Peak Palladium: Is it all downhill from here?

12 September 2023

It looks as if the third decade of the twenty-first century is beginning to witness a new cycle in the long series of rises and falls in demand for palladium.

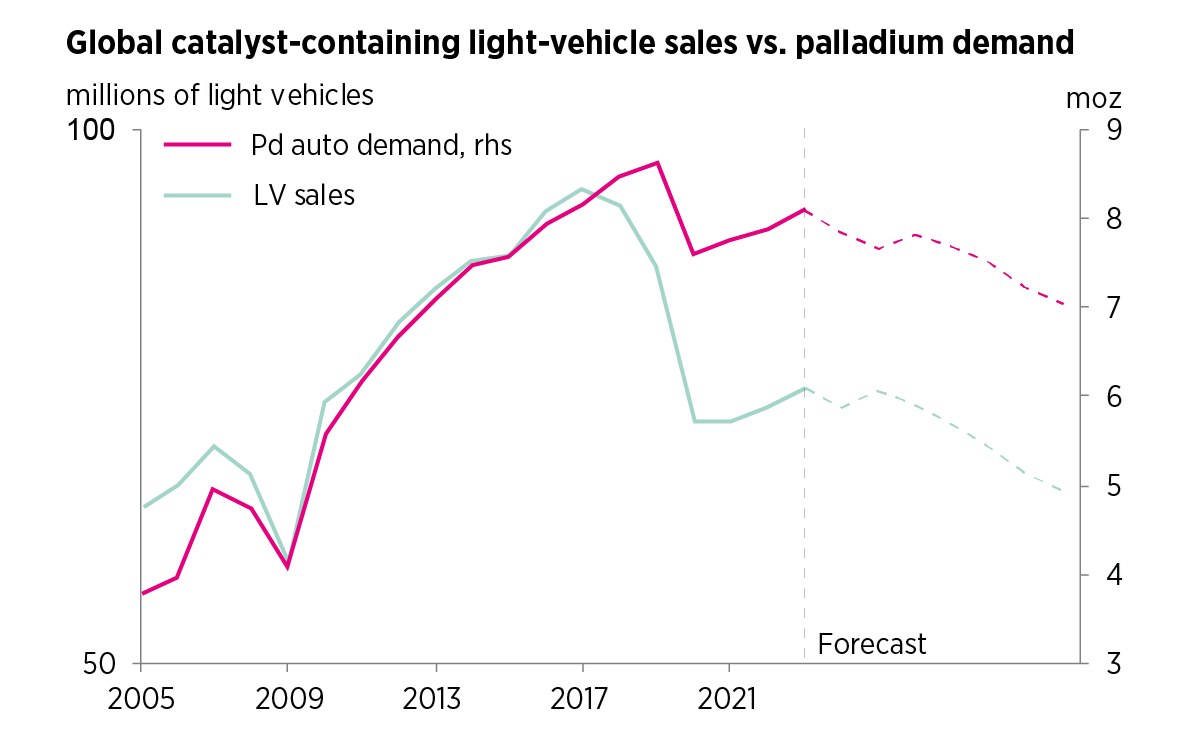

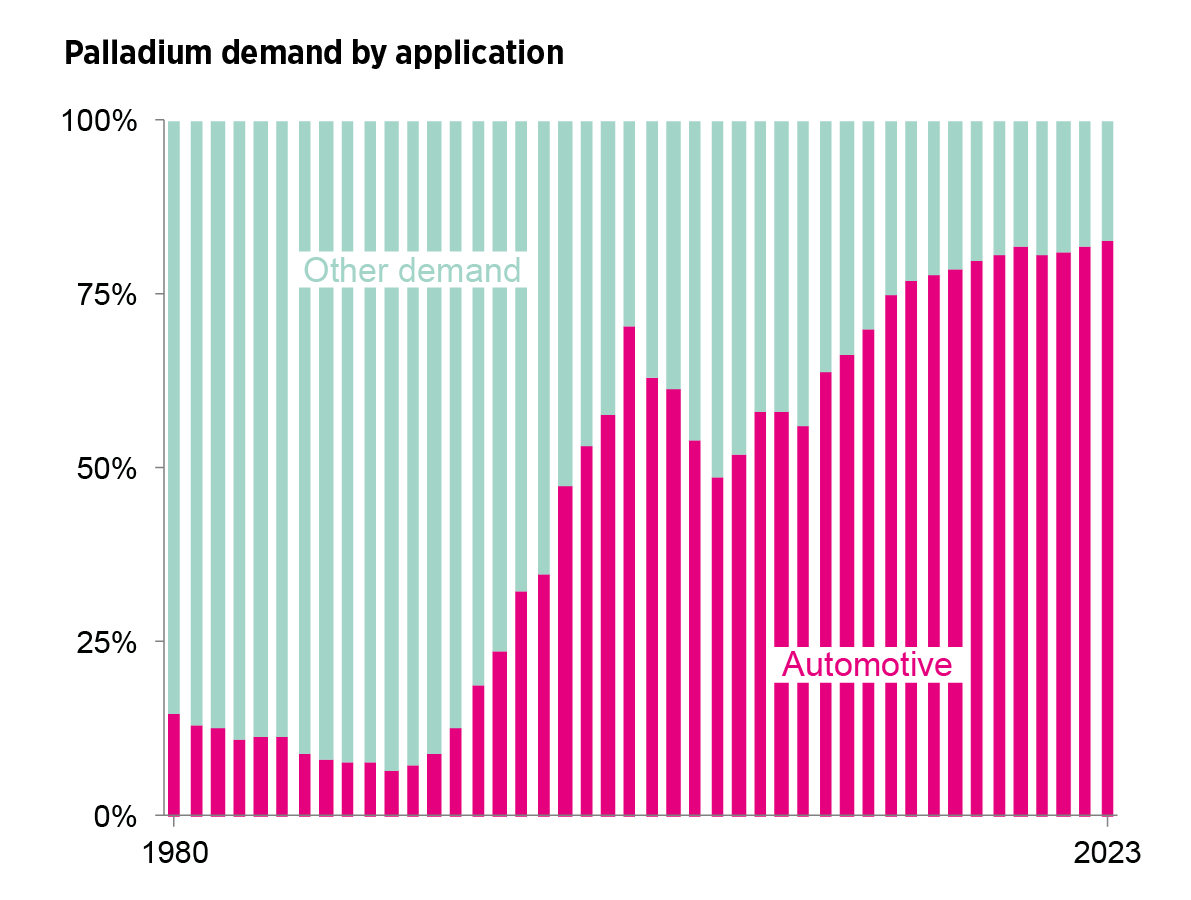

King of the autocatalyst precious metals, palladium’s use in vehicle emissions control far outstrips that of platinum and rhodium, and accounts for over 80% of palladium usage in all applications. Yet the peak of demand for palladium has almost certainly passed. The new energy paradigm, in its quest to achieve a net-zero world by 2050, will slash the use of traditional fossil fuels to power transport in all its forms, and demand for palladium will suffer as a result.

SFA (Oxford), GlobalData

Palladium has been here before, and more than once. Demand over the years has been buffeted by technical change, substitution and volatile prices. Who remembers that the leading use of palladium until the 1970s was in the form of contacts installed in the relay switches of mechanical telephone exchanges? Wiped out by the advent of the digital age, electrical demand was restored and expanded by a new use for palladium in conductive tracks in electronic circuits and multi-layer ceramic capacitors.

Electrical applications were the kingpin of palladium demand, and were not overtaken in importance by autocatalysts until 1996. Then, as palladium catalysts became dominant in gasoline engine emissions control, its price volatility increased and drove the electronic component industry to make an irreversible switch to nickel. Palladium’s price has lately also been responsible for reintroducing platinum into autocatalyst systems at the expense of palladium demand.

As every observer of PGM fundamentals understands, a conventional market response to declining demand — contracting supply — is more difficult to apply to palladium than to many other metals. The non-elasticity of supply inhibits it. More than 80% of palladium is mined as a by-product of nickel, copper or platinum. And secondary supply from spent catalytic converters, stimulated by circularity and material security concerns, will continue to pump recycled material into the market on a 15- to 20-year time lag.

Source: (SFA (Oxford)

This has negative implications for long-term palladium prices and producer revenues. The problem is further compounded this time around by the difficulty of identifying — at least at present — one single new giant application that can replace the inevitable loss of autocatalyst demand. The more likely case is that many smaller applications will be needed, challenging PGM stakeholders to explore more diverse sources of demand and work within a greater range of industrial sectors to build back palladium demand over the long term

How far, how fast?

The forecast near-term decline in autocatalyst demand for palladium is not abrupt, but it is progressive — as much as a 20% decrease by 2030 from its peak in 2019. That is largely predicated on the increased penetration of electric vehicles in the new car fleet. It is now only a question of how far demand for palladium in catalytic converters will fall, and how long it will take, but the answers remain unclear. There are many reasons why the take-up of electric vehicles might not be as rapid, or as extensive, as official targets such as bans on sales of new ICE cars, subsidies and incentives and zero-emission driving zones would imply.

In her article, The US auto market in the spotlight, Kimberly Berman addresses these issues using the US experience as a template. The weight of American legislation is swinging behind the promotion of electric vehicle manufacture, and the rate of growth of sales is increasing at a pace suggesting that the majority of new cars sold nationwide will be electric by 2030. Yet there are anxieties beyond the established ones of driving range: weightier issues (which apply to most Western markets) include material security — the high exposure of the US to foreign sources of battery raw materials — and ready access to energy in the shape of a uniform and widespread public charging infrastructure.

No time to waste

Regulation, technological advances and public acceptance were the foundations of the development and global application of PGMs in the control of air pollution from the mid-1970s onwards. PGMs succeeded because of their unique catalytic properties. The same qualities imply that the metals can find application in the future green energy economy too: in, for example, the abatement of carbon emissions from chemicals manufacturing and in the energy transition away from fossil fuels. But not automatically, however, as cost, scarcity and the ever-present possibility of substitution will continue to influence how far PGMs can be utilised.

In our second article, The future of PGMs: Navigating a rapidly changing energy landscape, Gyubin Hwang considers some of the ways in which the expected shifts in energy production and a sharper focus on energy efficiency and decarbonisation could provide new opportunities for palladium and other PGM demand. Since conventional vehicle and energy technologies are in decline, the old certainties for demand are dissolving; PGM stakeholders need to recognise the imperative to be proactive in discovering new avenues for palladium use. Gyubin highlights three strategies which the PGM industry should consider to ensure a place for palladium and other PGMs in a green energy economy, and provides case studies to illustrate the possibilities.

Disclaimer, copyright & intellectual property

SFA (Oxford) Limited has made all reasonable efforts to ensure that the sources of the information provided in this document are reliable and the data reproduced are accurate at the time of writing. The analysis and opinions set out in the document constitute a judgement as of the date of the document and are subject to change without notice. Therefore, SFA cannot warrant the accuracy and completeness of the data and analysis contained in this document. SFA cannot be held responsible for any inadvertent and occasional error or lack of accuracy or correctness. SFA accepts no liability for any direct, special, indirect or consequential losses or damages, or any other losses or damages of whatsoever kind, resulting from whatever cause through the use of or reliance on any information contained in the report. The material contained herewith has no regard to the specific investment objectives, financial situation or particular need of any specific recipient or organisation. It is not to be construed as a solicitation or an offer to buy or sell any commodities, securities or related financial instruments. The recipient acknowledges that SFA is not authorised by the Financial Conduct Authority to give investment advice. The report is not to be construed as advice to the recipient or any other person as to the merits of entering into any particular investment. In taking any decision as to whether or not to make investments, the recipient and/or any other person must have regard to all sources of information available to him. This report is being supplied to the recipient only, on the basis that the recipient is reasonably believed to be such a person as is described in Article 19 (Investment professionals) or Article 49 (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005.

© Copyright reserved. All copyright and other intellectual property rights in any and all reports produced from time to time remain the property of SFA and no person other than SFA shall be entitled to register any intellectual property rights in any report or claim any such right in the reports or the information or data on the basis of which such reports are produced. No part of any report may be reproduced or distributed in any manner without written permission of SFA. SFA specifically prohibits the redistribution of this document, via the internet or otherwise, to non-professional or private investors and accepts no liability whatsoever for the actions of third parties in reliance on this report.

SFA (Oxford)'s PGM Team

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Dr Ralph Grimble

Operations Director

Dr Jenny Watts

Head of Clean Energy & Sustainability

Jamie Underwood

Principal Consultant

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Ismet Soyocak

ESG & Critical Minerals Lead

Oksan Atilan

Consulting Automotive Analyst

Alex Biddle

Senior Mining Analyst

Dr Sandeep Kaler

Market Strategy Analyst

Daniel Croft

Commodity Analyst

David Mobbs

Head of Marketing

Brought to you by

Henk de Hoop

Chief Executive Officer

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.