Electrolysis

Renewable energy for green hydrogen production

An introduction to electrolysis

Enabling technology for the green hydrogen economy

Water electrolysers hold a pivotal place in the middle of the energy value chain, emitting no carbon emissions to generate power. Hydrogen is the new “oil”, and green hydrogen goes hand-in-hand with renewable energy. Electrolysers use electricity to safely split water into oxygen and hydrogen on demand. The process is known as electrolysis and it eliminates the need to store hydrogen. Electrolysis represents just 2% of total global hydrogen production presenting an opportunity ahead for electrolysers to serve multiple industries with low-carbon hydrogen.

A key energy reversal is taking place. Until now, fossil fuel molecules (oil, gas, coal) have been used to generate electrons (electricity). Now that electrons can be generated renewably (solar, wind, nuclear), the energy transition relies on renewable modules being generated from renewable electrons. This is especially relevant for energy-intensive applications and where emissions are difficult to abate, for example, in heavy industry, shipping and aviation.

If renewable power (solar, wind, nuclear) is used to produce hydrogen using electrolysers, the hydrogen produced is termed “green hydrogen”, and is a shift away from the use of fossil fuels and towards lower carbon emissions. This strategy using water and electrolysers to make green hydrogen has enormous potential to slow down climate change and creates considerable opportunities for industries to participate in the transitioning hydrogen economy. Using electrolysers, companies can cut carbon emissions, lower energy costs, improve long-term profitability and reduce their energy dependence using hydrogen from carbon-intensive fossil fuels.

Widespread green hydrogen production provides clean energy without the risky additional step of carbon capture and storage of blue hydrogen. However, green hydrogen costs need to reduce substantially for it to be taken seriously – but there are no insurmountable barriers at present. Once green hydrogen costs are reduced over the long term, principally through lower-cost renewable electricity input and electrolyser CAPEX investment (optimising electrolyser operation), green hydrogen can become cheaper than blue hydrogen (fossil fuel source with carbon capture – removes 90% of carbon emissions) or grey hydrogen (produced from fossil fuels – associated with carbon emissions), and potentially cheaper than natural gas.

Electrolyser technologies

There are four competing water electrolyser technologies that support green hydrogen production, each with unique operating advantages and disadvantages. The four key electrolysis technologies are:

-

PEM electrolysers – Proton exchange membrane

-

ALK electrolysers – Alkaline

-

SOE electrolysers – Solid oxide electrolysis

-

AEM electrolysers – Anion exchange membrane

PEM electrolysers are one of the most attractive routes to producing green hydrogen and can be scaled up quickly by linking up with other upstream and downstream technologies. PEM is also the only electrolyser type that uses PGMs (platinum and iridium) on a significant scale.

PEM electrolysers have great potential, using proven PGM-based technology. There are substantial cost savings to be made by scaling up in the next ~5 years. PEM technology resides with a mix of relatively small pure-play companies, and is integrated within industrial conglomerates facilities to offer the best integration and greatest visibility with renewable energy.

The iridium anode acts as a catalyst for the oxygen evolution reaction due to its good trade-off between activity and stability. On the cathode, platinum-based catalysts are used for the hydrogen evolution reaction.

PEM electrolysers currently represent around 70% of new projects, and over the long term provide an opportunity for significant new platinum and iridium demand as demand from ICE engine autocatalysts falls over the coming decade with the rise of passenger car electrification. PEM electrolysers are modular and scalable so they are attractive to end-users.

ALK electrolysers are the most mature as they are already operating at scale, with less scope for cost-cutting and process efficiency gains, but offer long-term markets and opportunities to spread risk.

AEM and SOE electrolysers are at a relatively early stage technologically and commercially, but are being developed by a mix of small, highly innovative companies and established large industrial companies.

SOE electrolysers use steam to operate properly to produce hydrogen from water and are built to work at temperatures around 10 to 12 times higher (700-800°C) than PEM electrolysers which operate at 70-90°C, and alkaline electrolysers which operate at less than 100°C.

The current situation

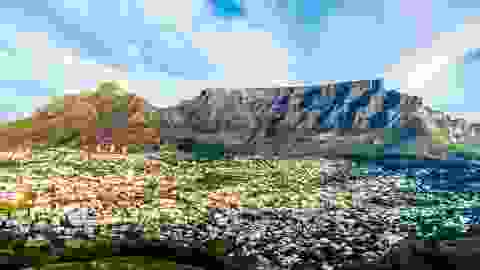

Air quality legislation and committed government funding is driving the scale-up of water electrolyser installations and pushing down costs to make green hydrogen more viable, ready for the mass market. There are huge regional variations in hydrogen production costs today, and their future economics depend on factors that will continue to vary regionally, including prices for fossil fuels, electricity and carbon.

Renewable energy accessibility is the main driver of electrolysis costs. The declining costs of solar photovoltaic and wind could make them a low-cost energy source for hydrogen production in regions with favourable resource conditions.

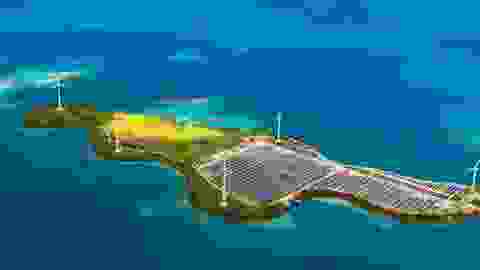

Electrolyser project sizes are scaling up quickly as the technology and supply chain matures: to date most projects have been between 1 MW and 10 MW. By 2025, a typical project will be 100-500 MW, typically supplying ‘local clusters’, meaning that the hydrogen will be consumed locally to the facility.

Up to 2030, it can be expected to see projects on the 100 MW to GW scale, which is a scale jump of 1-2 orders of magnitude from current levels. Currently announced EU projects suggest that this scale will be reached well before 2030. By 2030, typical projects are expected to scale up further to 1 GW+, with the emergence of large-scale hydrogen export projects, deployed in countries benefiting from cheap electricity – vital to compete on volume and cost.

Hydrogen consulting solutions

Explore SFA (Oxford)'s available hydrogen economy and green hydrogen services for clients.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.