Augmented mine planning

PGM consulting for miners

Independently assessing mine and project business plans

SFA (Oxford)'s on-mine consulting is often commissioned as part of a strategic business review of mining assets to dovetail new shaft development and old shaft closures or ensure timely shaft delivery. The SFA team has visited and assessed numerous mine shafts, pits and projects. Our on-mine consulting is led by Stephen Forrest (Chairman), a chartered and professional engineer with over 15 years of PGM mine experience as a Mine Manager and Head of Technical Services. Stephen has also conducted and led many due diligence assignments, and been responsible for mine shaft sinking. He has worked for Boards and investors to seek opportunities to add value or leverage value from assets. Depending on the assignment, the team utilises expert associate mine engineers, geologists, metallurgists, and analysts.

Scrutinising assumptions and targets for outperformance

Our consulting team evaluates mining company business plans, assisting clients in finalising, committing and verifying the critical production parameters for new shafts and operating mines, as well as the timeline for delivery against strategy. Analysis of production parameters includes:

-

Analysing development rate assumptions.

-

The scrutiny of half-level layouts (mechanised vs. conventional).

-

Referencing geological plans (extraction rates) and upcoming geological drilling schedule.

SFA undertakes stoping rates and team efficiency assessments against shaft construction schedules and construction schedule reviews (logistics, reef, material handling).

We also verify logistical challenges and determine whether significant bottlenecks prevent the shaft from reaching its full potential.

Furthermore, we establish the current issues facing the commissioning of projects and quantify the upside and downside risks to shaft production profiles to ensure targets are met unconditionally and communicated to the Board.

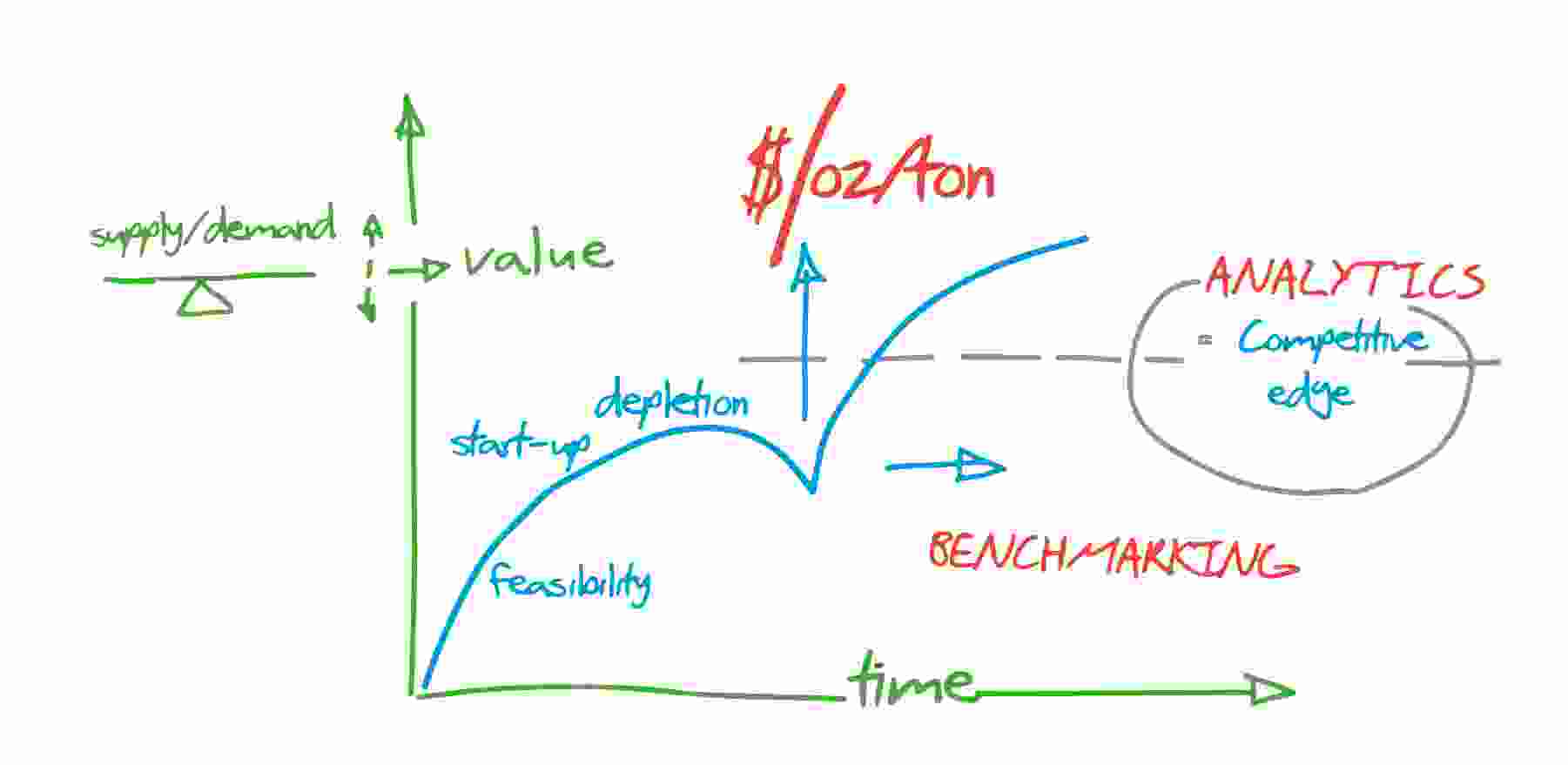

We benchmark agreed parameters against internal (where relevant) and external (risk scenario analysis) operations using our extensive industry database and client data. The project/mine planned performance is then benchmarked against the wider sector, where applicable, to identify the competitive edge.

Scenario planning and risk analysis

With our unrivalled depth of experience and unique databases, we can produce a comprehensive suite of industry players' contextualised analytics and provide a competitive view of the industry sector. Therefore, we can act as an independent reference point for stress testing in-house scenarios and undertaking a risk analysis.

Leveraging our vast knowledge and understanding of the Southern African PGM peer group and other global players, along with our detailed modelling platform to extrapolate macro and micro scenarios of PGM markets, we can provide a thorough risk matrix for the project, show risk categorisation and suggest mitigants for each risk and a risk management plan.

Furthermore, we can leverage our constant monitoring of industry dynamics and awareness of activities within the global PGM peer group to use our distinguished track record of modelling, using appropriate sensitivity analyses on the impact of identified risk and their materiality.

Case studies

Let's discuss your mine plan and future risks

Contact one of our team for more details.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Other PGM consulting solutions

Explore other services our clients use regularly.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.