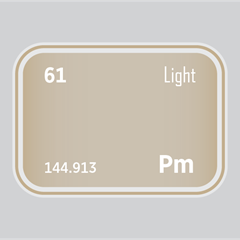

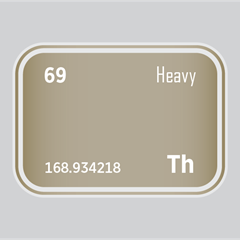

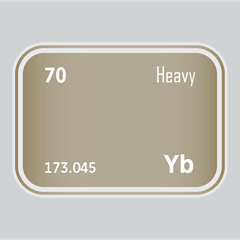

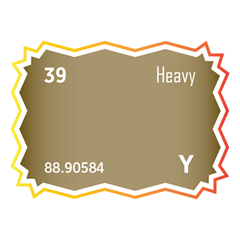

The European Commission’s 2023 proposal for a Regulation on critical raw materials (COM(2023) 160 final) sets out a strategic list of raw materials vital to the EU’s green transition, digital economy, and defence capabilities. As detailed in Annex I, these include battery-grade lithium, cobalt, nickel, manganese, and natural graphite; high-purity metals such as bismuth, magnesium, titanium, and tungsten; and key inputs like gallium, germanium, and silicon metal. The list also features copper, boron (metallurgy grade), platinum group metals, and rare earth elements used in permanent magnets, namely neodymium, praseodymium, terbium, dysprosium, gadolinium, samarium, and cerium. These materials are considered essential to securing the EU’s industrial resilience and reducing strategic dependencies.

European Union

Critical minerals, policy, and the energy transition

The Energy Transition in the European Union

The European Union (EU) is navigating a complex landscape of defence, energy transition, and geopolitical challenges, with a clear focus on strengthening its strategic autonomy and global influence. In response to escalating security threats and shifts in U.S. foreign policy, the EU introduced the Readiness 2030 plan, a transformative initiative aimed at mobilising up to €800 billion for defence infrastructure over the next four years. This ambitious programme encompasses key elements such as fiscal flexibility to increase defence spending, joint defence projects, and advancements in air and missile defence systems, drones, artillery, and cyber capabilities. The EU’s participation in the European Sky Shield Initiative further strengthens its collective defence by integrating national air defence systems into a unified network. On the energy front, the EU is committed to being a global leader in the energy transition, with projections for adding 89 gigawatts of renewable energy capacity by 2025. This includes 70 GW from solar and 19 GW from wind power, highlighting the EU’s dedication to achieving carbon neutrality. The Clean Industrial Deal, a €100 billion initiative, aims to boost the competitiveness of EU industries, particularly in clean technologies like hydrogen, which are pivotal to decarbonisation. Geopolitical tensions, such as the ongoing conflict in Ukraine, have prompted the EU to reassess its defence and energy strategies. In response, it has pledged over €21 billion in military aid to Ukraine, while also evaluating ways to reduce energy dependencies within the bloc. These multifaceted efforts are ensuring that the EU remains a powerful force in shaping the future of global energy, security, and trade, while reinforcing its commitment to sustainability, security, and resilience amid complex international dynamics.

Latest news and insights

Stay ahead in the energy transition with SFA (Oxford)’s cutting-edge insights into how critical raw materials policy, ESG regulation, strategic autonomy, and clean energy investment are positioning the European Union at the forefront of sustainable industrial transformation.

Critical minerals could make the next outage permanent

18 November 2025 | Jamie Underwood, Ismet Soyocak

Cloudflare’s outage disrupted 20% of global web traffic, spotlighting the internet’s vulnerability to centralised systems, and the critical minerals powering them.

China’s REE Export Controls Reshape Global Supply Chains

10 October 2025 | Jamie Underwood

China’s rare earth export controls redefine global power dynamics, threatening defence, energy, and tech supply chains, forcing the West to respond.

Annex-I: Adjusted US Reciprocal Tariffs Country List

2 April 2025 | White House

European Union's critical raw minerals list (2023)

Annex II of the European Commission’s 2023 proposal for a Regulation on critical raw materials (COM(2023) 160 final) sets out the official list of materials designated as critical to the EU’s economic resilience, clean energy transition, and strategic autonomy. These raw materials are deemed essential based on their high economic importance and significant supply risk. The list encompasses a comprehensive range of elements and compounds, including antimony, cobalt, natural graphite, rare earth elements (both light and heavy), lithium, and battery-grade nickel, alongside industrial minerals such as bauxite, fluorspar, and phosphate rock. It also includes strategic metals such as tungsten, vanadium, tantalum, and the platinum group metals.

While the spotlight often falls on high-profile materials like lithium and rare earths, the 2023 critical raw materials list equally prioritises several lesser-publicised but strategically indispensable inputs. These materials may not appear directly in final products, but they are fundamental to upstream value chains across clean energy, advanced manufacturing, defence, and agri-tech. Their designation reflects the EU’s systemic understanding of supply chain risk: strategic exposure often originates not at the end-use stage, but in the unheralded building blocks of industrial capacity. The following materials exemplify this logic.

Bauxite is the principal ore of aluminium, a metal central to decarbonised manufacturing, renewable infrastructure, and strategic sectors such as aerospace and defence. While aluminium itself is absent from the list, bauxite’s inclusion underscores its upstream significance and the EU’s exposure to import reliance and energy-intensive refining processes that threaten value chain stability.

The dual listing of phosphate rock and phosphorus signals a deliberate effort to secure both the raw mineral and its processed derivatives. Phosphate rock underpins global fertiliser systems, while phosphorus is increasingly integral to lithium iron phosphate (LFP) batteries, chemicals, and flame retardants. The EU’s high import dependency, often from politically volatile sources, amplifies the urgency of securing these foundational inputs.

Despite its association with fossil fuels, coking coal, also known as metallurgical coal, is included in the EU’s critical raw materials list due to its irreplaceable role in conventional steelmaking. Used to produce metallurgical coke for blast furnaces, coking coal remains essential for high-strength steel products required in construction, automotive, and defence sectors. While green steel technologies are emerging, scalable alternatives are not yet widely deployed, making coking coal a transitional necessity for industrial competitiveness and infrastructure development.

Fluorspar is the principal source of hydrofluoric acid, a precursor to fluorochemicals critical for semiconductors, batteries, refrigerants, and aluminium production. The EU’s domestic capacity is limited, while China controls a dominant share of global supply, creating a structural dependency in multiple high-tech and clean energy value chains.

Though abundant, Feldspar plays a critical role in producing specialised ceramics, glass, and electronic components. Its inclusion reflects supply concerns around high-purity grades and the EU’s underdeveloped processing infrastructure, factors that can disrupt production in key downstream sectors.

Meet the Critical Minerals team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Dr Jenny Watts

Critical Minerals Technologies Expert

Ismet Soyocak

ESG & Critical Minerals Lead

Thomas Shann Mills

Senior Machine Learning Engineer

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Franklin Avery

Commodity Analyst

Shunjie Zhao (Tony)

Commodity Analyst: APAC

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.