Business as usual despite disruptions

27 September 2023

Impact of Euro 7, UK 2035 and US strikes on automotive PGM forecasts

Automakers globally are navigating a series of near-term disruptions, and important regional policy changes, which compound the ongoing costly and complex transition from ICE to BEV powertrains.

Strikes at established US automakers over pay: near-term downside to PGM demand, the scale of which is highly dependent on the length of the UAW strike. We estimate 10% of US annual PGM demand at risk based on an 11-week strike – 152 koz Pd, 56 koz Pt, 18 koz Rh. Latest news indicates Ford is making progress with the union, while the strike has escalated to more GM and Stellantis plants.

UK government decision to delay new ICE car sales ban to 2035 from 2030: automakers are unlikely to change production plans significantly from BEV back to ICE, tough BEV targets still in place (80% by 2030). As this only affects the UK market, the potential upside to 3E PGM demand from a slightly longer tail of hybrids is less than 50 koz per annum from 2025 onwards.

Europe watering-down Euro 7 emissions legislation: automakers are reluctant to invest in BEV powertrains and additional cost of aftertreatment for ICE powertrains. EU ministers have now agreed not to change the existing Euro 6 standards for cars and vans, though they will follow the original, more stringent, standards planned for heavy-duty vehicles. Combined, we believe this will have a very limited net impact on EU PGM demand forecasts compared to our original assumptions.

US big 3 on strike: estimating short-term impact on PGM demand

Strikes have begun at certain plants of the Detroit 3 automakers after current employment contracts between the automakers and the UAW expired on 14 September and acceptable new deals have not been reached. The probability of an extended strike is relatively high, as the two sides are starting from very different positions, though neither side can afford a long strike. Interestingly, with US elections looming in 2024, it has already become a very politicised strike, with US President Joe Biden joining the striker’s picket lines!

As an industry in transition from ICE to BEV powertrains, both the automakers and the UAW union are aware of the risks of conflict. For the Detroit 3 automakers, being forced to pay high wages would put them at a competitive disadvantage compared to non-unionised automakers with a strong BEV product range such as Tesla and emerging Chinese automakers. For the unions, there may be fewer jobs in the future if the new car market contracts as vehicle prices rise, and if BEV production requires fewer workers than ICE vehicle production.

Three plants were targeted initially at GM, Ford and Stellantis. The aim is to create maximum disruption by targeting smaller numbers of plants, so reducing the UAW’s strike payment obligations and retaining leverage to increase pressure on automakers over time by taking more plants out.

Significant and prolonged risks to the supply chain have also been highlighted; some tier 1/2/3 independent plants supplying the affected automotive plants have already made temporary layoffs, with little financial resilience after several years of weak profits following the pandemic, the chip shortage, high raw materials costs and irregular automotive production schedules. Laid-off skilled employees are likely to find alternative employment, and then be unavailable to return to the automotive sector once the strike is over, exacerbating future production difficulties for the sector. The steel industry has been impacted already, with U.S. Steel Corp idling a blast furnace in Illinois in response to lower demand for steel.

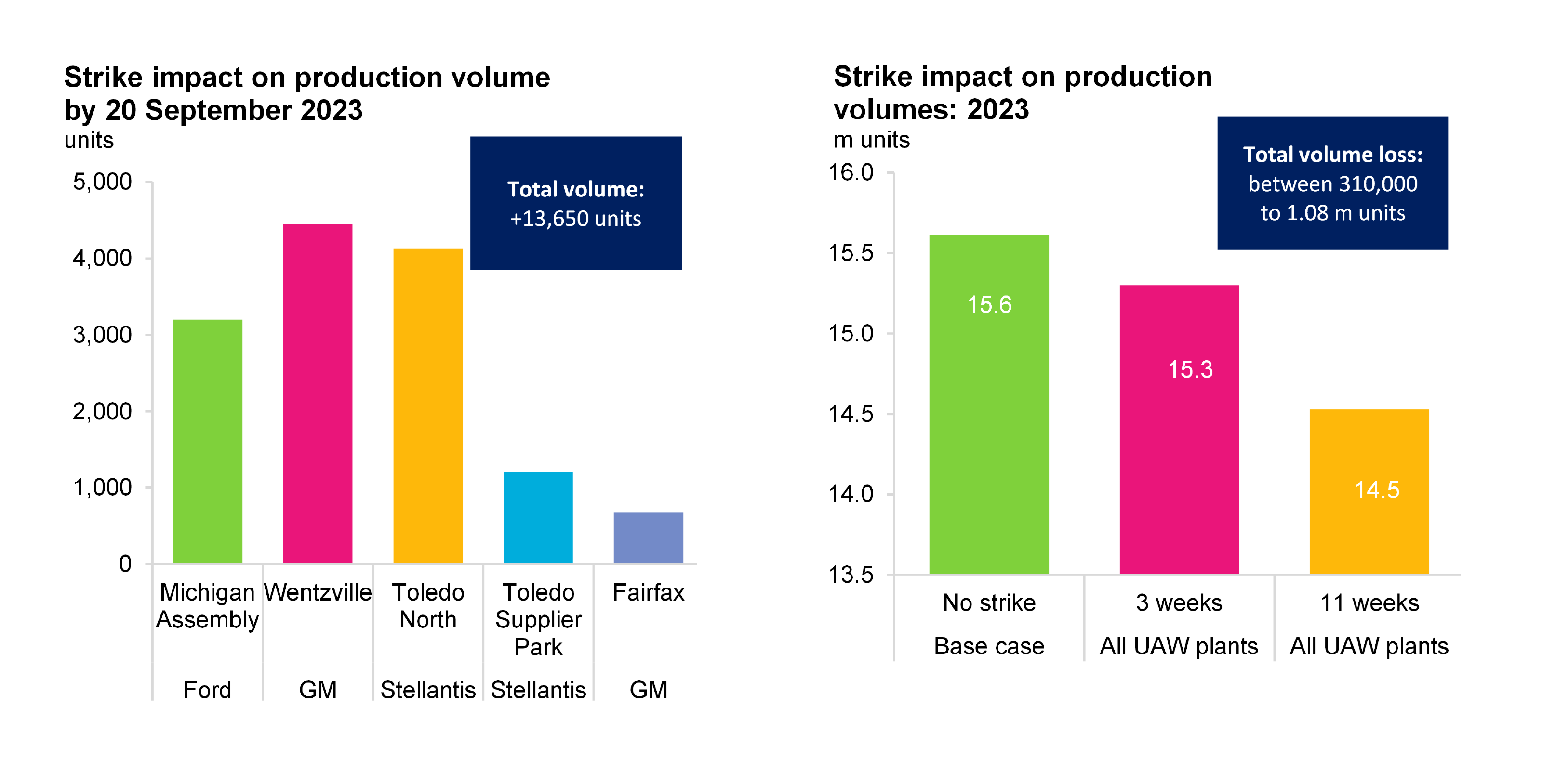

Lost production estimates vary given the rapidly changing situation, but a three-week strike across all UAW plants would remove approximately 300,000 units from production (-2%) while an eleven-week strike would cut output by just over 1.0 million vehicles (-7%), shown on the charts below. There is further downside risk to Canada and Mexico output from shortages of US-built engines, transmissions and other parts exported to those countries.

US UAW Strikes

Source: SFA (Oxford), GlobalData

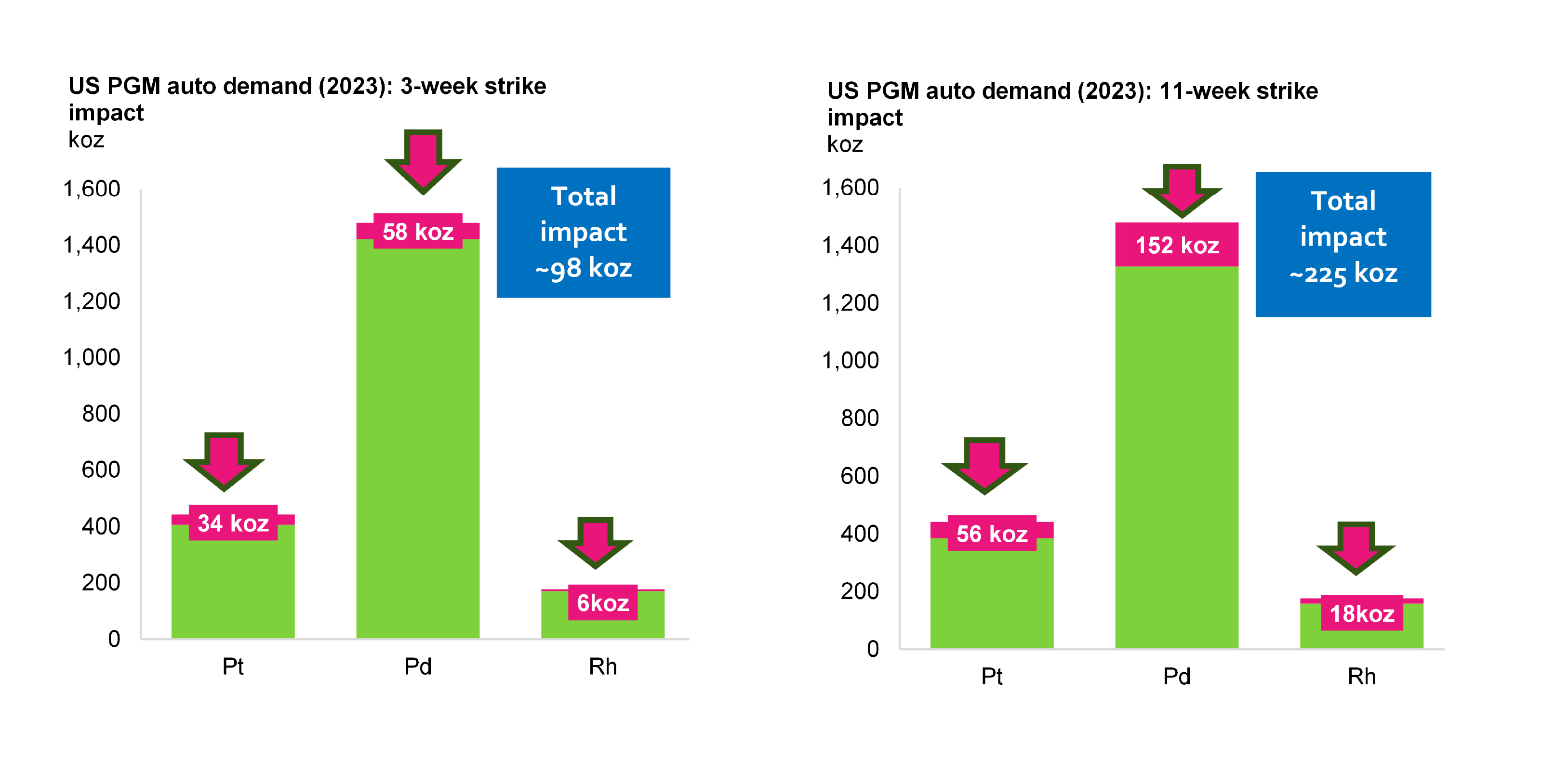

Approximately 10% of annual Pd demand may be at risk. The corresponding impact on PGM demand of these production cuts are shown below for both a short strike and for a more prolonged strike, with green showing the reduced annual demand for each of these metals, and pink showing the ounces at risk under the two strike scenarios. In this gasoline-dominated market, the greatest impact would be for palladium, with 152 koz at risk from a total 1,350 koz, followed by 56 koz platinum at risk out of 410 koz and 18 koz rhodium at risk out of 160 koz, for an 11 week strike (current demand is green + pink on charts).

Source: SFA (Oxford), GlobalData

UK delays ICE vehicle sales ban from 2030 to 2035 in line with Europe

UK targets were regarded by many in the industry as more of a political aspiration than a practical reality for 2030. The UK government still expects the majority of new light vehicles sold by 2030 will be BEVs, based on the assumption of increasingly attractive prices for BEVs compared to ICE cars.

Automakers selling cars in the UK still face a BEV mandate; in 2024 they must sell 22% electric vehicles, and 80% by 2030. So after 2030, only 20% (and decreasing) of vehicles sold may be ICE-only or hybrid.

Automakers including Ford and VW criticized the delay, citing the need for supportive government policy to help them add BEV manufacturing capacity and to promote BEV use to consumers. Toyota though recognized that the delay allows the full range of low emissions and affordable powertrain technologies to be used in vehicles. Stellantis reiterated its commitment to selling only zero-emission cars and vans in the UK and EU, ahead of the 2035 ban. Charging infrastructure stakeholders criticized the delay, for risking investment in renewables and charging technologies.

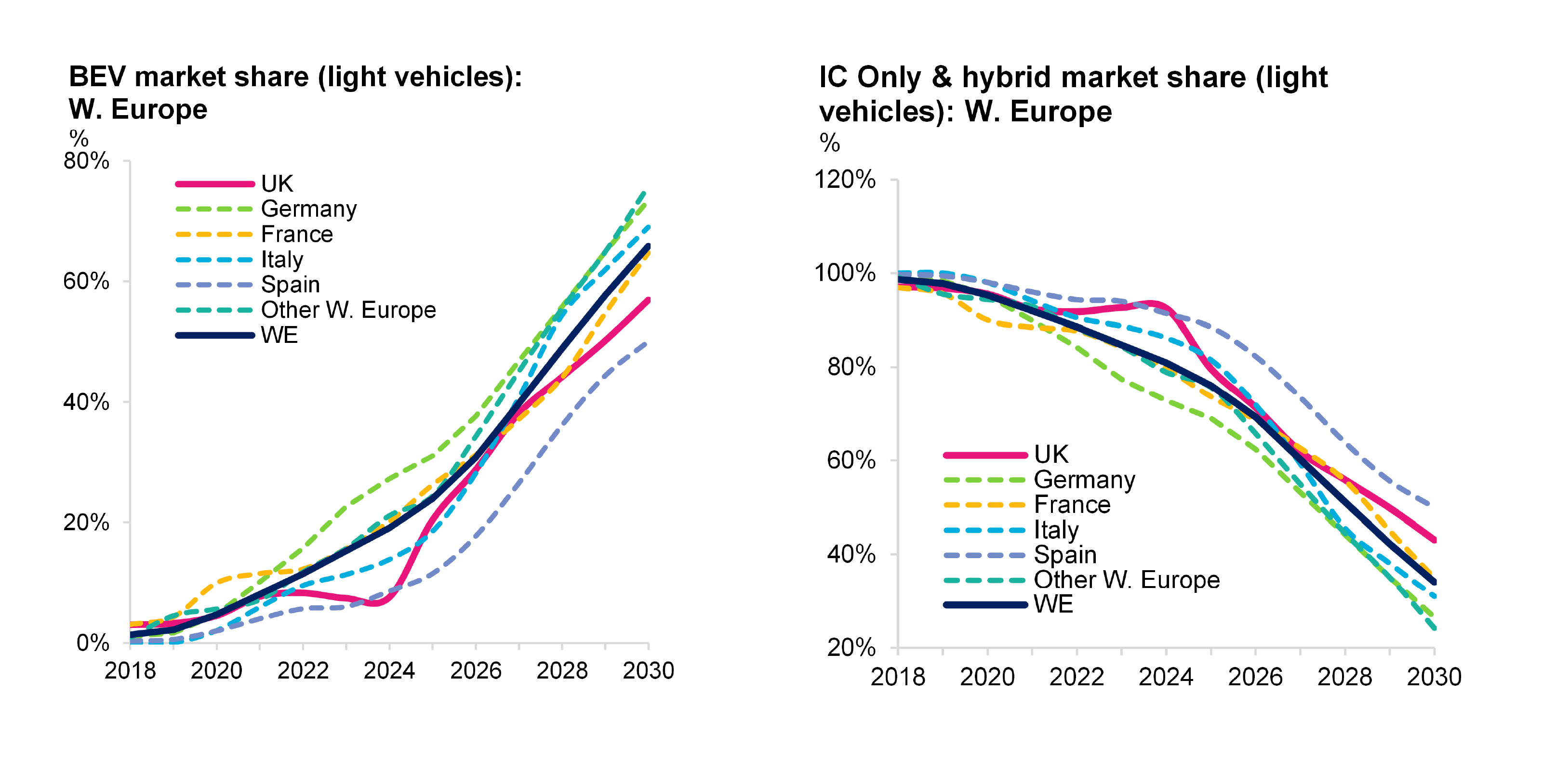

The charts below show the UK is currently forecast to be one of the less aggressive adopters of BEVs.

UK ban on new ICE cars to be delayed to 2035

Source: SFA (Oxford), GlobalData

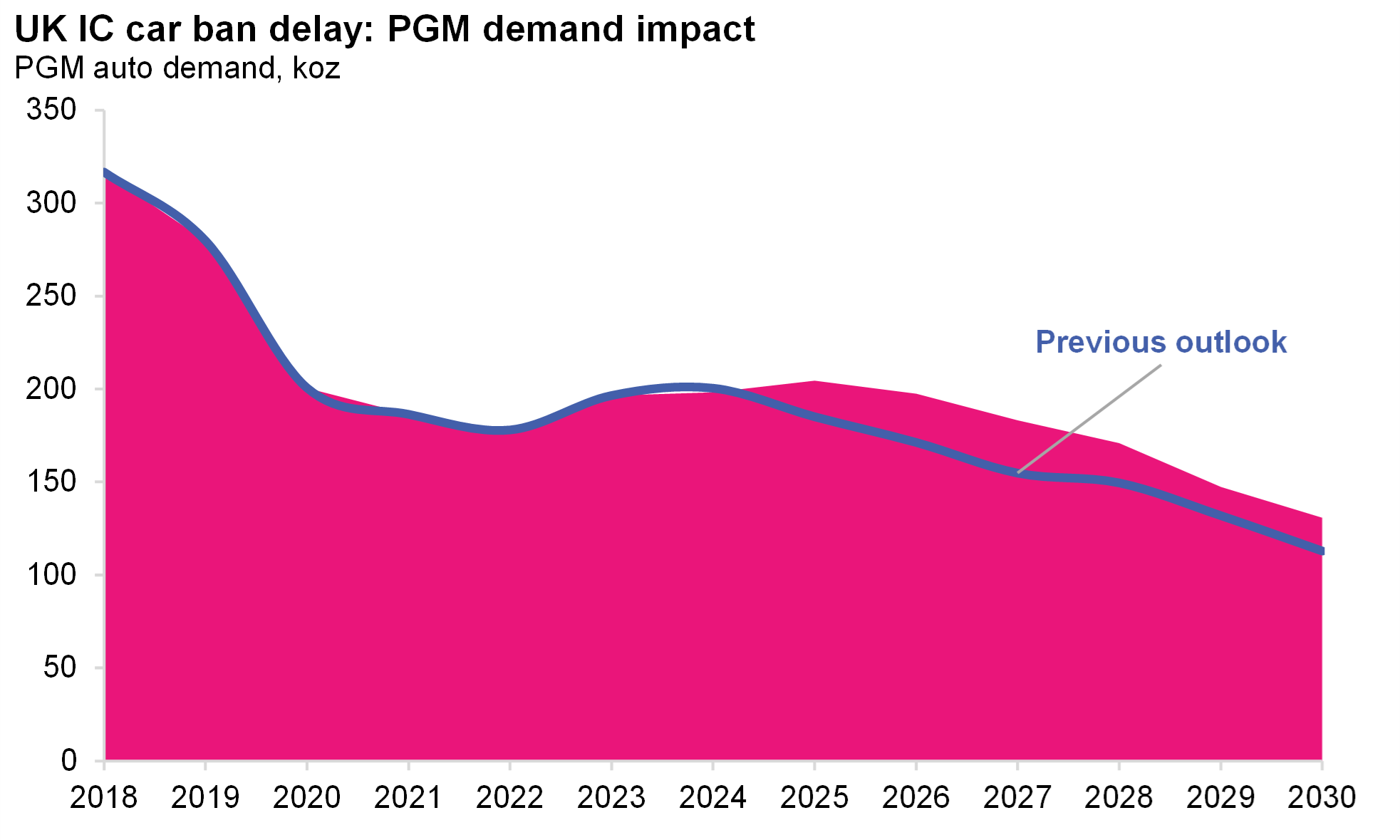

The chart below shows the limited additional PGM demand likely to be delivered by slightly higher ICE/hybrid shares under the 2035 scenario, comparing the upper pink bound (2035 ban) to the blue line under the 2030 ban scenario.

Source: SFA (Oxford), GlobalData

Euro 7 stays at Euro 6 for cars –may sustain slightly more (small car) ICE / hybrid sales

Euro 7 has been in the pipeline for several years and was expected to be the final round of EU tailpipe emissions standards regulating ICE cars. Eight EU nations, including automaking heavyweights France and Italy, have opposed tighter emissions standards as automakers are seen to have enough challenges to meet the bloc’s planned end to sales of new CO2-emitting light vehicles from 2035 to meet net-zero targets. These eight have sufficient voting power to carry their wishes. EU ministers agreed therefore on 25 September to water down the European Commission proposal on Euro 7 emissions standards:

-

Cars and vans: the existing Euro 6 standards will not be amended

-

Heavy-duty: more stringent standards will be implemented

-

New particle limits from brake and tyre wear to be introduced, applicable equally to BEV and ICE vehicles.

Impact on EU PGM demand projections:

-

The previously suggested short timescale for Euro 7 implementation, originally for July 2025, would likely have required some temporary uplift in Pd and Rh loadings in gasoline TWCs, with thrifting back close to current Euro 6d/e levels after a couple of years. SFA had not assumed the short timescale as base case, so no change in our forecasts.

-

The most significant change for air quality in Euro 7 proposals perhaps was the cut in NOx emissions from 80 mg/km to 60 mg/km for light diesel vehicles. This was increasingly irrelevant anyhow, as the diesel share of car sales in 2025 in Western Europe is forecast to be just 7% (and declining). Also, from a PGM demand perspective, most of the NOx aftertreatment is now accomplished using no-PGM SCR catalyst technology. For gasoline light vehicles, where the NOx aftertreatment does rely on Rh in the TWC, there would be no upside as the limit was unchanged at 60 mg/km from Euro 6 to 7. Again, no change in SFA assumptions required.

-

Retaining Euro 6 standards has the potential to sustain higher ICE-only and hybrid shares for longer (particularly for small cars), from those automakers that have not already announced full transition to selling only BEV powertrains in Europe. Nissan for example intends to sell only fully electric vehicles in Europe from 2030, along with Renault, Ford, Stellantis and Volvo. Our car modelling is based on Global Data forecasts and we doubt that last week’s Euro 7 update would materially change their outlook or have a noticeable impact on car mix and hence PGM balances in the years ahead.

-

The tougher heavy-duty requirements will likely largely addressed by finetuning non-PGM SCR technology, with perhaps small upside from additional Pt containing ammonia slip catalysts. This potential increase is however too marginal to impact Pt demand noticeably, and likely offset by increased penetration of electrification in the heavy-duty sector towards the end of the decade. Again, no change in SFA assumptions required.

In summary: the Euro 7 ‘disappointment’ has very little to no impact on our projected EU automotive PGM demand compared to our existing base case.

Disclaimer, copyright & intellectual property

SFA (Oxford) Limited has made all reasonable efforts to ensure that the sources of the information provided in this document are reliable and the data reproduced are accurate at the time of writing. The analysis and opinions set out in the document constitute a judgement as of the date of the document and are subject to change without notice. Therefore, SFA cannot warrant the accuracy and completeness of the data and analysis contained in this document. SFA cannot be held responsible for any inadvertent and occasional error or lack of accuracy or correctness. SFA accepts no liability for any direct, special, indirect or consequential losses or damages, or any other losses or damages of whatsoever kind, resulting from whatever cause through the use of or reliance on any information contained in the report. The material contained herewith has no regard to the specific investment objectives, financial situation or particular need of any specific recipient or organisation. It is not to be construed as a solicitation or an offer to buy or sell any commodities, securities or related financial instruments. The recipient acknowledges that SFA is not authorised by the Financial Conduct Authority to give investment advice. The report is not to be construed as advice to the recipient or any other person as to the merits of entering into any particular investment. In taking any decision as to whether or not to make investments, the recipient and/or any other person must have regard to all sources of information available to him. This report is being supplied to the recipient only, on the basis that the recipient is reasonably believed to be such a person as is described in Article 19 (Investment professionals) or Article 49 (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005.

© Copyright reserved. All copyright and other intellectual property rights in any and all reports produced from time to time remain the property of SFA and no person other than SFA shall be entitled to register any intellectual property rights in any report or claim any such right in the reports or the information or data on the basis of which such reports are produced. No part of any report may be reproduced or distributed in any manner without written permission of SFA. SFA specifically prohibits the redistribution of this document, via the internet or otherwise, to non-professional or private investors and accepts no liability whatsoever for the actions of third parties in reliance on this report.

SFA's PGM Team

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Dr Ralph Grimble

Operations Director

Dr Jenny Watts

Head of Clean Energy & Sustainability

Jamie Underwood

Principal Consultant

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Ismet Soyocak

ESG & Critical Minerals Lead

Oksan Atilan

Consulting Automotive Analyst

Alex Biddle

Senior Mining Analyst

Dr Sandeep Kaler

Market Strategy Analyst

Daniel Croft

Commodity Analyst

David Mobbs

Head of Marketing

Brought to you by

Dr Jenny Watts

Head of Clean Energy & Sustainability

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.