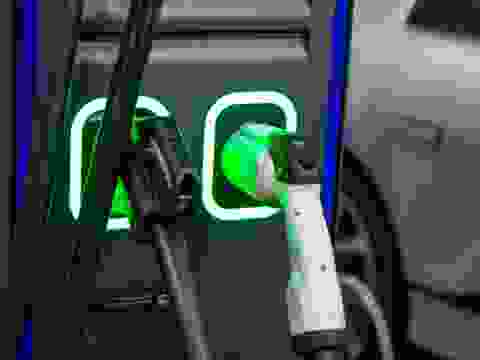

CATL's LFP: 400km of range in 10 minutes?

16 August 2023

While CATL’s improved LFP battery is an impressive technical achievement that will support increased LFP market share, charging infrastructure remains the primary barrier to mass-market rapid charging.

On 16th August, CATL (SHE: 300750) announced the world’s first 4C rapid charging battery based on a LFP chemistry. The Shenxing (“Divine Movement”) battery claims rapid-charging performance that can deliver 400km of range in 10 minutes for mass-market BEVs, including at sub-zero temperatures. Mass production is being targeted to begin in Q4’2023, with deliveries and cars on the road in Q1’24.

SFA’s views:

1. CATL seeks to regain market leadership position amidst strengthening competition.

-

-

CATL’s global LFP installations in H1’23, for automotive end-uses, were just shy of 30 GWh, equivalent to 35% of the market and representing y-o-y growth of 55% over H1’22.1

-

However, the company is being outperformed by BYD in the LFP segment, where H1’23 installations are up 95%, to 48 GWh. 1

-

While CATL have announced further breakthroughs in recent months, such as the ‘Qilin’ battery and the ‘Condensed matter’ battery, these have been primarily aimed at the higher cost, ternary (i.e., NCM) cathode technology. The announced LFP upgrade makes them more competitive in the lower cost, mass market segment.

-

2. Scaling well-understood technologies is key.

-

-

CATL’s announcement today cited two important factors that contribute to improved overall kinetics: better electrolyte and an ion conduction highway.

-

Better electrolyte: Lithium bis(fluorosulfonyl)imide (LiFSI) is likely to be one of the technology solutions here. LiFSI has higher ionic conductivity and improved chemical and thermal stability compared to lithium hexafluorophosphate (LiPF6), the dominant electrolyte in the market.

-

CATL has agreements with various producers to secure LiFSI supplies, including Huasheng Lithium, CATL SiCong, and Tianci Materials.

-

-

Ion conduction “highway”: This is likely to be some sort of structured carbon nanomaterial such as graphene or carbon nanotubes that can form a continuous conductive network within the electrodes, thereby lowering their respective individual internal resistances.

-

Improved lithiation and de-lithiation: There are other strategies that could have been used to improve reaction kinetics, including graphite anode surface structuring and electrode coating/doping.

-

3. Building out the charging infrastructure is still difficult and expensive.

-

-

As of May 2023, China had approximately 1.5m public charging stations, with just over 1,700 of those with charging rates of 250 kW. 2

-

Charging infrastructure developers are gradually converging on 800V (or higher) charging, which reduces vehicle wiring requirements compared to a high-current system. This may require better QC at the battery cell level to minimise risks associated with overcharging, making CATL’s claimed part per billion (ppb) defect rate all the more important.

-

While building a fast-charging station is not inherently more difficult than building a standard-speed pile, technical bottlenecks include the availability of high-voltage transformers as well as third generation SiC semiconductors that are better suited to 800V charging architectures.

-

1 Source: EV-Volumes Battery Installation Tracker

2 Source: EV-Volumes Charging Stations Count

No part of this material may be copied or redistributed in any form by any means without the prior consent of SFA (Oxford) Ltd.

Devil's Advocate:

-

400km claim likely to be based on China's CLTC standard; equivalent to ~330km WLTP or ~300km EPA.

-

While 4C charging equates to a 0-100% charge time of 15 minutes, it is unlikely for any battery to be able to consistently charge at that rate due to thermal constraints.

-

Existing cars can already achieve close to peak charging rates of 4C, but not for sustained periods.

-

4C charging rate equates to a 240kW charger for a 60kWh battery pack - these are very expensive to install.

-

Fast-charging capable batteries are only as useful as the availability of sufficient high-speed charging stations.

Disclaimer, copyright & intellectual property

SFA (Oxford) Limited has made all reasonable efforts to ensure that the sources of the information provided in this document are reliable and the data reproduced are accurate at the time of writing. The analysis and opinions set out in the document constitute a judgement as of the date of the document and are subject to change without notice. Therefore, SFA cannot warrant the accuracy and completeness of the data and analysis contained in this document. SFA cannot be held responsible for any inadvertent and occasional error or lack of accuracy or correctness. SFA accepts no liability for any direct, special, indirect or consequential losses or damages, or any other losses or damages of whatsoever kind, resulting from whatever cause through the use of or reliance on any information contained in the report. The material contained herewith has no regard to the specific investment objectives, financial situation or particular need of any specific recipient or organisation. It is not to be construed as a solicitation or an offer to buy or sell any commodities, securities or related financial instruments. The recipient acknowledges that SFA is not authorised by the Financial Conduct Authority to give investment advice. The report is not to be construed as advice to the recipient or any other person as to the merits of entering into any particular investment. In taking any decision as to whether or not to make investments, the recipient and/or any other person must have regard to all sources of information available to him. This report is being supplied to the recipient only, on the basis that the recipient is reasonably believed to be such a person as is described in Article 19 (Investment professionals) or Article 49 (High net worth companies, unincorporated associations etc.) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005.

© Copyright reserved. All copyright and other intellectual property rights in any and all reports produced from time to time remain the property of SFA and no person other than SFA shall be entitled to register any intellectual property rights in any report or claim any such right in the reports or the information or data on the basis of which such reports are produced. No part of any report may be reproduced or distributed in any manner without written permission of SFA. SFA specifically prohibits the redistribution of this document, via the internet or otherwise, to non-professional or private investors and accepts no liability whatsoever for the actions of third parties in reliance on this report.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Kimberly Berman

Energy Transition Technology and Metals Specialist

Daniel Croft

Commodity Analyst

Thomas Chandler

Principal Lithium Supply Analyst

Lakshya Gupta

Senior Market Analyst: Battery Materials and Technologies

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Adele Rouleau

ESG and Critical Minerals Lead

Dr Fahad Aljahdali

General Manager, KSA

David Mobbs

Head of Marketing

Joel Lacey

Sales and Marketing Specialist

Brought to you by

Lakshya Gupta

Senior Market Analyst: Battery Materials and Technologies

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.