The Lithium Market

Critical Minerals and The Energy Transition

An introduction to lithium

Lithium demand and end-uses

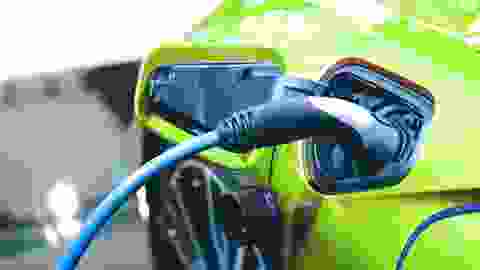

Lithium is a well-established industrial metal with uses diversified across sectors including materials for glass and ceramics production, as a component in performance greases and lubricants and as a metallurgical powder. More recently, it has come to the fore as a battery material for electric vehicles, as well as portable electronics.

Lithium is the lightest solid element and the lightest alkali metal. Lithium’s advantages are its high electrochemical potential, while it also has the lowest density and highest specific heat capacity of all metals. It is found in the Earth’s crust, but never in its pure metallic form as it exhibits similar properties to other alkali metals, such as high reactivity and flammability.

Lithium’s end-uses can be broadly split into three categories: automotive battery, other battery, and non-battery. Major end-uses for lithium comprise lithium-ion batteries (LiBs) for electric vehicles (EVs), energy storage and other electronic devices, such as mobile phones, laptops, tablets and power tools, primary (non-rechargeable) batteries for electronic devices, and non-battery applications, including glass and ceramics, greases and lubricants, air treatment, aluminium smelting, metallurgical casting powders, pharmaceutical drugs (medical) and rubber tyre manufacturing (polymers). End-use applications for each salt vary, although there is some overlap, especially between lithium carbonate (Li2CO3) and lithium hydroxide (LiOH).

Since the early 2010s, lithium chemistries have started to play a leading role in automotive battery technologies, alongside several others as manufacturers have experimented with different chemistries to optimise all aspects of performance and, of course, price. Consequently, lithium consumption in automotive batteries started to rise significantly as EV production expanded rapidly.

Lithium supply and resources

Lithium occurs in over 100 different mineral compounds, although only a handful are currently economic to extract, with spodumene (highest grades) being the most commercially viable hard rock source and hence the most commonly mined. Spodumene is typically found in pegmatites which are igneous rocks similar to granites but with very coarse grain sizes. Pegmatites provide the greatest abundance of lithium-bearing materials, also commonly containing petalite, lepidolite, amblygonite and eucryptite. Some of these minerals are also currently extracted for lithium, while the others have been mined in the past. Other notable minerals include hectorite (clay), jadarite and zinnwaldite, deposits of which are currently being evaluated as potentially economic sources of lithium.

Aside from rock-based sources, lithium is also commonly found in brine water, particularly in sub-surface continental (closed-basin) brines (160-2,000 ppm), which are typically found in arid climates under salt pans (also known as salars). These shallow deposits are accumulations of saline groundwater within closed basins that are enriched with dissolved lithium leached from local lithium-rich source rocks. Lithium is also found in seawater (0.14-0.25 ppm), with higher concentrations found near hydrothermal vents (up to 7 ppm), as well as in leachates of geothermal wells (geothermal brines). Brines containing lithium (petrobrines; up to 700 ppm) are also extracted from oilfields as a waste product from underground formations, along with oil and gas.

Thus, lithium deposits that are economically viable to exploit fall into two broad categories: hard rock and brine. Hard rock mineral deposits (including clay) are exploited by open-pit or underground mining methods. Mined ore is then typically concentrated into a more mineral-rich product, such as spodumene concentrate, for further processing into lithium compounds at conversion plants around the world. Significant hard rock resources are located in Australia, the US, China, sub-Saharan Africa, Europe, Canada, Mexico and Russia. Continental brine deposits are pumped to the surface and then concentrated in a series of large solar evaporation ponds. As the water is evaporated by the Sun it creates an increasingly concentrated brine which, once sufficiently enriched in lithium (~5,000 ppm), is processed at a chemical plant and converted into lithium compounds, primarily lithium chloride (LiCl), Li2CO3 and LiOH. Substantial brine resources are located in the Lithium Triangle of South America (Chile-Argentina-Bolivia), China and the US.

Owing to its high reactivity, lithium is sold commercially as various lithium compounds, particularly Li2CO3 and LiOH, as well as LiCl, lithium fluoride (LiF), and butyllithium.

Lithium supply and demand are reported in lithium carbonate equivalent (LCE) tonnes as an industry standard, rather than in tonnes of pure lithium metal. LiOH readily absorbs water from the air, forming lithium hydroxide monohydrate (LiOH.H2O), and is often sold in this form.

Recent presentations on the battery metals markets

Lithium carbonate equivalent (LCE) market balance

| LCE tonnes | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021f | ||

| Primary lithium supply | |||||||||

| Regional | |||||||||

| Australia | |||||||||

| Chile | |||||||||

| China | |||||||||

| Argentina | |||||||||

| North America | |||||||||

| Brazil | |||||||||

| Rest of World | |||||||||

| Total primary LCE supply | 158,695 | 196,725 | 316,915 | 398,755 | 429,425 | 397,005 | 454,865 | ||

| Lithium demand and recycling |

|||||||||

| Lithium-ion battery demand | |||||||||

| Battery electric vehicles (BEV) | |||||||||

| Plug-in hybrid electric vehicles (PHEV) | |||||||||

| Full hybrid electric vehicles (FHEV) | |||||||||

| Mild hybrid electric vehicles (MHEV) | |||||||||

| Full cell electric vehicles (FCEV) | |||||||||

| Heavy-duty electric vehicles (HDEV) | |||||||||

| E-bikes | |||||||||

| Total LCE battery demand for transport | 13,530 | 22,865 | 33,155 | 68,570 | 94,335 | 134,225 | 202,305 | ||

| Other battery demand | |||||||||

| Laptops and tablets | |||||||||

| Mobile phones | |||||||||

| Energy storage | |||||||||

| Other battery (incl. non lithium-ion) | |||||||||

| Total other LCE battery demand | 36,865 | 36,015 | 37,090 | 37,305 | 38,080 | 40,480 | 47,135 | ||

| Non-battery lithium demand | |||||||||

| Glass & ceramics | |||||||||

| Greases & lubricants | |||||||||

| Other non-battery | |||||||||

| Total non-battery LCE demand | 116,645 | 119,365 | 123,700 | 127,805 | 130,865 | 129,910 | 136,065 | ||

| Gross LCE demand | 167,010 | 178,245 | 195,950 | 233,685 | 263,280 | 304,615 | 385,505 | ||

| Lithium recycling | 0 | 0 | 0 | 0 | 0 | 5 | 35 | ||

| Net LCE demand | 167,010 | 178,245 | 195,950 | 233,680 | 262,280 | 304,610 | 385,470 | ||

| Lithium market balance (LCE) | -8,315 | 18,480 | 120,965 | 165,075 | 166,145 | 92,395 | 69,390 | ||

| Lithium price history | |||||||||

| Lithium carbonate price (99% China, $/tonne) | 18,871 | 19,307 | 16,191 | 8,552 | 5,400 | 12,750 | |||

| Lithium carbonate price (battery grade, 99.5% China, $/tonne) | 22,255 | 21,822 | 17,974 | 9,940 | 6,383 | 14,000 | |||

| Spodumene 5% min (China, $/tonne) | 869 | 615 | 429 | 650 | |||||

Source: SFA (Oxford). Updated July 2021.

Lithium hydroxide (LiOH.H20) market balance

| LiOH.H2O tonnes | 2017 | 2018 | 2019 | 2020 | 2021f | ||||

| Lithium hydroxide supply | |||||||||

| Regional | |||||||||

| China | |||||||||

| Chile | |||||||||

| USA | |||||||||

| Australia | |||||||||

| Rest of World | |||||||||

| Total LiOH supply | 40,500 | 60,980 | 82,270 | 97,025 | 121,005 | ||||

| Lithium hydroxide demand and recycling |

|||||||||

| Lithium hydroxide battery demand | |||||||||

| Battery electric vehicles (BEV) | |||||||||

| Plug-in hybrid electric vehicles (PHEV) | |||||||||

| Full hybrid electric vehicles (FHEV) | |||||||||

| Mild hybrid electric vehicles (MHEV) | |||||||||

| Full cell electric vehicles (FCEV) | |||||||||

| Heavy-duty electric vehicles (HDEV) | |||||||||

| E-bikes | |||||||||

| Total LiOH battery demand | 16,355 | 39,455 | 61,185 | 90,460 | 178,810 | ||||

| Gross lithium hydroxide demand | 16,355 | 39,455 | 61,185 | 90,460 | 178,810 | ||||

| Lithium hydroxide market balance | 24,145 | 21,525 | 21,085 | 6,565 | -52,805 | ||||

| Lithium hydroxide price history | |||||||||

| LiOH price (56.5% China, $/tonne) | 22,024 | 20,794 | 11,811 | 7,297 | 13,550 | ||||

Source: SFA (Oxford). Updated July 2021.

Battery-grade lithium hydroxide producers

Potential battery-grade lithium hydroxide producers

The Battery Metals market

SFA (Oxford) also provides regular market intelligence on the battery metal markets. Discover some of the critical materials used in batteries.

SFA's lithium market reports

SFA (Oxford) provides regular bespoke lithium-ion battery market intelligence reports on the lithium market as well as in-depth studies on lithium-ion recycling, lithium trade flows, and lithium pricing for lithium carbonate and lithium hydroxide.

Meet the Battery Metals team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Daniel Croft

Commodity Analyst

Thomas Chandler

Principal Lithium Supply Analyst

Lakshya Gupta

Senior Market Analyst: Battery Materials and Technologies

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Ismet Soyocak

ESG & Critical Minerals Lead

David Mobbs

Head of Marketing

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.