Subsea Mining Critical Minerals

Critical minerals, policy, and the energy transition

Introduction to Subsea Mining and Critical Minerals

Subsea mining, the extraction of minerals from the ocean floor, is a pivotal yet contentious frontier for securing critical minerals including cobalt, nickel, manganese, and rare earth elements, which are essential for batteries, electric vehicles, renewable energy systems, and advanced electronics. Identified in the 1960s, deep sea deposits such as polymetallic nodules, seafloor massive sulphides, and cobalt rich ferromanganese crusts span key regions including the Clarion Clipperton Zone in the Pacific, the Mid Atlantic Ridge, and the Central Indian Ocean Basin. Found at depths often exceeding one thousand metres, these resources offer vast potential to meet escalating demand driven by the global energy transition. Early ventures were hindered by technological and economic challenges, but advancements in robotics, cutting systems, and slurry transport have revitalised commercial interest. Activities are governed internationally by the International Seabed Authority under the 1982 United Nations Convention on the Law of the Sea, and nationally by frameworks such as Norway’s 2019 Seabed Minerals Act, which was paused in 2024, and the United States’ 2025 Deep Seabed Hard Mineral Resources Act initiative. Balancing extraction with ecosystem preservation remains central in this evolving field.

Critical Minerals discovered in Subsea Mining

International Governance Bodies

International governance bodies are central in overseeing seabed mineral activities in areas beyond national jurisdiction, where no single state holds sovereignty. These regions, collectively known under UNCLOS as "the Area", are governed by a multilateral legal framework designed to balance equitable access to seabed resources with environmental protection and long-term global stewardship. At the core of this system is the International Seabed Authority (ISA), the institution mandated to regulate licensing, environmental oversight, and benefit-sharing for exploration and future exploitation. Supporting this framework is the United Nations Convention on the Law of the Sea (UNCLOS), which provides the legal foundation for all seabed activities beyond national control.

Together, these instruments form the institutional and legal architecture for managing seabed mining in international waters, setting enforceable standards for environmental assessment, resource allocation, and global equity.

1. International Seabed Authority (ISA)

The International Seabed Authority (ISA) is the central global institution responsible for regulating mineral-related activities in the “Area”, the seabed, ocean floor, and subsoil beyond national jurisdictions. Established under Part XI of the United Nations Convention on the Law of the Sea (UNCLOS), the ISA operates as the legal and administrative body charged with ensuring that mineral resources in the Area are developed for the benefit of all humankind, in line with the principle of the common heritage.

Headquartered in Kingston, Jamaica, the ISA’s primary mandate includes issuing exploration licences and, in future, exploitation licences for deep-sea mineral resources such as polymetallic nodules, cobalt-rich crusts, and seafloor massive sulphides (SMS). As of 2025, the ISA has approved 31 exploration contracts covering more than 1.5 million km² of seabed. These contracts are held by a mix of state-sponsored entities, national governments, and private-sector contractors.

The ISA is also responsible for developing and enforcing the Mining Code, a set of legally binding regulations that govern exploration, environmental protection, and financial terms for resource extraction. While the ISA has finalised exploration regulations, the Draft Exploitation Code remains under negotiation, with unresolved debates on issues such as environmental thresholds, financial payment systems, and benefit-sharing mechanisms for developing countries. The outcome of these negotiations will determine when and how large-scale commercial mining can proceed in international waters.

In addition to regulatory oversight, the ISA coordinates environmental management and scientific research, including the designation of Areas of Particular Environmental Interest (APEIs), the development of Regional Environmental Management Plans (REMPs), and the review of Environmental Impact Statements (EISs) submitted by contractors.

As the only international body with legal authority over seabed mineral resources in international waters, the ISA plays a pivotal role in shaping the future of deep-sea mining, balancing commercial access with environmental stewardship and equitable global benefit-sharing. Its evolving regulatory framework will have far-reaching implications for critical mineral supply chains, ocean governance, and geopolitical competition over strategic subsea resources.

2. UNCLOS: The Foundational Framework

The 1982 United Nations Convention on the Law of the Sea, UNCLOS, provides the primary legal framework for the governance of international waters, including regulating subsea mining in areas beyond national jurisdiction. It defines the Area as the seabed, ocean floor, and subsoil beyond the limits of any state's Exclusive Economic Zone or continental shelf. It designates all mineral resources found there as the common heritage of humankind. This principle prohibits any state or private actor from asserting ownership over these resources and requires that benefits from their exploitation be shared equitably among all nations.

To manage activities in the Area, UNCLOS established the International Seabed Authority, ISA, under Part Eleven, granting it the exclusive mandate to organise, authorise, and oversee all exploration and exploitation activities on behalf of the global community. This framework is supported by several legal provisions that together form a distinct regulatory regime, combining international oversight, public trusteeship, and controlled access for corporate actors operating under the sponsorship of states. The system is designed to balance commercial development with environmental responsibility and global equity.

As of July 2025, UNCLOS has been ratified by 168 states, providing a strong legal foundation for international seabed governance. However, non-ratification by key players, particularly the United States, presents challenges. The United States regulates its flagged operators under the 1980 Deep Seabed Hard Mineral Resources Act, asserting unilateral rights without ISA-recognised licences, creating ongoing legal and diplomatic tensions.

The following articles within UNCLOS are particularly relevant to subsea mining:

-

Article 136 – Common Heritage of Humankind: Declares that all mineral resources in the Area are the collective property of humanity, prohibiting any unilateral claims, ownership, or exclusive benefit. This principle underpins the obligation for equitable benefit sharing, especially with landlocked and developing countries.

-

Article 137 – No Sovereignty Over the Area: Explicitly denies any state or private actor the right to claim, appropriate, or exercise sovereign rights over resources in the Area. The ISA has exclusive authority to organise, regulate, and manage all resource-related activities, reinforcing the legal principle that these resources belong to all of humanity and must be governed for the collective benefit of all states.

-

Article 145 – Environmental Protection Obligations: Imposes a duty on the ISA to adopt measures to prevent, reduce, and control pollution and other hazards to the marine environment arising from mining operations. This includes setting rules, standards, and guidelines to protect vulnerable ecosystems, promote environmental baseline data collection, and manage cumulative impacts.

-

Article 153 – Contract-Based Exploitation Regime: Sets the legal foundation for a contractual system in which states or state-sponsored private companies may apply to explore or exploit seabed minerals through ISA-issued licences. Contractors must be sponsored by a state party to UNCLOS and are subject to compliance with ISA regulations, including financial, environmental, and operational obligations.

Challenges to UNCLOS Implementation in Subsea Mining Governance

The implementation of UNCLOS faces several geopolitical and operational tensions that complicate the regulation of subsea mining. For example:

-

United States non-ratification – One of the most significant issues is the non-ratification of UNCLOS by the United States. As of July 2025, the Convention has been ratified by 168 countries, including the European Union, China, India, Japan, and the majority of Pacific Island States. However, the United States remains a notable outlier. Although it has signed the treaty, it has never ratified it, primarily due to long-standing concerns over national sovereignty and mandatory benefit-sharing provisions. In place of UNCLOS, the U.S. relies on its 1980 Deep Seabed Hard Mineral Resources Act (DSHMRA), which permits U.S.-based companies to pursue mining claims in international waters independently of the International Seabed Authority (ISA), so long as they comply with U.S. licensing rules. This parallel system introduces legal ambiguity and diplomatic friction, particularly in areas like the Clarion–Clipperton Zone (CCZ), where U.S.-affiliated firms operate alongside ISA-sanctioned contractors.

-

Delay in the exploitation code – Another key challenge is the delay in finalising the ISA Exploitation Code. The legal framework for commercial-scale mining remains incomplete, creating uncertainty for both investors and operators. In 2021, the Republic of Nauru triggered the so-called “two-year rule,” obligating the ISA to adopt exploitation regulations by 2023. However, scientific, ethical, and environmental concerns have stalled progress. As of 2025, despite multiple pilot deployments, no commercial exploitation licences have been issued, and pressure continues to mount from industry stakeholders seeking clarity and authorisation to proceed.

-

Sponsorship and liability – The requirement for state sponsorship of contractors also raises complex issues around liability and enforcement. Under UNCLOS, all companies conducting activities in the Area must be sponsored by a state party, which is jointly liable for the contractor’s compliance with ISA rules. This has prompted concern, particularly when small or developing states such as Nauru, Tonga, or Kiribati sponsor large international mining firms. While the ISA has established basic compliance mechanisms, practical enforcement remains constrained by limited regulatory capacity, unequal bargaining power, and the jurisdictional complexity of cross-border operations.

-

Equity and benefit sharing – Lastly, operationalising Article 136’s mandate for equitable benefit-sharing remains an unresolved legal and political challenge. The ISA is responsible for ensuring that the financial benefits derived from seabed mining are distributed fairly, particularly to landlocked and developing countries. However, as of 2025, there is still no functioning system to manage or disburse these benefits. Ongoing negotiations continue over key components, including royalty frameworks, technology transfer obligations, and institutional sharing mechanisms, all of which are critical to realising the Convention’s vision of global equity.

Regional and Transboundary Governance Mechanisms

While the International Seabed Authority (ISA) governs activities beyond national jurisdictions, regional and transboundary frameworks play a critical supporting role in the management of seabed mineral resources—particularly where jurisdictions are shared or environmental sensitivity requires area-specific oversight. These mechanisms are increasingly important for ensuring coherence between international regulation, national sovereignty, and regional ecological stewardship.

1. Joint Management Areas (JMAs)

Joint Management Areas are formal frameworks through which two or more coastal states jointly govern an extended continental‑shelf zone that straddles or lies between their national maritime boundaries, as permitted by UNCLOS Articles 76, 82 and 83. Designed to turn potential boundary disputes into collaborative opportunities, JMAs provide a single jurisdictional platform for licensing, revenue sharing and environmental oversight in spaces that fall outside any one state’s 200‑nautical‑mile EEZ but remain within their lawful continental‑shelf claims.

The benchmark example is the Mascarene Plateau JMA between Mauritius and Seychelles. Established by twin treaties in 2012, the regime covers 396 000 km² across the Saya de Malha Bank, a region now recognised for cobalt‑rich ferromanganese crust potential.

A three‑tier governance structure is envisaged:

-

Ministerial Council – sets high‑level policy and approves budgets.

-

Joint Commission – issues research permits, screens exploration tenders and monitors compliance.

-

Designated Authority (in formation) – day‑to‑day regulator that executes Environmental Impact Assessments (EIAs), enforces operating standards and collects royalties.

Core Operating Features

The Mascarene Plateau JMA is designed as a turnkey governance package: revenue sharing, science oversight, environmental safeguards, capacity‑building and conflict resolution are all built into a single operating system. Its principal components are as follows.

-

Legal and fiscal clarity is achieved through a two‑tier royalty model that combines a production royalty with a ring‑fenced environmental levy, ensuring benefits flow equitably to both partner states while underwriting ecosystem management costs. Crucially, the partners remit their Article 82 payments to the ISA as a single entity, simplifying administration and eliminating revenue‑sharing disputes.

-

Scientific rigour underpins every operational decision. An independent Scientific Advisory Committee peer‑reviews all environmental impact assessments, sets baseline sampling protocols and validates monitoring data. To foster transparency, the joint authority maintains open‑access data portals that publish bathymetry, biodiversity inventories and quarterly compliance audits, enabling real‑time scrutiny by researchers, investors and civil society.

-

Robust environmental safeguards complement this science‑based approach. Precautionary buffer zones and designated “no‑mine corridors” shield shallow seagrass meadows, tuna nurseries and biodiversity‑rich slopes from direct disturbance. Joint satellite surveillance and ROV patrols enforce licence conditions, deter illegal activity, and provide additional environmental oversight.

-

Revenue and capacity‑building mechanisms are woven into the financial architecture. A dedicated Blue‑Economy Fund diverts an agreed share of royalties into coastal resilience projects, vocational training and marine‑science scholarships for both countries. Initial programme financing has been bolstered by a US $2.2 million UNDP‑GEF grant, while supplementary technical assistance is under negotiation with the World Bank.

-

A standing arbitration panel, modelled on the Nigeria–São Tomé Joint Development Zone, offers binding dispute‑resolution for contractual or environmental conflicts, giving contractors and financiers the legal certainty required for long‑term capital deployment.

-

Finally, the joint authority integrates mineral allocations into a comprehensive marine spatial‑planning system. Mineral licence blocks, shipping lanes, marine protected areas and prospective offshore‑wind corridors are digitised in a single GIS platform, reducing user conflicts and aligning resource development with each nation’s climate and conservation commitments.

Similar structures are now being discussed for the Gulf of Guinea, the Red Sea’s Atlantis II Deep, and sections of the Caribbean, signalling a broader trend toward regional, multi‑stakeholder stewardship of transboundary seabed resources.

2. Regional Environmental Management Plans (REMPs)

Regional Environmental Management Plans (REMPs) are strategic, ISA‑endorsed blueprints for managing seabed minerals in areas beyond national jurisdiction. Drafted with input from contractors, coastal states, scientists, and NGOs, they are not regulations in themselves, yet they act as binding reference documents: every exploration contract, environmental impact assessment, and—ultimately—exploitation licence must align with the relevant plan. By mapping ecologically important zones, setting environmental baselines and indicators, and establishing clear management objectives, REMPs guide mineral exploration and potential mining while safeguarding vulnerable habitats.

Each REMP sets out five pillars of spatial and ecological governance. First, it maps ecologically important areas, such as habitat types, biodiversity hotspots, or larval‑connectivity corridors that warrant special attention. Second, it prescribes Spatial Management Measures such as no‑mine zones, buffer corridors, and designated reference sites for long‑term monitoring. Third, it codifies Environmental Baselines and Indicators, defining the physical, chemical, and biological metrics contractors must track. Fourth, it articulates clear Management Objectives covering conservation targets, priority research needs, and adaptive‑management triggers. Finally, it specifies Cumulative‑Impact Protocols, obliging contractors to assess and report overlapping pressures across multiple licence blocks rather than treating each block in isolation.

Key REMPs include:

-

CCZ REMP (2012; updated 2021) – sets aside nine 160,000 km² conservation areas, standardises baseline protocols, and requires a rolling review tied to pilot‑mining milestones.

-

Mid‑Atlantic Ridge REMP (due 2027) – will cover vent fields such as TAG and Rainbow, with vent‑specific protection zones and plume limits informed by the LIFEDEEPER science programme.

-

Indian Ocean Nodule & Ridge REMP (scoping 2025‑26) – expected to introduce dynamic management blocks that can shift with monsoonal productivity.

REMP provisions are enforced through a four‑part compliance cycle: every exploration or mining licence must demonstrate alignment with the relevant plan, a check performed by the ISA’s Legal & Technical Commission; contractors then upload baseline and monitoring datasets to the ISA’s open‑access DeepData portal, allowing the Authority to track regional trends; the plan itself undergoes a formal review roughly every five years, so spatial rules and protection zones can tighten or shift if cumulative impacts exceed agreed limits; and, throughout, multi‑stakeholder workshops bring in Indigenous knowledge, academic research, and NGO feedback to refine zoning and monitoring indicators, ensuring the regime adapts to both new science and community concerns.

REMPs turn the ISA’s global mandate into region‑specific, science‑based rules that balance mineral access with ecosystem protection. As the Exploitation Code nears finalisation, REMPs will decide where, when, and under what conditions commercial mining can start, and they will frame the cumulative‑impact assessments that follow. For contractors, REMPs bring spatial certainty; for civil society, they offer transparency and enforceable safeguards. In short, REMPs are set to be the operational backbone of environmental governance for deep‑sea mining.

National Seabed Authorities — Within EEZs or Extended Continental Shelves

National seabed authorities translate UNCLOS principles into domestic law, regulating mineral exploration and extraction within a country’s 200 nautical mile Exclusive Economic Zone or its legally recognised extended continental shelf. Their mandates typically include licensing, environmental impact assessments, benefit sharing, and in some cases, representation before the International Seabed Authority.

These authorities play a central role in shaping how seabed resources are accessed and governed. They issue permits, set and enforce environmental standards, monitor operator compliance, and ensure that revenues contribute to national objectives such as climate adaptation, scientific research, and community development. While institutional frameworks vary across jurisdictions, all are grounded in the principles of environmental responsibility, legal certainty, and strategic resource stewardship.

Some countries have introduced moratoria to allow time for scientific baselining and public consultation, with France in 2023 and New Zealand in 2015 and 2017 offering notable examples. Others are advancing legal and operational frameworks through licensing systems, pilot extraction trials, and state-supported research programmes. These include the Cook Islands, India, Japan, and Norway. The Cook Islands has established a two tier royalty system with dedicated allocations to healthcare and climate funds. Japan is conducting rare earth element and cobalt pilot extraction under a dedicated national strategy. India is scaling up seabed technologies through its Deep Ocean Mission, while Norway has mapped Arctic mineral provinces under the Seabed Minerals Act, although licensing is currently paused. In contrast, the United States, while not a party to UNCLOS, is expanding access through the Deep Seabed Hard Mineral Resources Act and a 2025 executive order focused on critical minerals and supply chain security.

Together, these national authorities illustrate a global shift toward assertive, state-led seabed governance, combining precautionary regulation, technological development, and critical mineral policy to define the future of marine resource management.

Active Developers with Strategic National Programmes

Japan, India, China, the United States, South Korea, the Cook Islands, Russia, and Brazil represent the most advanced national jurisdictions in seabed mineral governance. Each has progressed beyond policy formation to operational readiness, establishing legal frameworks, issuing licences, or initiating state-backed pilot projects. These programmes are closely aligned with broader national objectives, including critical mineral security, industrial diversification, energy transition, and geopolitical positioning.

Japan, India, and South Korea are leading in end-to-end technological development, with national pilots, wet-tested collector systems, and growing domestic processing capabilities. China and Russia are embedding seabed minerals within their strategic resource portfolios, using ISA contracts to bolster long-term supply resilience and industrial leverage. The United States, though not a UNCLOS signatory, has accelerated seabed policy through executive action, inter-agency coordination, and the launch of a critical minerals leasing framework. The Cook Islands continues to define best practice among small island states, combining transparent licensing, environmental safeguards, and sovereign revenue mechanisms. Brazil, while earlier in the development curve, is actively building domestic capacity through ISA-linked research and coordinated geoscientific efforts.

Together, these states are laying the legal, scientific, and institutional foundations for commercial-scale deep-sea mining, positioning themselves as early movers in what is emerging as one of the most strategically significant domains of the 21st-century ocean economy. Further details below:

-

Japan – METI / JOGMEC – Japan governs seabed mineral development through the Seabed Mineral Development Act 2022, administered by the Ministry of Economy, Trade and Industry (METI) and implemented by the Japan Oil, Gas and Metals National Corporation (JOGMEC). The government is funding a pilot extraction project at Minamitorishima Seamount, targeting 1,000 tonnes of REE-rich mud and cobalt-rich crusts by 2026. The project is supported by a national seabed mineral research centre, with strict zero-discharge processing guidelines and plume limits exceeding ISA standards.

Revenues from future commercial activity will flow into a critical minerals security fund managed by the National Security Council, reinforcing Japan’s broader strategy to reduce dependence on Chinese REEs and battery inputs. Public opinion polling in 2024 indicated 63% national support for seabed mining, conditional on strict environmental protections. Japan’s programme combines R&D investment, legislative clarity, and strategic alignment, positioning it as one of the most advanced and publicly accountable seabed jurisdictions globally.

-

India – Ministry of Earth Sciences (MoES) / National Institute of Ocean Technology (NIOT) – India’s seabed mineral programme is led by the Ministry of Earth Sciences (MoES) and implemented by the National Institute of Ocean Technology (NIOT) as part of the country’s flagship Deep Ocean Mission, valued at ₹4,000 crore. The programme includes the Samudrayaan human-occupied submersible, a 6,000-metre-rated nodule collector (undergoing wet testing), and an active ISA nodule exploration licence in the Central Indian Ocean Basin, renewed in 2023.

India has also submitted an ISA application for seafloor massive sulphide (SMS) exploration on the Central Indian Ridge, reflecting its dual focus on nodules and SMS systems. Draft seabed mineral regulations require contractors to allocate 1% of project expenditure to coastal community development and mandate public access to environmental baseline data through the National Marine Data Portal. India’s seabed strategy integrates technology development, international engagement, and critical mineral security, reinforcing its ambition to become a vertically integrated deep-sea mining state.

-

China – Ministry of Natural Resources / COMRA – China regulates seabed mineral development under the 2023 Seabed Resources Guideline, issued by the Ministry of Natural Resources, while its international and ISA activities are managed by the China Ocean Mineral Resources R&D Association (COMRA). China holds multiple ISA exploration licences for polymetallic nodules, seafloor massive sulphides, and cobalt-rich crusts, and has mapped significant cobalt-rich provinces within its own EEZ in the western Pacific.

COMRA has developed and tested crawler-based nodule and crust collectors, operating at depths of 1,500 to 2,000 metres, and is advancing marine geological mapping, environmental baselines, and processing technology in parallel. These efforts align with China’s broader industrial strategy to reduce dependence on foreign sources of battery metals, particularly cobalt, nickel, and rare earth elements. The seabed programme is considered a national strategic priority and is tightly integrated with China’s energy transition and critical mineral diplomacy.

-

United States – BOEM and NOAA – Although the United States has not ratified UNCLOS, the Deep Seabed Hard Mineral Resources Act (DSHMRA) gives federal jurisdiction over U.S.-flagged seabed mining operations in international waters. In 2025, a Presidential Executive Order instructed the Bureau of Ocean Energy Management (BOEM) to fast-track a critical minerals leasing programme, covering both domestic EEZ areas (such as off American Samoa) and potential claims in the Clarion–Clipperton Zone. The National Oceanic and Atmospheric Administration (NOAA) is responsible for environmental reviews, scientific permitting, and coordinating habitat protection standards.

Proposed rules issued in late 2025 would cap annual extraction tonnage, set timelines for completing NEPA (National Environmental Policy Act) reviews within twelve months, and impose mandatory buffer zones around coral habitats. An inter-agency Ocean Critical Minerals Working Group, comprising BOEM, NOAA, the State Department, the Department of Defense, and the Department of Energy, coordinates U.S. positions in ISA negotiations and advises on seabed governance strategy. While not a party to UNCLOS, the U.S. is now moving assertively to establish a legal, scientific, and geopolitical footprint in seabed mining through domestic legislation and international partnerships.

-

South Korea – KIOST and Ministry of Oceans and Fisheries – South Korea is one of the most technically advanced ISA sponsors, holding contracts for both polymetallic nodules and seafloor massive sulphides (SMS) in the Clarion–Clipperton Zone and the Indian Ocean. These are managed by the Korea Institute of Ocean Science and Technology (KIOST) under the supervision of the Ministry of Oceans and Fisheries, which sets national ocean policy.

KIOST has been actively developing and field-testing nodule collector prototypes, conducting baseline environmental studies, and investing in geotechnical modelling to support future exploitation. South Korea’s ISA work is directly linked to its domestic industrial priorities, particularly in battery metals and green manufacturing supply chains. Its research vessels have conducted regular cruises since 2013, and in-country processing trials have been conducted to evaluate economic viability. While no commercial-scale operations have begun, South Korea is among the few states capable of executing an end-to-end deep-sea mineral project within the next decade.

-

Cook Islands – Seabed Minerals Authority (SBMA) – The Seabed Minerals Authority (SBMA) was established under the Seabed Minerals Act 2009, revised in 2020 to introduce a two-tier regulatory model balancing commercial access with environmental oversight. The SBMA has issued two polymetallic nodule exploration licences—Moana Minerals and CI Resources—covering the Penrhyn Basin, which hosts one of the world’s largest national nodule inventories. The Authority operates a digital licence registry, enforces a two-phase environmental impact assessment (EIA) framework, and oversees a royalty structure designed for long-term public benefit.

Under the benefit-sharing model, 50% of royalties are allocated to a sovereign fund supporting healthcare and climate adaptation, 25% to local island councils, and 25% to a national reserve fund. Licensees are required to post environmental performance bonds, conduct annual plume-dispersion audits, and engage in mandatory public consultations. The Cook Islands positions itself as a model jurisdiction for small-island states, combining scientific transparency, precautionary regulation, and sovereign resource management in partnership with the ISA.

-

Russia – Ministry of Natural Resources and Environment / Yuzhmorgeologiya – Russia holds ISA exploration contracts for both polymetallic nodules (in the CCZ) and SMS (in the Mid-Atlantic Ridge), managed through the state-owned company Yuzhmorgeologiya, under the Ministry of Natural Resources and Environment. Russian seabed strategy is closely linked to its Arctic and deep-sea energy resource priorities, including mineral exploration on the Arctic continental shelf and technological partnerships with submarine engineering firms.

Russia operates several deep-sea research vessels and has completed multi-year environmental and geophysical surveys within its ISA licence blocks. Although commercial mining timelines remain unclear, Russia has signalled long-term interest in seabed minerals as a hedge against critical mineral import dependence and to diversify its state-owned resource portfolio. Engagement with international environmental standards has been limited in recent years, but technical capability and seabed mapping capacity remain extensive.

-

Brazil – Geological Survey of Brazil (CPRM) and Ministry of Mines and Energy – Brazil holds a polymetallic nodule exploration contract in the Clarion–Clipperton Zone through the Geological Survey of Brazil (CPRM), under the oversight of the Ministry of Mines and Energy. Since securing its ISA licence in 2015, Brazil has conducted baseline environmental surveys, mineralogical assessments, and sediment analysis as part of its multi-year programme to evaluate resource potential and inform future extraction strategies.

CPRM has partnered with academic and international research institutions to develop a national knowledge base on deep-sea ecosystems and marine geology. Brazil views seabed minerals as part of its broader strategy to expand domestic capacity in strategic raw materials, including rare earths and battery metals. While domestic EEZ exploration is still at an early stage, the ISA programme has helped build national expertise and regulatory readiness for potential future development, both in international waters and on Brazil’s own continental margin.

Cautious or Precautionary Regulators

France, New Zealand, Norway, Papua New Guinea, and South Africa have adopted precautionary approaches to seabed mining, asserting full regulatory authority while prioritising environmental integrity, scientific baselines, and public accountability. Each has either imposed a moratorium, rejected commercial proposals, or paused licensing to allow for further impact assessment and policy development.

France has frozen exploitation in its national waters pending robust environmental data, though marine scientific research continues. New Zealand has rejected two major offshore mining applications under its stringent EIA framework, setting a high bar for any future approvals. Norway has suspended licensing following parliamentary pressure and public litigation, with a national environmental study due in 2026. Papua New Guinea, following the collapse of Solwara 1, is advancing a moratorium bill backed by strict financial and ecological safeguards, including a $150 million rehabilitation bond. South Africa, while not yet licensing seabed mining, is conducting policy consultations and offshore mapping, with government signalling that future development will be contingent on public engagement and environmental science.

These states are not opposed to seabed mining in principle, but their regulatory posture reflects a deliberate, science-led stance rooted in public interest and environmental law. Collectively, they define the upper boundary of regulatory scrutiny in the global seabed mining landscape. Further details below:

-

France – Directorate‑General for Maritime Affairs (DGAMPA) – France, which holds the second-largest EEZ in the world at approximately 11 million km², enacted a national moratorium on commercial seabed mining in 2023. The policy was issued by the Directorate‑General for Maritime Affairs, Fisheries and Aquaculture (DGAMPA), under the Ministry for Ecological Transition. The moratorium applies to all commercial exploitation activities within French maritime zones, but does not restrict marine scientific research, including baseline surveys conducted by the national research institute Ifremer.

The decision reflects France’s strong precautionary stance and commitment to environmental due diligence. However, the policy remains open-ended: should the ISA finalise a stringent Exploitation Code and global demand for critical minerals increase, the government has retained the legal option to revisit its position under the existing Mining Code and supporting maritime decrees. France remains a leading scientific contributor to seabed research and an influential voice in global ocean governance, advocating for robust multilateral standards and precautionary science in both ISA and EU forums.

-

New Zealand – New Zealand regulates seabed mineral activities under the Exclusive Economic Zone and Continental Shelf (Environmental Effects) Act 2012, which designates the Environmental Protection Authority as the sole decision maker for offshore mining consents. The EPA has twice rejected high-profile applications, Chatham Rock Phosphate in 2015 and Trans Tasman Resources in 2017, reaffirmed in 2021, citing uncertainty over benthic impacts and the precautionary principle.

These decisions have effectively established a de facto moratorium, setting a high evidentiary bar for any future mining proposals in ecologically sensitive regions such as the Campbell Plateau or Kermadec Ridge. While New Zealand does not oppose seabed mining in principle, its regulatory framework prioritises ecosystem protection, Māori consultation, and adherence to international conservation standards, including commitments under the Convention on Biological Diversity and regional marine protection agreements.

-

Norway – The Seabed Minerals Act 2019 authorises the Norwegian Petroleum Directorate (NPD), under the Ministry of Energy, to license cobalt-rich crust and SMS exploration on Norway’s extended continental shelf, particularly in the Norwegian–Greenland Sea. In 2023, the NPD published a resource assessment and mapped 21 prospective blocks. However, in 2024, Parliament enacted a political pause on licensing pending the results of a government-commissioned environmental impact study, due in 2026.

Public and NGO scrutiny has intensified, with several environmental groups filing a Supreme Court petition arguing that deep-sea mining would violate Article 112 of Norway’s Constitution, which guarantees the right to a healthy environment. Norway continues to support marine scientific research in the area, but commercial progress has halted. The current pause reflects both domestic political caution and Norway’s broader ambition to align its ocean industries with high environmental and climate standards.

-

Papua New Guinea – Papua New Guinea was the first country to issue a commercial seabed mining licence, approving Nautilus Minerals’ Solwara 1 project in the Bismarck Sea. After the project collapsed financially in 2019, the Mineral Resources Authority (MRA) repossessed Nautilus’ seafloor production tools and commissioned CSIRO to assess site impacts. In 2025, the government circulated a draft Seabed Mining Moratorium Bill, which would freeze all new licences until at least 2030.

The bill includes provisions to create a Coastal Community Benefits Trust, requires a USD 150 million rehabilitation bond for any future project, and mandates full scientific reassessment of national marine resources before resuming activity. Papua New Guinea’s experience has shaped global debates around financial risk, environmental accountability, and the need for robust legal frameworks in early-stage seabed mining jurisdictions.

-

South Africa – South Africa has begun formalising its seabed mineral strategy through a government-led offshore mapping initiative coordinated by the Council for Geoscience, under the oversight of the Department of Mineral Resources and Energy (DMRE). While no commercial licensing framework has yet been finalised, South Africa is actively evaluating its offshore mineral potential, including phosphorite, ferromanganese crusts, and heavy mineral sands.

Policy consultations have prioritised public engagement, scientific baselining, and alignment with the country’s Blue Economy Strategy and Ocean Economy Operation Phakisa. Stakeholder dialogue with industry, academia, and civil society is ongoing, and the government has signalled that any future licensing regime will be subject to stringent environmental assessment and Indigenous community consultation. South Africa is not yet a seabed mining jurisdiction, but it is laying the institutional and scientific groundwork to become one.

Enabling Jurisdictions with International Engagement

Tonga, Kiribati, Fiji, and Australia have established seabed mineral governance frameworks that enable future development while remaining closely engaged with international processes, particularly through the International Seabed Authority (ISA). These jurisdictions combine legal readiness with scientific cooperation, regional diplomacy, and precautionary planning.

Tonga and Kiribati have enacted dedicated seabed mineral legislation and actively sponsor ISA exploration contracts, including partnerships in the Clarion–Clipperton Zone. Their national authorities have drafted benefit-sharing mechanisms and environmental protocols that prioritise local equity and the protection of marine heritage, such as Kiribati’s UNESCO-listed Phoenix Islands.

Fiji has opted for a science-first posture, maintaining licensing authority under its 2013 Deep Sea Minerals Policy while working closely with regional bodies like the Pacific Community (SPC) to build capacity and coordinate environmental baselines. No commercial licences have been issued, but policy and institutional architecture are firmly in place.

Australia operates under a mature dual-level system, with offshore mineral activities governed federally beyond three nautical miles and by states in coastal waters. Geoscience Australia has completed resource mapping, and a 2022 discussion paper proposed extending national law to deep-sea sulphides on the Norfolk Ridge. All developments remain subject to the federal Environment Protection and Biodiversity Conservation Act, requiring dual-gate environmental review. Further details below:

-

Tonga – Tonga regulates seabed minerals under the Seabed Minerals Act 2014, which established a dedicated Seabed Minerals Authority within the Ministry of Lands and Natural Resources (MLNR). The Kingdom is a registered ISA sponsoring state and currently backs Tonga Offshore Mining Ltd. (TOML), which holds a polymetallic nodule exploration licence in the Clarion–Clipperton Zone (CCZ). Domestically, Tonga has drafted model regulations to govern any future applications for SMS mining within its EEZ.

Tonga’s framework includes a benefit-sharing mechanism that earmarks 40% of future seabed royalties for climate adaptation projects in outer islands, reflecting its commitment to community resilience and equitable development. The legal regime also mandates stakeholder engagement and baseline data transparency. As a small island developing state with ISA participation, Tonga’s approach balances national development interests with environmental stewardship and international alignment.

-

Kiribati – Kiribati’s Seabed Minerals Act, enacted in 2017, authorises the Ministry of Fisheries and Marine Resources Development (MFMRD) to issue licences for prospecting, exploration, and environmental assessments within its EEZ. The ministry currently sponsors an ISA contract (in partnership with South Korea’s KIOST) for nodule exploration in the CCZ, making Kiribati an active participant in international seabed governance.

The country’s seabed strategy is shaped by the presence of the Phoenix Islands Protected Area, a UNESCO World Heritage Site, which occupies a large portion of its EEZ. As such, Kiribati is finalising EIA guidelines that integrate traditional ecological knowledge and strict marine protection requirements. The legal and scientific processes are designed to ensure that any future seabed development aligns with both international environmental norms and cultural values.

-

Fiji – Fiji governs seabed mineral activity under its 2013 Deep Sea Minerals Policy, which empowers the Mineral Resources Department (MRD) to issue exploration licences and sponsor ISA contracts. A Deep-Sea Minerals Unit within MRD evaluates environmental impact assessments and coordinates regional baseline studies and research cruises through the Pacific Community (SPC).

While Fiji has not issued any commercial licences to date, it has positioned itself as a science-first jurisdiction, focusing on regional collaboration, capacity-building, and evidence-based policymaking. Fiji’s participation in ISA consultations, its engagement in multi-country scientific campaigns, and its commitment to precautionary governance place it among the most internationally engaged small island states in seabed minerals.

-

Australia – Australia regulates seabed mineral activity under the Offshore Minerals Act 1994 (Commonwealth), which applies beyond three nautical miles, while state and territory laws govern seabed activity in coastal waters. Geoscience Australia has conducted extensive mapping of marine mineral deposits, including phosphate, heavy mineral sands, and potential deep-sea sulphides on the Norfolk Ridge.

A 2022 federal discussion paper proposed extending the scope of the Offshore Minerals Act to cover deeper marine provinces. Any such development would require clearance under the Environment Protection and Biodiversity Conservation (EPBC) Act, creating a dual-gate regulatory process. Australia’s federal–state model is mature but not yet activated for deep-sea mining, though policy consultations and resource mapping indicate a growing national interest.

Geological Endowment and Deposit Typologies

Subsea mining targets three principal deposit types, each formed through distinct geological processes and associated with different mineral profiles, physical characteristics, and geographic distributions. These include polymetallic nodules, cobalt-rich ferromanganese crusts, and seafloor massive sulphides (SMS). Together, they represent a vast and largely untapped source of critical minerals essential for the energy transition, including cobalt, nickel, rare earth elements, and battery-grade metals.

-

Polymetallic nodules are potato-sized concretions lying loose on the abyssal plains of the deep ocean floor. They form over millions of years through the slow accretion of metal oxides around a core, typically at depths of 4,000 to 6,000 metres. Nodules are rich in manganese, nickel, copper, cobalt, lithium, and rare earth elements, often with relatively uniform and high-grade metal content across large areas. The most commercially significant region is the Clarion–Clipperton Zone (CCZ), located in international waters between Mexico and Hawaii, and administered by the International Seabed Authority (ISA). Other notable deposits include the Peru Basin and the Central Indian Ocean Basin, also in international waters, as well as deposits within national jurisdictions such as the Penrhyn Basin in the Cook Islands, the EEZ of Niue, and regions of French Polynesia. Compared to terrestrial sources, polymetallic nodules offer the potential for lower strip ratios, fewer waste volumes, and reduced need for large-scale land disruption.

-

Cobalt-rich ferromanganese crusts are thin, hard layers that form on the flanks and summits of seamounts, typically at depths of 800 to 2,500 metres. These crusts grow through hydrogenetic precipitation of metals from seawater and are a promising source of cobalt, nickel, manganese, rare earth elements, tellurium, and platinum. They tend to occur in rugged terrain that complicates extraction, but the metal grades, particularly for cobalt and tellurium, can exceed those of many terrestrial deposits. Key locations include the Prime Crust Zone in international waters between Hawaii and the Mariana Trench, as well as within the EEZs of Japan (notably the Minamitorishima Seamounts and Izu–Bonin Arc), the United States (Hawaiian Seamount Chain), and several Pacific Island nations such as the Marshall Islands and Kiribati. Crusts have also been identified in the Mascarene Plateau in the Indian Ocean, spanning both national EEZs and international waters.

-

Seafloor massive sulphides (SMS) are hydrothermal ore deposits formed by the precipitation of metal-rich fluids at or beneath the ocean floor, particularly at mid-ocean ridges, back-arc basins, and volcanic arcs. These deposits contain high concentrations of copper, zinc, gold, silver, and lead, often in compact, high-grade zones. The most studied SMS sites include the Mid-Atlantic Ridge (TAG and Rainbow fields) and the Southwest and Central Indian Ridges, all in international waters. Within national jurisdictions, prominent examples include the Solwara Field in the Bismarck Sea (Papua New Guinea), the Lau Basin between Tonga and Fiji, the Okinawa Trough in the Japanese EEZ, and the Atlantis II Deep in the Red Sea, a rare example of a joint EEZ zone between Saudi Arabia and Sudan. These deposits are often geologically analogous to massive volcanic sulphide (VMS) deposits on land, but they can offer superior grades, particularly for precious metals like gold and silver.

Extraction Methods, ESG risks and Challenges

The extraction of deep-sea mineral resources requires highly specialised technologies capable of operating under extreme pressure, low light, and fragile ecological conditions. Each deposit type presents unique engineering and environmental challenges. For polymetallic nodules, extraction typically involves tracked collector vehicles deployed to the seafloor, which scoop or vacuum nodules from the sediment and transfer them through riser systems to a surface vessel. These systems are designed to minimise disturbance to the surrounding substrate, but inevitably generate sediment plumes, both at the seafloor and midwater column. These plumes can reduce water clarity, interfere with filter-feeding organisms, and potentially spread contaminants over large distances, with uncertain effects on microbial and benthic communities.

For cobalt-rich ferromanganese crusts, extraction involves cutting or stripping crust layers from hard rock surfaces on seamount flanks and summits. This is mechanically complex and may involve cutting tools or drills mounted on remotely operated vehicles (ROVs), with higher risks of habitat destruction due to the permanence of seamount communities and their slow recovery rates. Seafloor massive sulphides (SMS) require more intensive mechanical removal, often resembling small-scale open-pit mining, with excavation tools used to dislodge sulphide chimneys and underlying deposits. These activities can disrupt hydrothermal vent ecosystems, which are characterised by unique and often endemic species, many of which are poorly studied or undocumented.

Environmental and social governance (ESG) risk profiles vary significantly by deposit type. Polymetallic nodules, which lie on soft sediment plains, present relatively lower physical habitat disruption compared to crusts and sulphides, but pose serious concerns over sediment plume dispersion, faunal displacement, and long-term ecosystem function. In contrast, crust mining threatens to damage biologically rich and structurally complex seamount habitats, which are exceptionally slow to regenerate. SMS deposits are typically smaller in spatial extent but may host some of the most vulnerable biological communities, including chemosynthetic organisms adapted to hydrothermal environments. The destruction of these habitats could lead to irreversible biodiversity loss, particularly given the short spatial ranges of many species.

Mitigation strategies remain in the early stages of development. Operators have proposed various technical solutions, including low-sediment collectors, plume containment mechanisms, and real-time environmental monitoring. Environmental baseline studies are underway in several contract areas, most notably the NORI-B environmental programme in the CCZ, which has conducted multi-year studies on sediment dynamics, biodiversity mapping, and ecosystem response modelling. These efforts are intended to inform impact assessments and guide the development of adaptive management strategies, although the long-term effectiveness of proposed mitigation remains uncertain.

Civil society organisations and independent scientists have expressed increasing concern over the pace and transparency of ISA decision-making. Many argue that the precautionary principle is not being adequately applied and call for a moratorium on commercial exploitation until more comprehensive scientific data are available. Over 800 marine scientists have signed declarations urging restraint, and several countries, including France, Chile, and New Zealand, have publicly supported temporary bans. This resistance has shaped a more adversarial science-policy interface within the ISA, with growing demands for independent review processes, improved public consultation, and enhanced legal protection for vulnerable marine ecosystems.

1) Polymetallic Nodules (high readiness, bulk tonnage)

Polymetallic nodules are mineral-rich concretions scattered across deep-sea abyssal plains, found at depths of 4,000 to 6,000 metres. They contain economically significant concentrations of manganese, nickel, copper, cobalt, lithium, and rare earth elements, materials essential for electric vehicles, energy storage systems, and renewable energy technologies. As demand for critical minerals accelerates, nodules offer an abundant and scalable resource, but unlocking their potential requires both technological maturity and coordinated governance.

Three principal regions illustrate the global scope and varied regulatory pathways of nodule exploration: the Clarion–Clipperton Zone (CCZ), the Penrhyn Basin in the Cook Islands’ EEZ, and the Central Indian Ocean Basin (CIOB). The CCZ, located in international waters and regulated by the International Seabed Authority (ISA), is the world’s most advanced subsea mining zone, with 17 contracts, extensive environmental baselines, and full pilot trials completed. Yet its future hinges on the adoption of the ISA’s Exploitation Code and resolution of geopolitical tensions, particularly involving non-ratifying states like the United States. In contrast, the Cook Islands’ Penrhyn Basin represents a pioneering national approach, with legislation in place, exploration licences awarded, and robust stakeholder engagement. It demonstrates how smaller island states can align deep-sea mining with economic, cultural, and ecological priorities. India’s CIOB programme highlights how emerging producers are integrating nodule extraction into broader national strategies, leveraging seabed resources to diversify supply chains and reduce import dependence.

Key elements in in polymetallic nodules

-

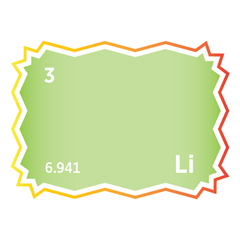

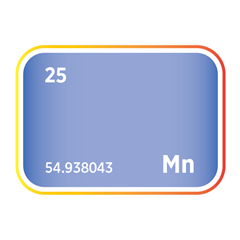

Manganese – Manganese is the dominant element in polymetallic nodules, typically comprising 25-40% by weight, depending on location and depth. It forms the structural matrix of the nodules through layered manganese and iron oxides, such as vernadite and todorokite, which accumulate around a nucleus over millions of years.

-

Nickel – Nickel is present in concentrations of 0.8-1.5%, making it one of the primary target metals. In nodules, nickel is often concentrated in the outer oxidised layers, adsorbed onto manganese oxides. The relatively even distribution of nickel in nodules allows for bulk-scale recovery, supporting its commercial viability as a primary product.

-

Copper – Copper typically accounts for 0.5-1.2% of nodule mass and is commonly found as finely dispersed minerals or absorbed within the manganese-oxide matrix. Its consistent presence across nodule fields adds significant economic value. Its co-occurrence with nickel and cobalt makes polymetallic nodules an attractive multi-metal feedstock, particularly in the context of global energy transition demands.

-

Cobalt – Cobalt is found in concentrations ranging from 0.1-0.25%, often concentrated in the outermost oxide-rich layers of nodules. It is strongly adsorbed onto manganese and iron hydroxides. Cobalt’s inclusion strengthens the case for nodules as a battery-grade multi-metal resource, particularly in light of supply chain concerns related to terrestrial cobalt sources, such as the DRC.

Trace elements in polymetallic nodules

Several elements are present in polymetallic nodules only in trace amounts or select locations. While they do not currently drive commercial interest, they hold varying degrees of strategic or technical relevance depending on processing capabilities, market demand, and environmental considerations.

-

Lithium – Lithium has been detected in small concentrations in some Clarion–Clipperton Zone (CCZ) nodules, typically occurring in adsorbed forms or within clay-like inclusions. However, levels remain too low and inconsistent to support commercially viable recovery using current technology. Despite its marginal contribution to total metal content, lithium's critical role in battery technologies continues to prompt research into its potential extraction as a by-product.

-

Rare earth elements (REEs) – REEs, including lanthanum, cerium, neodymium, and yttrium, have been identified in trace amounts in nodules from both the CCZ and Central Indian Ocean Basin (CIOB). These elements are typically adsorbed onto iron-manganese oxides or occur in loosely bound mineral inclusions. While present in low concentrations, REEs are essential for high-performance magnets, electric motors, and electronics, encouraging further investigation into whether they can be economically recovered as by-products of large-scale nodule processing.

-

Thorium – Thorium, a naturally radioactive element, is also found in minor quantities in some nodule provinces, particularly in the CCZ. Due to its radiological properties, it poses regulatory and waste-handling challenges during processing. However, nodules from the Penrhyn Basin in the Cook Islands are known to contain lower thorium levels, which simplifies environmental compliance and enhances their attractiveness from a residue management perspective.

-

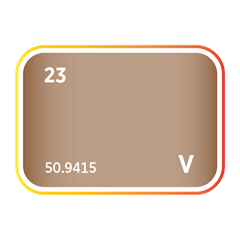

Molybdenum, titanium, and vanadium appear sporadically in nodules, usually as trace impurities or within micro-inclusions. These elements do not significantly influence the economic value of the resource under current market conditions, but they may affect the performance and design of metallurgical flowsheets, particularly in refining and waste treatment stages. Their presence is being monitored as part of broader assessments of nodule mineralogy and processing optimisation.

1.1 Clarion–Clipperton Zone (CCZ)

Spanning 4.5 million km² between Mexico and Hawaii, the Clarion–Clipperton Zone (CCZ) is the most extensively explored and technologically advanced region for polymetallic nodule development. As of 2025, it hosts 17 of the International Seabed Authority’s (ISA) 19 active nodule exploration contracts, covering a vast swathe of the Northeast Pacific. These contracts are held by contractors sponsored by states including Canada, Belgium, Germany, China, the United Kingdom, and South Korea—reflecting broad international interest in the region’s resource potential.

Leading operators such as The Metals Company (TMC) and Global Sea Mineral Resources (GSR) are pioneering commercial pathways. In 2024, TMC’s NORI-D project marked a significant milestone with a 60-day pilot collector trial, successfully lifting 3,000 tonnes of nodules from 4,000 metres below the surface at a continuous rate of 86 tonnes per hour. The nodules recovered from the CCZ contain, on average, 1.3% nickel, 1% copper, 0.2% cobalt, and trace amounts of lithium and rare earth elements, grades that, when scaled, rival or exceed many terrestrial sources of these metals.

All contractors have submitted Environmental Impact Statements (EISs) and extensive baseline datasets addressing key ecological parameters such as sediment plume behaviour, benthic biodiversity, and mid-water column dynamics. Despite this progress, the lack of a finalised ISA Exploitation Code continues to delay commercial development. As of July 2025, the code remains under negotiation, leaving timelines for large-scale production uncertain. Most projections suggest first production is unlikely before 2031 to 2033, contingent on regulatory clarity and investor confidence.

Adding further complexity, the United States, which has not ratified UNCLOS and is therefore not a party to the ISA system, issued a 2025 executive order enabling U.S. firms to apply for CCZ exploration blocks under the Deep Seabed Hard Mineral Resources Act (DSHMRA). This unilateral approach creates legal ambiguity and geopolitical tension, particularly as American entities begin to operate alongside ISA-sanctioned contractors. The result is a highly dynamic regulatory and competitive environment in what is likely to be the world’s first industrial-scale deep-sea mining zone.

1.2 Penrhyn Basin, Cook Islands EEZ

Transitioning from international waters to national jurisdictions, the Penrhyn Basin within the Cook Islands’ Exclusive Economic Zone (EEZ) illustrates a sovereign-led model for deep-sea mineral development. Covering approximately 160,000 km² within the country’s 1.9 million km² EEZ, the basin holds one of the largest known national nodule resources. In 2023, licensees Moana Minerals and CI Resources reported an inferred resource of 6.7 billion tonnes of polymetallic nodules, with average grades of 0.8% nickel, 0.6% copper, 0.09% cobalt, and 30% manganese. Located in relatively shallower waters than the Clarion–Clipperton Zone, up to 4,500 metres, the nodules here also contain lower concentrations of radioactive thorium, a characteristic that simplifies downstream processing and residue management.

Governance is led by the Seabed Minerals Authority, established under the Seabed Minerals Act (2020). This framework mandates a two-phase Environmental Impact Assessment (EIA) process before any mining licence can be granted. It includes large-scale collector system trials and independent modelling of sediment plumes and benthic disturbance. This ensures that environmental protection standards meet or exceed emerging international benchmarks.

Beyond regulation, the Cook Islands have proposed a sovereign royalty fund designed to return 50% of future mining revenues to public services, notably healthcare and climate adaptation infrastructure. This fiscal approach aligns resource development with long-term national resilience goals. While some regional NGOs and customary groups have raised concerns about ecological disruption and the cultural significance of the ocean, public consultations in 2024 revealed broad conditional support, especially if community benefits are transparently allocated and marine ecosystems are properly safeguarded.

With pilot nodule lifts scheduled for 2027, the Penrhyn Basin is on track to become the world’s most advanced EEZ-based deep-sea mining initiative, setting an important precedent for how small island developing states (SIDS) can exercise sovereign control over seabed resources while embedding ESG safeguards and inclusive development strategies.

1.3 Central Indian Ocean Basin (CIOB)

In the Central Indian Ocean Basin (CIOB), India stands out as the sole ISA contractor operating in this region, holding a polymetallic nodule exploration licence covering 75,000 km² of deep-sea floor between 4,800 and 5,800 metres depth. The licence is managed by the National Institute of Ocean Technology (NIOT), which has undertaken extensive geophysical and environmental mapping since 2019. This includes over 10,000 line-kilometres of high-resolution geophysical surveys and the collection of 1,200 box-core samples. The nodules in this region contain 1.2% nickel, 1% copper, and 0.18% cobalt, with a notably high manganese content. While these grades are slightly lower than those found in the Clarion–Clipperton Zone, they remain commercially viable, particularly given India’s domestic processing capabilities.

In 2024, NIOT conducted a successful wet test of a 17-tonne tracked collector prototype, designed to operate at depths of up to 6,000 metres. Parallel laboratory trials demonstrated 92% nickel recovery using a combination of acid leaching and solvent extraction, validating India’s metallurgical approach. The CIOB project forms part of a broader dual-resource strategy, with NIOT also applying for an ISA licence to explore seafloor massive sulphides (SMS) on the adjacent Central Indian Ridge. This aligns closely with India’s national priorities, supporting critical inputs for stainless steel production, energy storage, and electric vehicles under the Critical Minerals Strategy 2030.

India’s subsea mineral initiatives are geopolitically significant, positioned as a direct response to Chinese dominance in terrestrial and processing-stage critical minerals. The CIOB programme also reflects India’s intent to establish itself as a vertically integrated deep-sea mining actor. While environmental activism has been relatively muted, NIOT has committed to adhering to the ISA’s forthcoming Indian Ocean regional environmental management plan, expected in 2026. This includes sediment plume modelling, benthic biodiversity studies, and baseline oceanographic monitoring.

2) Cobalt‑Rich Ferromanganese Crusts

Cobalt-rich ferromanganese crusts form as slow-growing mineral coatings on the flanks and summits of underwater seamounts and ridges, typically at depths of 800 to 2,500 metres. These crusts are enriched in cobalt, nickel, manganese, rare earth elements (REEs), tellurium, and platinum—metals that are increasingly vital for batteries, renewable energy systems, and high-performance electronics. Unlike polymetallic nodules, which lie loose on the seafloor, crusts are firmly bound to hard rock substrates, making their extraction technologically complex and environmentally sensitive.

Three key regions illustrate the diversity of crust mining strategies and governance models: the Prime Crust Zone (PCZ) in the Western Pacific, Japan’s EEZ projects at Minamitorishima and the Izu–Bonin Arc, and the Mascarene Plateau Joint Management Area (JMA) in the Indian Ocean. The PCZ’s high-grade deposits are being explored under ISA oversight, but steep terrain and delicate ecosystems challenge collector design and habitat preservation. Japan’s national programme combines REE-rich crusts and deep-sea muds with cutting-edge regulation and industrial policy aimed at reducing import dependence. Meanwhile, the Mascarene Plateau offers a pioneering transboundary framework, co-managed by Mauritius and Seychelles, for equitable and environmentally responsible resource development.

Together, these regions highlight the strategic potential of crust mining to diversify global supply chains for cobalt and REEs. But success will depend on solving engineering challenges, such as reliable cutting, lifting, and processing systems at scale, while ensuring strong environmental protections and harmonised international governance.

Key elements in cobalt-rich ferromanganese crusts

-

Manganese – Manganese is the dominant structural component of cobalt-rich ferromanganese crusts, typically comprising 20–30% by weight. It accumulates over millions of years through hydrogenetic precipitation of manganese and iron oxides from seawater, forming thin, dense layers on the flanks and summits of seamounts. These manganese oxides act as hosts for key strategic metals such as cobalt, nickel, and rare earths. The extremely slow growth rate—often just 1–5 mm per million years—results in finely laminated crusts with high metal retention capacity.

-

Cobalt – Cobalt is the principal economic driver of crust mining, with concentrations ranging from 0.5% to 1%, significantly higher than many terrestrial laterite deposits. It is strongly adsorbed onto manganese oxides in the upper layers of the crust and is often more enriched at the surface due to ongoing hydrogenetic processes. Cobalt’s inclusion makes these crusts particularly attractive for battery production, superalloys, and strategic defence materials, especially as nations seek to diversify away from Congolese supply chains.

-

Nickel – Nickel is found in concentrations of 0.3% to 0.7%, depending on seamount geology and crust thickness. It is generally co-located with cobalt within the manganese-oxide matrix, contributing to the crust’s multi-metal value. While typically lower than in polymetallic nodules, nickel from crusts remains a strategic input for lithium-ion battery cathodes, stainless steel, and aerospace alloys, and may be co-recovered in integrated hydrometallurgical flowsheets.

-

Copper – Copper occurs in lower concentrations than in nodules or SMS deposits, typically at 0.05% to 0.2%, but may be locally enriched. It is present as trace minerals or adsorbed onto iron-manganese surfaces. Though not a primary target, copper contributes marginally to the overall metal value and can be recovered as a by-product in some processing configurations, particularly in crusts with higher Fe-Mn content.

Trace elements in cobalt‑rich ferromanganese crusts

While cobalt, nickel, and manganese are the dominant components in cobalt-rich ferromanganese crusts, several trace elements occur in varying concentrations across different crust provinces. These elements may not currently drive project economics, but their strategic value, co-production potential, or impact on processing make them increasingly important to long-term development strategies, particularly as demand for clean energy technologies intensifies.

-

Rare Earth Elements (REEs) – REEs are among the most strategically important trace components in cobalt-rich ferromanganese crusts, particularly on Western Pacific seamounts such as those in the Prime Crust Zone (PCZ) and Minamitorishima Seamount within Japan’s EEZ. These crusts contain a mix of light and heavy REEs, most commonly lanthanum, cerium, neodymium, and yttrium, with dysprosium occasionally present. Typical concentrations range from 100 to 400 ppm total REEs, although localised enrichments may exceed these levels under favourable geochemical conditions. REEs are primarily hosted within the iron–manganese oxide layers, either as adsorbed ions or as inclusions within fine-grained mineral phases.

-

Tellurium – Tellurium is another high-value trace element commonly enriched in the outermost microns of cobalt-rich crusts, particularly those growing on slow-accreting seamounts with high oxygenation and minimal sedimentation. Concentrations typically range from 50 to 200 ppm, with some localised samples exceeding 250 ppm. Tellurium is a critical material for cadmium telluride (CdTe) solar cells, thermoelectric modules, and semiconductor alloys. However, due to its surface-bound distribution and fine dispersion, selective extraction remains technically complex, and no commercial recovery pathway has yet been demonstrated at scale.

-

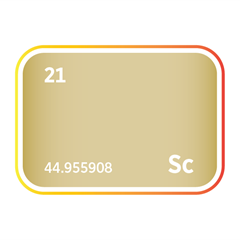

Scandium – Scandium is present in elevated concentrations in select crust provinces, especially around Minamitorishima, where grades of 30 to 70 ppm have been reported. Scandium is prized for its role in lightweight aluminium–scandium alloys, used in aerospace structures, hydrogen technologies, and solid oxide fuel cells. Although present only in trace amounts, even small concentrations can carry significant economic value due to scandium’s scarcity and high unit price. As with REEs and tellurium, its potential recovery would require tailored flowsheets that can integrate with cobalt and nickel processing without adding complexity or cost to the overall metallurgical system.

-

Platinum Group Metals (PGMs) – PGMs, particularly platinum and palladium, have been detected in trace concentrations in some Pacific crusts, likely concentrated through slow hydrogenetic precipitation. Their occurrence is highly variable and site-specific, often at levels below 1 ppm, but nonetheless of interest given their role in catalytic converters, hydrogen fuel cells, and electronic components. While not currently considered viable targets, PGEs remain under scientific review for future co-recovery scenarios.

-

Finally, trace levels of bismuth, molybdenum, vanadium, and tungsten have been documented sporadically in crust samples, typically as minor inclusions or adsorbed species. These elements are generally not recoverable under current technologies but may influence metallurgical behaviour, waste profiles, or residue handling protocols.

2.1 Prime Crust Zone (PCZ), Western Pacific

Straddling the Marshall Islands and the Mariana Trench, the Prime Crust Zone (PCZ) is the leading frontier for cobalt-rich ferromanganese crust exploration under the governance of the International Seabed Authority (ISA). Exploration licences in this region are held by Japan’s JOGMEC and China’s COMRA, targeting clusters of seamounts where crusts up to 8 centimetres thick yield cobalt concentrations of around 1%, approximately three times higher than many terrestrial laterite deposits. These crusts also contain significant levels of nickel, manganese, and trace rare earth elements (REEs), positioning the PCZ as a strategic resource zone for energy transition metals.

The region’s complex topography, with vertical relief exceeding 1,500 metres, prevents conventional tracked collectors typically deployed in nodule fields. Instead, operators are trialling crawler-mounted drum-cutters paired with high-pressure slurry pumps to detach and transport crust material. In 2024, JOGMEC successfully retrieved 12 tonnes of saw-cut crust slabs from a depth of 1,800 metres, demonstrating the technical feasibility of mechanical extraction under real seafloor conditions.

Despite these advancements, the ecological risks remain substantial. Footage from remotely operated camera sleds has revealed that crust mining could severely damage slow-growing coral and sponge communities that dominate seamount ecosystems. These findings raise the ESG risk profile of crust extraction above that of polymetallic nodules. In response, the ISA is drafting seamount-specific environmental thresholds, focusing on biodiversity protection and sediment plume mitigation strategies.

From a strategic standpoint, Japanese projections suggest that cobalt sourced from the PCZ could reduce the country’s reliance on the Democratic Republic of the Congo by up to 20% by 2035, assuming that processing technologies for high-manganese feedstocks continue to advance. However, the absence of a finalised ISA Exploitation Code, still under negotiation as of July 2025, continues to delay commercial progress. As a result, full-scale mining in the PCZ is unlikely to begin before 2032–2035, contingent on regulatory clarity, environmental safeguards, and industrial-scale system integration.

2.2 Japanese EEZ: Minamitorishima & Izu–Bonin Arc

Through legislative clarity, targeted public investment, and advanced offshore technologies, Japan is positioning itself as a global leader in the sustainable development of high-value seabed resources.

Within its Exclusive Economic Zone (EEZ), Japan is advancing exploration of both cobalt-rich ferromanganese crusts and rare earth element (REE)-rich muds, particularly at the Minamitorishima Seamount and the Izu–Bonin Arc. Located approximately 1,850 km southeast of Tokyo, Minamitorishima hosts deep-sea pelagic muds with REE concentrations reaching up to 5,000 ppm total rare-earth oxides—20 to 30 times the average concentration found in continental crust. Additionally, crusts in the region grade 1.1% cobalt and contain elevated scandium levels, a strategic element for lightweight alloys and clean energy technologies.

In 2023, JOGMEC conducted a successful drilling campaign that confirmed a 1.4 gigatonne inferred resource, intersecting up to 31 metres of REE-rich mud. To accelerate development, the Japanese government has allocated ¥7 billion for a 2026 pilot lift of 1,000 tonnes, using a barge-mounted plant to test in situ separation techniques for REE recovery. This operation will provide essential data on the feasibility of offshore extraction and processing in one of the world’s most geochemically promising EEZ settings.

Parallel efforts in the Izu–Bonin Arc and Okinawa Trough target seafloor massive sulphide (SMS) deposits, which average 7% zinc, 6% copper, and 4 g/t gold, adding diversification to Japan’s subsea mineral strategy. A 2023 environmental impact study warned that removal of active hydrothermal vent chimneys could create trenches up to 30 metres deep, prompting researchers and regulators to explore active habitat recolonisation measures to mitigate long-term ecological disruption.

These initiatives are governed by Japan’s 2022 Seabed Mineral Development Act, which imposes stricter sediment plume limits and environmental standards than the draft ISA Exploitation Code, reflecting Japan’s strong domestic commitment to marine conservation and biodiversity protection within its territorial waters. Aligned with the country’s Critical Minerals Strategy and industrial decarbonisation goals, Japan’s EEZ projects aim to reduce its 60% dependency on Chinese REE imports by 2030.

2.3 Mascarene Plateau Joint Management Area (JMA)

The Mascarene Plateau, spanning 396,000 km² and jointly governed by Mauritius and Seychelles, represents a pioneering transboundary governance model for seabed mineral exploration in the Indian Ocean. Established through a pair of 2012 bilateral treaties, the Joint Management Area (JMA) covers parts of the Saya de Malha Bank, a large undersea plateau where initial reconnaissance dredging has recovered 5–8 cm-thick cobalt-rich crusts, grading up to 1% cobalt, 0.8% nickel, and enriched tellurium. These early samples signal promising potential for future cobalt supply, especially for countries seeking alternatives to Pacific seamounts.

To support responsible development, a 2024 UNDP-funded capacity-building programme allocated US$2.2 million to help establish governance instruments, including a Marine Scientific Research Code, an Environmental Code of Practice, and a fiscal-sharing framework for future resource revenues. Complementary domestic legislation was passed in both countries in 2023—Seychelles’ Mascarene Plateau Act and Mauritius’ Seabed Minerals Bill—paving the way for exploration tenders once comprehensive environmental baselines are completed.

Ecological concerns are central to the JMA’s regulatory design. The plateau hosts shallow seagrass meadows, critical blue-carbon ecosystems, and key tuna nurseries, raising the stakes for managing plume dispersion from future mining along deeper slopes. These sensitivities have led to stringent draft thresholds for sediment plume impacts and strengthened precautionary approaches to ecosystem protection.

Reflecting growing geopolitical interest in the Indian Ocean’s mineral potential, both India and France have proposed joint expeditions to the JMA in 2026, with research focused on geochemical mapping and biodiversity assessments. If environmental assessments progress as planned, a competitive bidding round could launch in 2027, positioning the Mascarene Plateau as a regionally significant cobalt supply alternative.

3) Seafloor Massive Sulphides (high grade, high ESG risk)