Joining the dots of Battery Raw Materials

Lithium, Nickel and Cobalt

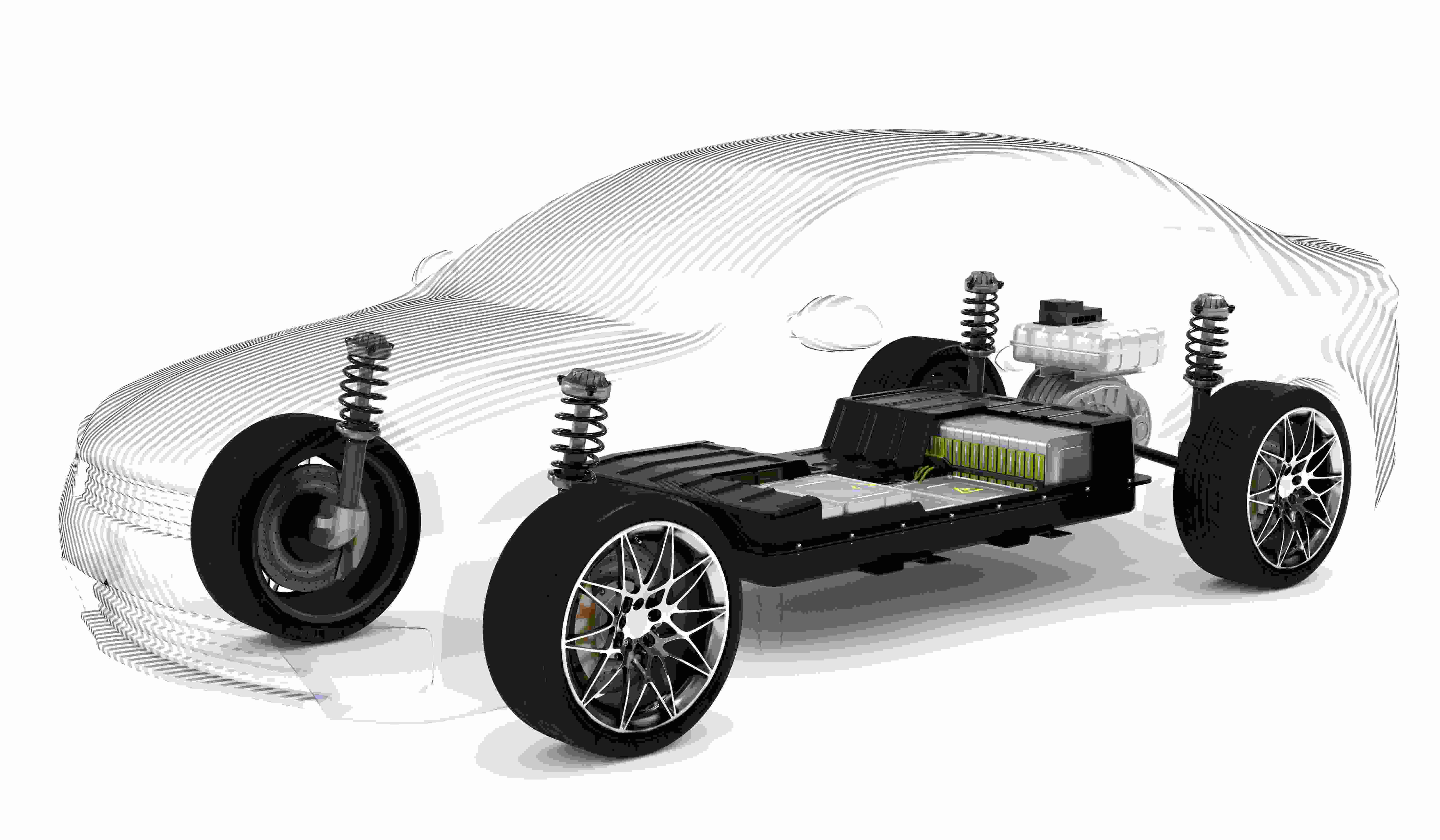

Verifying the extent EVs will shock the metal markets

SFA (Oxford)'s Battery Metals and Materials team presents a granular 480-page examination of the electric vehicle (EV) sector and its impact on lithium, nickel and cobalt consumption. With these key battery commodities at, or near, the bottom of their price cycle, there is significant strategy and commercial value to be gained from taking a 360-degree perspective on their markets, 'joining the dots' on how EV uptake is developing around the globe and how individual supply chains for these metals are evolving. Our consulting experience, including due diligence in the lithium sector and on-site visits to cobalt mines in the DRC and HPAL plants in Australia, uniquely positions us to understand the economics of lithium, nickel and cobalt.

Market outlook for lithium, nickel and cobalt

SFA’s long history of supplying OEMs with comprehensive analytics in the automotive supply chain, its understanding of key technological innovations, and comprehensive knowledge of emissions legislation and business developments form the basis for our leading analytical edge. Specifically, our history of conducting critical PGM research with emissions compliance has provided us with a responsive appreciation of automotive emission technologies, delivering OEMs and fabricators with key analytical insights into the dynamics of raw material requirements for two decades.

Our team of experts used a granular approach to develop a comprehensive ‘join the dots’ linkage that extrapolates regional supply and demand for each critical battery material, forming the backbone and analytical integrity of this report:

-

Demand modelling utilises the principle of ‘equilateral thinking’, imposing complex variables (e.g. battery chemistry, battery pack costs and battery pack size) on EV forecasts to predict EV battery demand for lithium, nickel and cobalt on a like-for-like basis.

-

Comprehensive supply modelling accounts for mine (and project) economics, life-of-mine and quality of saleable product.

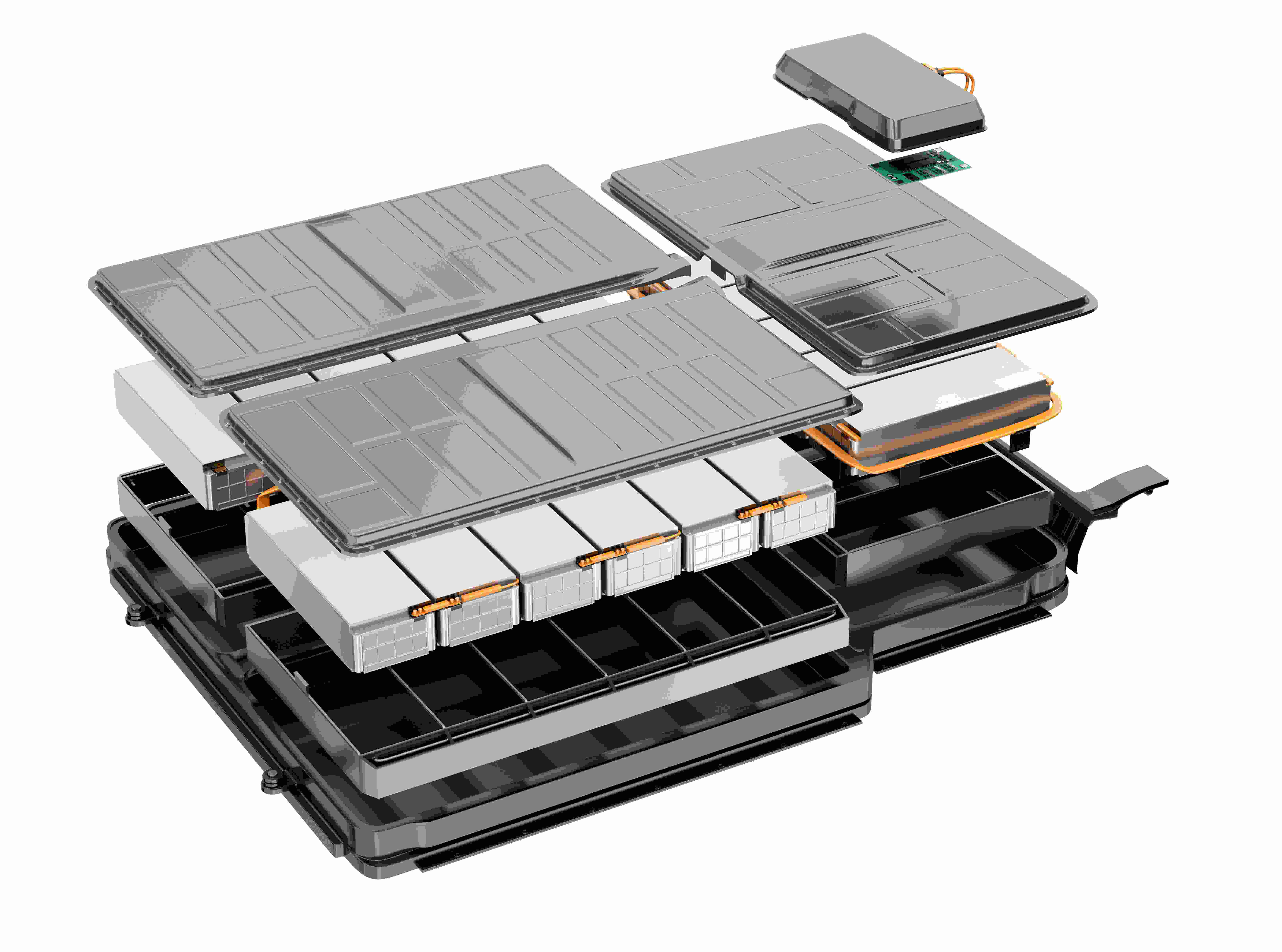

The drivers of EV uptake, the evolution of battery technology and the level of upcoming battery demand from the automotive sector out to 2040 are detailed. Currently, OEMs are switching to nickel-rich cathodes to improve the energy density of their batteries so as to extend the driving range of EVs. Consequently, lithium demand is shifting to hydroxide over the traditional carbonate form.

Our analyst briefing definitively answers the following 15 questions recently asked by clients:

-

What does long-term EV battery demand mean for critical battery cathode materials?

-

What are the drivers for EV battery demand?

-

Where is EV battery demand growth coming from in the short, medium and long term?

-

Who are the major EV battery suppliers in each region?

-

What are the demand risks from EVs for critical battery materials?

-

Who are the major lithium producers? Who are their clients?

-

Who are the major nickel producers? Who are their clients?

-

Who are the major cobalt producers? Who are their clients?

-

What are the preferred product forms, for the three key metals, in EV batteries?

-

To what extent is the EV battery supply chain vertically integrated?

-

What is the possibility of further integration in the future?

-

When will battery metal prices incentivise new mine supply?

-

Where will the new mine supply come from?

-

What is the lead time for new projects to come online?

-

What role will EV battery recycling play in future supply?

Who should read this report?

-

All industry stakeholders and new business entrants who need to keep abreast of the evolving influences on the lithium, nickel and cobalt markets and prices, including end-users, mining companies and juniors.

-

Investors and financial institutions needing to understand and quantify the risks and opportunities in the industry, future costs of production and short- to medium-term prices.

Live Q&A with the analysts

-

Our detailed report 'Joining the Dots between electric vehicles and critical battery metals' is supported by a video call, most often hosted through MS Teams, which is led by Beresford Clarke, along with our team of expert Battery Metals and Materials analysts, to run through our key findings, and address any further questions your team may have.

Section 1: Lithium

Background

-

Reserves and resources

-

Supply history

-

Supply chain

-

Processing and costs

-

End-uses

-

Demand history

-

Recycling

-

Trade flows

-

Product pricing

-

Price history

Market outlook

-

LCE market

-

Oversupply risk

-

Lithium hydroxide (LiOH) market

-

Covid-19 impact

-

Stocks

-

Price outlook

-

Economic window

-

Project incentive price

Lithium supply

-

LCE supply outlook

-

Probable and possible supply

-

Lithium hydroxide supply outlook

-

LiOH conversion capacity

-

Potential LiOH conversion capacity

-

LCE supply by source

-

Brine operations

-

Hard rock mines

-

China

-

Producer costs

Supply chain and offtake agreements

-

Overview

- Albemarle

-

Altura Mining

-

Alita Resources

-

AMG Lithium

-

Bacanora Lithium

-

Core Lithium

-

Covalent Lithium

-

Galaxy Resources

-

Ganfeng Lithium

-

Grupo Mota / Lepidico

-

Lithium Americas

-

Livent

-

Mineral Resources

-

Nemaska Lithium

-

North American Lithium

-

Orocobre

- Pilbara Minerals

- POSCO

-

Prospect Resources

-

Sayona Mining

-

SQM

-

Talison Lithium

-

Tianqi Lithium

Section 2: Nickel

Background

-

Sulphide ores

-

Laterite ores

-

Global reserves

-

Global resources

-

Historical demand

-

Historical supply

-

Nickel value chain

Market outlook

-

Recent market developments

-

Market outlook

-

Demand summary

-

Price movements

-

China

Nickel supply

-

Supply overview

-

Nickel sulphide production

-

Nickel laterite production

-

By-product production

-

2019 nickel supply

-

Current nickel supply

-

Main Class 1 producer profiles

-

Off-take agreements

-

Nickel production to 2025

-

Production from projects

-

Project incentive price

-

Nickel sulphate projects

-

Nickel sulphate economics

-

Nickel supply forecast to 2040

-

The optimal window for nickel projects

-

Class 1 nickel in stainless steel

-

Class 1 nickel supply outlook

-

High-pressure acid leach process (HPAL)

Section 3: Cobalt

Background

-

Global reserves

-

Historical demand

-

Historical supply

-

Cobalt supply chain

-

Processing

-

Price history

-

Stocks

Market outlook

-

Recent market developments

-

Market outlook

-

Demand outlook

-

Price movements

-

China

Cobalt supply

-

Supply overview

-

Primary cobalt production

-

Cobalt as a by-product of copper mining

-

Cobalt as a by-product of nickel laterite mining

-

Cobalt as a by-product of nickel sulphide mining

-

2019 cobalt supply

-

Current cobalt supply

-

Main producer profiles

-

Offtake agreements

-

Cobalt production to 2025

-

Cobalt production to 2040

-

Cobalt production by country

-

Projection from projects

-

Project incentive price

-

Cobalt production forecast to 2040

(including probable and possible projects)

-

The optimal window for cobalt projects

-

Cost of production

-

Non-conventional supply

-

Recycling

-

DRC supply risks

-

Ethical supply

-

Substitution

Section 4: Battery metals and materials fundamentals

BEV market outlook

-

Global BEV production outlook

-

Powertrain electrification drivers

-

China

-

Western Europe

-

North America

-

Global xEV production outlook

-

Automotive battery demand outlook

Battery technology developments

-

Lithium-ion – development and deployment

-

Li-ion battery chemistries

-

Battery metal loadings

-

Battery technology risks

-

Future cathode developments

-

OEM battery preferences

Supply chain mapping

-

Downstream supply chain

-

Battery manufacturers, clients and suppliers

-

Manufacturing capacity

-

Battery-makers and plant expansions

Drivers behind powertrain electrification

-

Car ownership

-

Electric vehicle cost

-

Emission standards

Lithium demand outlook

-

Recent market developments

-

Market outlook

-

Demand outlook

-

Price movements

-

China

Nickel demand outlook

-

Nickel demand by segment

-

Nickel battery demand by cathode

Cobalt demand outlook

-

Cobalt demand by segment

-

Cobalt battery demand by cathode

Appendix

Market balances

-

Lithium (LCE basis)

-

Battery-grade lithium hydroxide

-

Nickel

-

Cobalt

Vehicle production

-

Light-duty electric vehicle production

Lithium summary tables

-

LCE supply (by country and by producer)

-

LCE supply (by mine)

-

LCE probable and possible supply

-

LCE demand (by end-use)

-

Lithium EV demand (by region)

-

Lithium hydroxide EV demand

Nickel summary tables

-

Nickel supply (by country)

-

Nickel probable and possible supply

-

Nickel demand (by end-use)

-

Nickel EV demand (by region)

Cobalt summary tables

-

Cobalt supply (by country)

-

Cobalt probable and possible supply

-

Cobalt demand (by end-use)

-

Cobalt EV demand (by region)

Contact one of our team for more details

Beresford Clarke

Managing Director: Technical & Research

Lakshya Gupta

Senior Market Analyst: Battery Materials and Technologies

Thomas Chandler

Principal Lithium Supply Analyst

Dr Ralph Grimble

Operations Director

Daniel Croft

Commodity Analyst

Other battery metals and materials market reports

Explore other reports our clients use regularly.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.