Financial ESG Services

ESG investment advisory

Empowering Investors in the Critical Minerals Value Chain

SFA (Oxford)’s Financial ESG Services offer tailored ESG integration, benchmarking and disclosure solutions designed for institutional investors, fund managers, private equity firms, and streaming companies operating across the critical minerals and energy transition minerals value chains — including PGMs, battery metals, rare earths, and other strategic commodities.

In an evolving regulatory landscape, investors are under mounting pressure to justify their ESG strategy & action alignment to regulators, Limited Partners, and other stakeholders. Our consulting solutions are built to support this mandate with robust, data-driven analytics and regulatory-ready reporting tools.

The push towards disclosure, accountability and transparency

In 2020, SFA began covering the upstream critical minerals sector, with comprehensive ESG market sector analytics, and their related economics, connecting all upstream, downstream and recycling-loop linkages of worldwide producers and users along the PGM food chain.

As organisations and institutions are assessed on their ethical and sustainability practices spanning environmental, social and governance (ESG) areas, ESG-compatible investment vehicles have been gathering traction amongst investors of all types as public awareness of companies' social and environmental influences increases.

In the face of new global social and environmental challenges, compliance with ESG initiatives has moved to the forefront of investor priorities. Understanding and mitigating regulatory, political and stakeholder issues are key to longevity in the natural resource sector. The pressures surrounding these factors are set to increase over the coming years.

To improve company accountability of their environmental footprints, SFA can help investors by benchmarking the peers in numerous ways to show new trends and sector outperformance. Some of the key ESG areas we look at include:

Key Features:

Custom ESG Risk Screening and Benchmarking

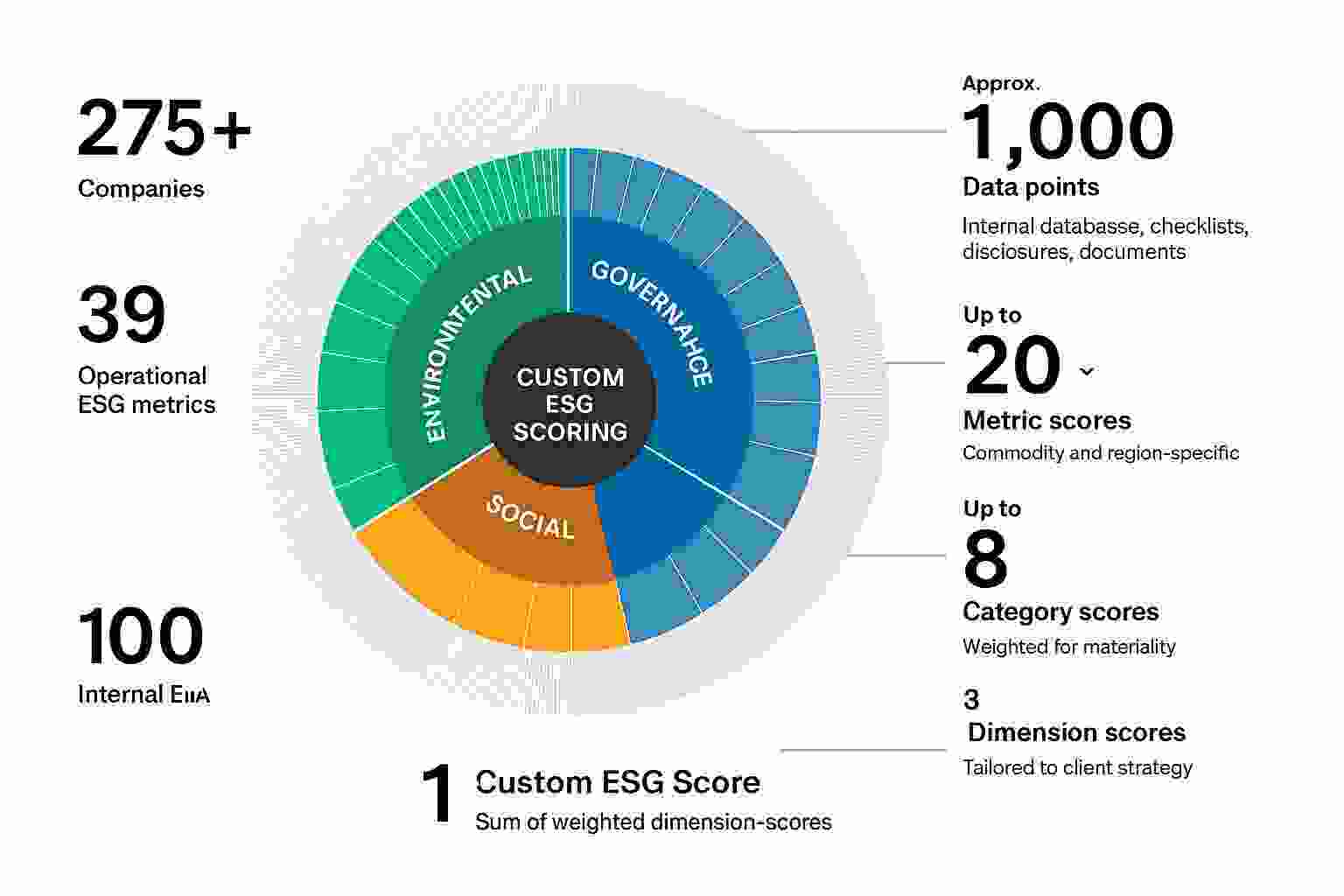

Our internal database tracks 39 operational ESG metrics across 275+ leading mining, refining, and fabrication companies. This enables:

-

Commodity- and region-specific peer group benchmarking

-

Custom ESG scoring aligned with investment strategy

-

ESG performance tracking at company, holding, and portfolio levels

-

Integration into traditional financial due diligence workflows

Materiality-led ESG Strategy and Regulatory Disclosures

We support clients through the full lifecycle of ESG compliance, from pre-investment screening to post-investment disclosure:

-

Bespoke ESG strategies aligned with EU Taxonomy, EU SFDR, UK SDR, SEC, FCA, and CSDR

-

Investable universe creation based on inclusionary/exclusionary criteria

-

Peer performance and index benchmarking (e.g. emissions, water, and energy intensity curves)

-

Pre-contractual disclosures, PAI statements, and annual ESG reporting

Who We Support:

Fund and Portfolio Managers

We design and implement robust ESG frameworks that integrate seamlessly with your investment decision-making process. From scoring models to regulatory filings, our tools enable transparent and credible ESG credentials for your financial products.

Private Equity and Streaming Firms

Gain a clear view of ESG risks and opportunities before capital deployment. Our services help validate ESG performance, address LP and client inquiries, and manage regulatory disclosures throughout the investment lifecycle.

Case Study:

A leading investment house with $8 billion AUM launched an Article 8 ESG fund under the EU SFDR, focused on energy transition. SFA (Oxford) delivered:

-

A tailored ESG strategy and screening methodology

-

A whitelist of 400+ companies validated against material ESG criteria

-

A bespoke ESG scoring model to qualify under “sustainable investment” thresholds

-

End-to-end pre-contractual disclosure and reporting services

The fund achieved regulatory registration within nine months and raised over €30 million in its first year — driven by the strength of its ESG proposition and investor confidence in its transparent methodology.

Let us quantify, benchmark and contextualise the ESG impacts of your financial decisions

Contact one of our team for more details.

Ismet Soyocak

ESG & Critical Minerals Lead

Henk de Hoop

Chief Executive Officer

Jamie Underwood

Principal Consultant

Other ESG consulting solutions

Explore other sustainability services for green investors.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.