palladium price history | |||||||||

| Palladium price (USD/oz) |

870 | 1,030 | 1,538 | 2,194 | 2,109 | 1,339 | 984 | ||

| Palladium price (GBP/oz) | 674 | 773 | 1,205 | 1,707 | 1,707 | 1,078 | 770 | ||

| Palladium price (EUR/oz) | 768 | 874 | 1,375 | 1,922 | 2,003 | 1,238 | 909 | ||

| Palladium price (CNY/oz) | 5,861 | 6,827 | 10,641 | 15,117 | 14,157 | 9,452 | 7,077 | ||

| Palladium price (ZAR/oz) | 11,580 | 13,673 | 22,247 | 35,940 | 34,391 | 24,632 | 18,022 | ||

| Palladium price (JPY/oz) | 97,485 | 113,853 | 167,631 | 234,191 | 276,105 | 186,955 | 148,932 | ||

Source: SFA (Oxford). Updated May 2025.

Linked palladium market reports

SFA (Oxford) provides regular bespoke market intelligence reports on palladium as well as in-depth studies on recycling, metal flows and price setting.

Meet the PGM team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Dr Ralph Grimble

Operations Director

Dr Jenny Watts

Head of Clean Energy & Sustainability

Jamie Underwood

Principal Consultant

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Ismet Soyocak

ESG & Critical Minerals Lead

Oksan Atilan

Consulting Automotive Analyst

Alex Biddle

Senior Mining Analyst

Dr Sandeep Kaler

Market Strategy Analyst

Daniel Croft

Commodity Analyst

David Mobbs

Head of Marketing

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.