The Ruthenium Market

Critical Minerals and The Energy Transition

Navigating the Ruthenium Market

Ruthenium is a rare, hard metal with unique electronic, catalytic, and magnetic properties that enable a wide range of high-performance technologies. As a member of the platinum group metals (PGMs), it is integral to semiconductor fabrication, data storage, chemical catalysis, and emerging electrochemical energy systems. Ruthenium’s ability to form stable nanostructures and conductive layers has made it indispensable in advanced memory devices, supercapacitors, and microelectronic components. It also plays a growing role in green chemistry, hydrogen evolution, and next-generation battery materials. Despite low absolute demand, ruthenium’s criticality is increasing due to limited substitutability, supply dependence on platinum and nickel by-products, and its expanding role in clean energy and digital infrastructure. As strategic sectors look to enhance material efficiency and energy resilience, ruthenium is becoming essential to high-density computing, low-carbon chemistry, and advanced circular economy platforms. SFA (Oxford)'s explores many of ruthenium’s end-uses, highlighting its growing relevance in the transition to a connected, secure, and sustainable global economy.

Ruthenium price news and insights

The UK’s 2025 Critical Minerals Strategy

1 December 2025 | Franklin Avery, Ismet Soyocak

The UK just launched its most elaborate critical minerals strategy to date, setting firm targets and funding to reshape supply chain security.

Platinum Group Metals Market Report – Q3 2025

30 September 2025 | Beresford Clarke

Platinum’s rally—short-term or structural shift? SFA’s Quarterly Report covers key drivers, industry impacts, and price risks to 2028.

Iridium’s outlook linked to hydrogen economy wariness

21 October 2024 | SFA (Oxford) & Heraeus

Chinese heavy-duty vehicle platinum demand could be ready for a rise

7 October 2024 | SFA (Oxford) & Heraeus

Where does the palladium market go from here?

23 September 2024 | SFA (Oxford) & Heraeus

The Chinese car market in 2024 – PHEVs, subsidies and palladium

19 August 2024 | SFA (Oxford) & Heraeus

An introduction to ruthenium

Ruthenium demand and end-uses

Ruthenium, a rare and functionally versatile member of the platinum group metals (PGMs), plays a vital role across electronics, catalysis, energy storage, and chemical manufacturing. Known for its exceptional hardness, catalytic efficiency, and ability to enhance the performance of other metals, ruthenium is essential in both established industrial systems and emerging clean technologies. While global production is limited and primarily as a by-product of platinum and nickel mining, demand for ruthenium is steadily increasing as sectors pursue higher efficiency, miniaturisation, and digital resilience.

One of the most significant uses of ruthenium is in electronics, particularly in hard disk drives (HDDs) and advanced microelectronics. Ruthenium thin films are used as stabilising layers in magnetic media, enabling higher data density and thermal stability. In semiconductor fabrication, ruthenium serves as a barrier material and electrode in dynamic random-access memory (DRAM), resistive RAM (ReRAM), and emerging logic devices. Its excellent conductivity and low diffusion rate make it a candidate for future transistor gate metals, especially as traditional materials reach their scaling limits. As data storage, 5G infrastructure, and artificial intelligence systems expand, ruthenium’s importance in electronics is expected to grow significantly.

In chemical catalysis, ruthenium is used in a range of high-value processes. It functions as a key component in hydrogenation, metathesis, and oxidation reactions, particularly in fine chemicals, pharmaceuticals, and agrochemicals. Ruthenium-based catalysts are valued for their activity, selectivity, and thermal stability, especially in homogeneous systems. One notable application is in the Fischer–Tropsch process, where ruthenium is used to synthesise liquid fuels from syngas. Its role in green chemistry continues to expand, supported by innovations in low-pressure catalytic systems and recyclable catalyst platforms.

Ruthenium plays a growing role in electrochemical and energy storage technologies. It is used in ruthenium oxide (RuO₂) coatings for electrodes in supercapacitors and electrolytic capacitors, where it enhances charge storage capacity and cycling performance. In lithium-ion batteries, ruthenium is being explored as a doping agent to improve electrode stability and conductivity. Its role in advanced anodes and solid-state battery systems is also under investigation, particularly for aerospace and military-grade energy storage where durability and performance under extreme conditions are paramount.

Ruthenium is essential to chlor-alkali production, where it is used in titanium anode coatings alongside iridium and tantalum. These dimensionally stable anodes (DSAs) are critical for efficient and long-lasting electrolysis in the production of chlorine and sodium hydroxide. Ruthenium’s inclusion in mixed-metal oxide coatings enhances the catalytic activity and life span of the electrode, supporting large-scale industrial chemical production.

In jewellery, ruthenium is used as an alloying agent with platinum and palladium to enhance hardness and wear resistance. It is also used as a plating material for watches, pens, and high-end accessories due to its dark grey lustre and corrosion resistance. Although jewellery demand is relatively modest, it contributes to brand positioning and product differentiation in the luxury sector.

Ruthenium is becoming increasingly important in aerospace and defence technologies. It is used in electrical contacts, thermocouples, and space-grade coatings, where durability, oxidation resistance, and conductivity are paramount. Ruthenium alloys are incorporated into precision instruments, sensors, and control systems designed to operate in high-vacuum or radiation-rich environments. These applications support satellite platforms, missile systems, and secure communications infrastructure.

In medical and bioanalytical devices, ruthenium-based compounds are used as fluorescent markers in biological assays and diagnostic kits. Their stability and photophysical properties enable highly sensitive detection in genomics and clinical testing. Ruthenium is also being studied for anticancer therapies, where its coordination complexes exhibit promising cytotoxic activity, potentially offering an alternative to platinum-based drugs with lower side effects.

Ruthenium’s relevance in emerging technologies is expanding rapidly. In photovoltaics, it is used in dye-sensitised solar cells (DSSCs), where ruthenium complexes serve as photoactive dyes. Although not yet commercialised at scale, this application highlights ruthenium’s potential in flexible and transparent solar solutions. It is also being researched in quantum dot fabrication, spintronic materials, and chemical sensors, where its unique electronic characteristics may offer performance gains in miniaturised systems.

Ruthenium supply

Ruthenium supply is limited and geographically concentrated, with over 90% of primary production sourced as a by-product from platinum and nickel operations in South Africa, Russia, and to a lesser extent Canada. South Africa’s Bushveld Complex is the single most important source, producing ruthenium alongside other platinum group metals (PGMs) during the processing of Merensky Reef, UG2, and Platreef ores. Russia’s Norilsk-Talnakh region contributes additional supply from nickel-copper sulphide operations, while minor output originates from Canada’s Sudbury Basin and isolated occurrences in the United States, Finland, and Zimbabwe. This high degree of concentration creates long-term vulnerability, particularly due to the reliance on by-product recovery and exposure to geopolitical and ESG risk.

Primary ruthenium is recovered as part of a PGM concentrate, with no large-scale stand-alone ruthenium mines. The element is typically present at less than 0.2 grams per tonne in PGM-bearing ores and is extracted through complex hydrometallurgical refining processes. Because production is tied to platinum and nickel output, ruthenium volumes cannot be flexed to meet demand changes, making the market structurally inelastic. This supply dependence on co-product extraction complicates forward planning and introduces volatility.

Secondary ruthenium supply is modest but growing in importance. It is primarily recovered through open-loop recycling of hard disk drives, electronics, and spent catalysts from the chemical and electrochemical sectors. Closed-loop systems are also in place for specific industrial applications, such as the chlor-alkali industry and capacitor manufacture, where ruthenium coatings or oxides are used. However, due to low loading levels, material dispersion, and technical separation challenges, recovery rates remain relatively low compared to platinum and palladium.

South Africa’s role as the primary ruthenium source carries strategic implications. Its mining industry faces well-documented issues, including electricity supply instability, deep-level operating risks, and policy uncertainty. Russia, while important to ruthenium supply, is subject to sanctions and export restrictions that may affect downstream trade and refining. Canada provides a more stable source, though volumes are comparatively small. The combination of constrained output, geopolitical tension, and lack of substitute sources underscores the fragility of ruthenium supply chains.

Environmental and regulatory pressures are increasingly influencing the ruthenium supply outlook. Although ruthenium mining itself does not occur in isolation, the refining and recovery stages are energy- and chemical-intensive. As demand grows in sustainability-linked sectors such as green chemistry, semiconductors, and advanced electrochemical storage, scrutiny over lifecycle emissions and waste handling will rise. Efforts are already underway to certify ruthenium production under responsible sourcing standards and to improve the traceability of recycled flows.

Ruthenium’s growing role in electronics, catalysis, energy storage, and emerging quantum and spintronic technologies is drawing policy and industry attention. While demand is rising, supply remains constrained by the economics of other metals. Current exploration activity is not targeting ruthenium directly, and investment in refining infrastructure has historically focused on higher-value PGMs. This lag presents a structural mismatch between long-term industrial needs and the availability of secure, scalable supply.

To address these risks, industrial users and governments are beginning to consider ruthenium in the context of critical minerals security. Although it is not yet formally listed on all national critical raw materials strategies, its relevance to advanced electronics, secure communications, and low-carbon manufacturing is becoming more visible. Improving collection systems, boosting recycling technologies, and supporting responsible refining initiatives will be essential to future-proofing ruthenium availability.

With demand expected to increase across semiconductors, data storage, capacitors, green chemical processing, and next-generation batteries, ruthenium’s supply chain resilience is a growing concern. Long-term strategies will need to focus on diversifying recovery pathways, enhancing closed-loop processing, and fostering greater alignment between downstream demand and upstream production realities. As digital infrastructure and clean technology accelerate, ruthenium will remain a crucial, if often under-recognised, enabler of global innovation.

Current primary ruthenium producers

Ruthenium substitution

In electronics, ruthenium is used as a critical material in hard disk drive platters, semiconductor interconnects, and advanced memory devices such as DRAM and resistive RAM (ReRAM). Its stability at the nanoscale, high conductivity, and resistance to electromigration make it valuable for miniaturised and high-speed circuitry. Potential substitutes include tungsten, cobalt, and copper in certain interconnect architectures, although these alternatives often require additional barrier layers or compromise performance at sub-10 nanometre scales. In memory applications, iridium and platinum are being explored as replacements in specific device structures, but ruthenium remains superior in balancing conductivity, durability, and manufacturability. As device geometries continue to shrink, material substitution becomes more challenging due to compatibility with existing deposition and etching techniques.

In catalysis, ruthenium is used in a variety of chemical and electrochemical processes, including hydrogenation, metathesis, ammonia decomposition, and water electrolysis. In the chemical sector, ruthenium can often be substituted with platinum, palladium, or rhodium, depending on the desired reaction kinetics and product selectivity. However, such substitutions may increase cost or alter reaction profiles. In electrocatalysis, ruthenium oxides are widely used in dimensionally stable anodes (DSAs) for chlorine and chlorate production. Alternatives such as iridium oxide or mixed metal oxides can be deployed, but they may reduce electrode life or current efficiency. In energy storage applications, such as supercapacitor electrodes and lithium-ion battery dopants, manganese and nickel-based materials are under investigation as replacements, although they generally do not match ruthenium’s specific capacitance or cycling performance.

In data storage, ruthenium has been instrumental in enabling perpendicular magnetic recording in hard drives. Substitutes such as cobalt-chromium alloys or synthetic antiferromagnetic structures can partially displace ruthenium, but these often entail higher complexity or reduced storage density. As solid-state storage replaces magnetic media in many applications, ruthenium’s role may diminish in this segment, but it remains critical in high-density archival formats and next-generation magnetic storage technologies.

In the glass and electrochemical industries, ruthenium is used in coatings for DSAs and high-temperature components. Platinum and iridium are common substitutes, particularly where chemical stability is prioritised over cost. However, in aggressive chemical environments or applications demanding low overpotentials and long service life, ruthenium-based coatings are typically superior. Alternative ceramic and conductive polymer coatings are under development but are not yet commercially scalable for large-volume electrochemical cells.

In the jewellery sector, ruthenium is occasionally used as a plating metal or alloying agent with platinum to enhance surface hardness and colour tone. Substitutes such as rhodium and osmium offer similar aesthetic benefits but may differ in wear resistance and market acceptance. Ruthenium’s use in decorative applications is limited in volume and relatively flexible with regard to substitution, depending more on brand positioning and consumer preferences than technical performance.

In medical and bioanalytical devices, ruthenium-based complexes are used as fluorescent markers and imaging agents. Alternatives include iridium, europium, and organic fluorophores, but ruthenium’s photostability and emission characteristics make it preferable in time-resolved fluorescence assays. In therapeutic contexts, ruthenium is being explored as a less toxic alternative to platinum in cancer treatments. While other metallodrugs are in development, none yet match ruthenium’s combination of redox activity, ligand versatility, and lower cytotoxicity in preclinical studies.

In advanced technologies such as quantum computing, spintronics, and catalytic water splitting, ruthenium is being tested for its unique electron configuration and redox stability. While platinum, iridium, and certain base metals are being considered in experimental systems, ruthenium often remains central to performance, especially in devices operating at high frequencies or under corrosive electrochemical conditions. Substitution in these fields is highly application-specific and largely dependent on ongoing materials science research.

Overall, ruthenium substitution is feasible in select use cases, particularly in decorative plating, simple chemical catalysis, or non-critical electronic components. However, in most industrial, medical, and energy-related applications, substitutes often entail performance trade-offs, increased process complexity, or diminished product lifespan. As ruthenium is typically used in low volumes but in highly specialised roles, reducing its loading through improved catalyst dispersion, thin-film deposition, and advanced recycling offers more promise than full substitution. With demand increasing across clean energy, data infrastructure, and medical diagnostics, securing sustainable and high-purity ruthenium supply remains a strategic priority alongside ongoing research into partial replacements.

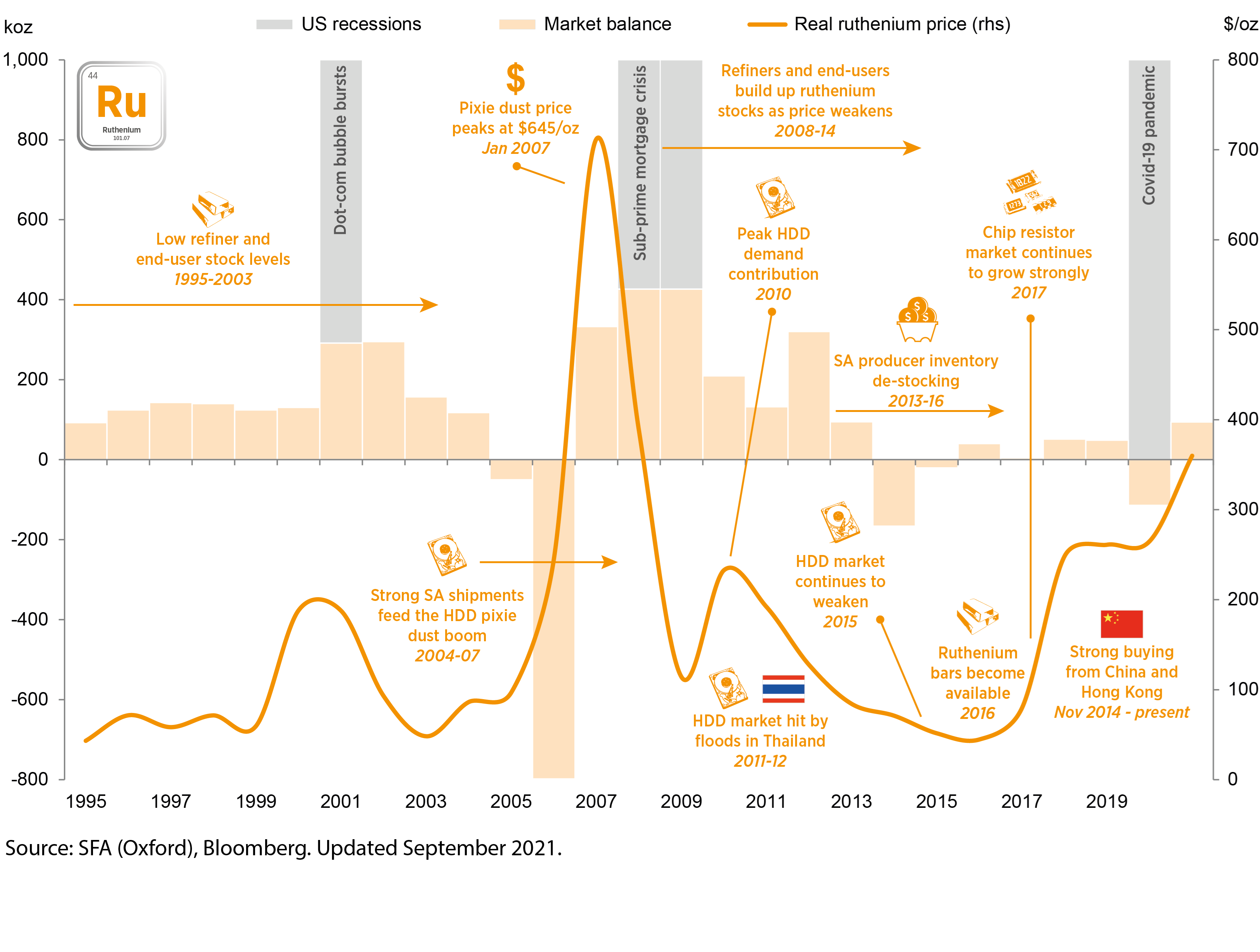

Ruthenium price in context, 1995 to 2021

Ruthenium market balance

| koz | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Primary ruthenium supply | |||||||||

| South Africa | |||||||||

| Russia | |||||||||

| Zimbabwe | |||||||||

| Other | |||||||||

| Total ruthenium supply | 1,1015 | 1,1015 | 1,030 | 1,024 | 806 | 1,107 | 951 | 941 | |

| Ruthenium demand |

|||||||||

| Automotive | |||||||||

| Chemical | |||||||||

| Electrical | |||||||||

| Electrochemical | |||||||||

| Hydrogen | |||||||||

| Other | |||||||||

| Total ruthenium demand | 909 | 916 | 870 | 880 | 803 | 867 | 862 | 804 | |

| Ruthenium market balance | 106 | 99 | 160 | 143 | 3 | 240 | 89 | 137 | |

| Ruthenium balance | |||||||||

| Ruthenium price history | |||||||||

| Ruthenium price (USD/oz) | 42 | 75 | 241 | 258 | 265 | 565 | 552 | 464 | |

| Ruthenium price (GBP/oz) | 31 | 58 | 181 | 202 | 207 | 411 | 447 | 374 | |

| Ruthenium price (EUR/oz) | 38 | 66 | 205 | 231 | 232 | 479 | 524 | 430 | |

| Ruthenium price (CNY/oz) | 276 | 505 | 1,600 | 1,784 | 1,827 | 3,645 | 3,707 | 3,289 | |

| Ruthenium price (ZAR/oz) | 612 | 1,004 | 3,217 | 3,729 | 4,364 | 8,335 | 8,997 | 8,572 | |

| Ruthenium price (JPY/oz) | 4,523 | 8,442 | 26,649 | 28,175 | 28,266 | 62,407 | 72,369 | 65,274 | |

Source: SFA (Oxford).

Ruthenium market balance

| koz | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Primary ruthenium supply | |||||||||

| South Africa | |||||||||

| Russia | |||||||||

| Zimbabwe | |||||||||

| Other | |||||||||

| Total ruthenium supply | 780 | 1,035 | 1,015 | 1,015 | 1,030 | 1,015 | 790 | 1,065 | |

| Ruthenium demand |

|||||||||

| Hydrogen | |||||||||

| Chemical | |||||||||

| Electrical | |||||||||

| Other | |||||||||

| Total ruthenium demand | 945 | 1,060 | 970 | 1,010 | 975 | 970 | 900 | 940 | |

| Ruthenium market balance | |||||||||

| Ruthenium balance | -165 | -25 | 45 | 5 | 55 | 45 | -110 | 125 | |

| Ruthenium price history | |||||||||

| Ruthenium price (USD/oz) | 65 | 47 | 42 | 75 | 241 | 258 | 265 | 565 | |

| Ruthenium price (GBP/oz) | 39 | 31 | 31 | 58 | 181 | 202 | 207 | 411 | |

| Ruthenium price (EUR/oz) | 49 | 43 | 38 | 66 | 205 | 231 | 232 | 479 | |

| Ruthenium price (CNY/oz) | 400 | 298 | 276 | 505 | 1,600 | 1,784 | 1,827 | 3,645 | |

| Ruthenium price (ZAR/oz) | 702 | 602 | 612 | 1,004 | 3,217 | 3,729 | 4,364 | 8,335 | |

| Ruthenium price (JPY/oz) | 6,840 | 5,744 | 4,523 | 8,442 | 26,649 | 28,175 | 28,266 | 62,407 | |

Source: SFA (Oxford). Updated November 2021.

Linked ruthenium market reports

In response to requests for more regular ruthenium market intelligence, we now produce a bespoke quarterly ruthenium market report that allows you to keep up to date with this market.

Meet the ruthenium team

Trusted advice from a dedicated team of experts.

Dr Jenny Watts

Critical Minerals Technologies Expert

Alex Biddle

Senior Mining Analyst

Jamie Underwood

Principal Consultant

Shunjie Zhao (Tony)

Commodity Analyst: APAC

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.