Due diligence and commercial advisory

Trusted advice from a dedicated team of experts

Working with clients and third parties, SFA (Oxford) has a long track record of providing technical due diligence and financial modelling support to help secure future funding from investors and lenders. Our confidential due diligence assignments span many clients, including mining companies, investment banks, hedge funds, metal traders, and high net worth individuals.

Independent valuations and technical assessments

The SFA team has the experience to evaluate a broad spectrum of assets and scenarios, including corporate entities, projects from exploration to feasibility stage, operating mines, expansions and restarts. We can also assess numerous specific transactions, ranging from corporate deals to commodity market trading opportunities.

Leveraging its extensive experience of exploration, project appraisal, mine operation management, mineral processing, marketing, mining finance and mineral economics, and covering a range of metals, the SFA team is able to make a rapid, accurate assessment of an asset or situation, from technical, financial and strategic viewpoints.

We have carried out valuation assignments ranging from PGM assets in Southern Africa and cobalt-rich deposits in the Democratic Republic of the Congo (DRC), to gold mines in Papua New Guinea. Valuations by SFA have led to asset sales for major producers as well as for junior mining companies.

In carrying out these assignments, SFA has several significant competitive advantages over 'traditional' technical consultants:

-

We are not constrained by any particular approach and our expertise cuts across traditional demarcation lines. Members of the SFA team have extensive experience of exploration, project appraisal, mine operation management, mineral processing, marketing, mining finance and mineral economics, covering a range of metals. This enables us to make a rapid, accurate initial assessment of an asset or situation, from technical, financial and strategic viewpoints.

-

The whole range of mined commodities is covered. Although we are probably best known for our specialisation in the platinum group metals, the SFA team frequently undertakes assignments on lithium, cobalt, gold and silver as well as in base metals, particularly aluminium, copper, nickel and zinc. We also cover a range of other commodities such as diamonds, iron ore, coal and industrial minerals, applying our proven analytical skills to each one.

-

We deliver focused, timely, effective and value-adding due diligence solutions. Our reports are concise and commercially focused and each one is prefaced with an Executive Summary that sets out clearly the key issues and strategic choices available to the client. Our communication style is tailored carefully according to each client's needs and preferences. In most instances, an initial report is issued within five working days of completing a site visit.

-

SFA has long maintained a strong network of trusted associates and specialist consultants. Where additional specialised input is called for, we identify the requirements and recommend a suitable expert. Typically, we call upon associates for specific engineering, geological, mineral market or other expert input, such as resource audits or engineering studies. More generally, our network penetrates the length and breadth of the mining industry and allied sectors, from senior operating management to investment bankers.

Case studies

Evaluation of cost-cutting measures and ore mix optimisation

An independent, due-diligence review of a major South African producer’s operations

With a view to leveraging greater value through improved production in line with business planning, SFA (Oxford) worked alongside the PGM producer’s management team, referencing past achievements so as to identify future risk, and challenging its operational planning to ensure maximum value. The producer’s business plan was reviewed in detail, taking into account shaft performances, with analysis and benchmarking of the wider sector also included, ultimately creating detailed mine valuations.

Acquisition due diligence

Assessment and financial modelling of a major producer’s operating divisions and projects

We provided our client with an independent evaluation of a PGM producer’s investment options, looking at its reserve base, life-of-mine, regional economics/advantages, ore economics, potential value creation, competitive factors and capital requirements.

Investment case

Independent assessment of a PGM project

SFA (Oxford) provided an up-to-date, high-level case for investment in a project against other global projects and operations, to be made available to a potential joint venture partner.

The PGM junior sector: comprehensive competitor analysis

Led to an asset sale

On a mine-by-mine basis, SFA (Oxford) carried out a benchmarking analysis on the projects that populate the PGM junior sector following the 2008 financial crisis, in order to provide the client with a coherent, competitive view of the sector.

Project valuations for, and augmentation of, a Southern African PGM producer’s investment case

Led to an asset sale

SFA (Oxford) assisted a junior mining company through pre-feasibility and feasibility by way of providing detailed discounted cash flow (DCF) project evaluations, independent metal price forecasts and a PGM market chapter for the company’s feasibility study.

Technical studies

Mine and project due diligence on behalf of its clients

SFA (Oxford) and its associates have also conducted evaluations of gold mines and projects globally.

Financial modelling and processing due diligence

Specialist consultants and financial modelling for a new PGM mining project in Zimbabwe

SFA (Oxford) acted as a specialist consultant to the lender in reviewing the business plan, processing strategy and financial model.

Business case crystallisation

Strategic workshop and contextualisation of the chrome industry

A strategic workshop was facilitated by SFA (Oxford) to crystallise a client’s business case for participation in the business of UG2 tailings dams and the retreatment of contained PGM waste, detailing the value-adding opportunities it presented to the company. The team also assisted the client through a contextualisation of the chromite concentrate market in terms of commercial price valuations for the concentrate.

Market fundamentals and technical studies

Market intelligence, and mine and project due diligence

SFA (Oxford)’s expertise in chrome includes the listing of chrome companies and providing chrome and ferrochrome supply-demand market intelligence and price forecasts to support the feasibility and bankable feasibility studies to chrome companies globally. The studies quantified the contribution chrome ore revenues made to a platinum producer and provided price valuations and commercial terms for UG2 chrome concentrate to traders/ exporters. SFA has a full understanding of the chrome value chain for primary and secondary producers in South Africa.

Value addition and beneficiation strategy

A joint collaboration with major PGM players

SFA (Oxford) identified the critical factors required for an optimal PGM beneficiation model for a PGM producing region, independently assessed commercial metallurgical options, and an incentive framework for higher investment levels.

Reverse engineering of potential concentrate processing options

Leveraging off SFA (Oxford)’s vast PGM knowledge, relationships with the major smelters, and a ‘reverse-thinking’ metallurgical review to establish the smelter target envelope

SFA held a metallurgical review workshop and undertook site visits to a selection of smelters across the globe to establish which of the selected smelters would a) prefer to treat, b) tolerate, c) could be adjusted to take, a client's concentrate feeds in terms of composition, tonnage, and timing.

The team clarified the nature and indicative terms of a potential mineral processing agreement with each of the selected smelters. Using indicative commercial terms provided by the smelters, SFA undertook a financial simulation exercise to determine which concentrate options yielded the highest revenues, as well as defining the nature of test work required for reverse engineering an optimal concentrate specification for acceptance at the smelter, and the optimal window for processing.

Strategic list of target customers

Ranking targets in the chemical sector for a client

Using our in-depth knowledge and understanding of PGM demand and metal flows to the chemical sector (silicones, nitric acid, paraxylene and PDH), SFA (Oxford) created a target list of potential customers for a client.

Precious metals chemicals industry

Evaluating players, metal use, and business opportunities for a client

SFA (Oxford) undertook a detailed strategic intelligence report on the precious metals chemicals markets, including PGM demand volumes and market value by segment and region, as well as the competitive landscape.

Ruthenium value chain

The European and US ruthenium catalyst markets: Supply, sale and application

SFA (Oxford) analysed the European and US ruthenium catalyst markets (including recycling), considering their fundamentals, trade flows, and major players/buyers, and supplying actual pricing information for ruthenium to better frame the market’s commercial/trading environment through, for example, spot pricing and contracts.

Global reconciliation of PGM flows through the open and closed-loop industries for a major fabricator

Full precious metals loop analysis, covering the value chain for platinum, palladium and rhodium, quantifying open- and closed-loop demand, system losses and recycling volumes

SFA (Oxford) provided a yearly snapshot of the PGM industry, detailing PGM volumes defined by the stream, including mining, consumption, precious metals in the loop (recycling volumes) and stocks. A high-level overview of the recycling sector covered key players and industrial segments, and the linkages and metal flow between each.

A detailed assessment of mining and secondary concentrates, chemical, and petrochemical, jewellery, dental, medicine, glass, electronic, production scrap and magnetic data storage sectors were covered. The SFA team provided installed industrial capacities of PGM, top-up requirements, major players and replacement cycles to complete a concise picture of the PGM markets.

Competitor purchasing intelligence

PGM use in automotive market and best-fit scenarios for a client

SFA (Oxford) helped the client better understand PGM use in the automotive market, then identified potential purchasing strategy developments to leverage the clients buying powers, reduce risk and guarantee supply.

Trends in PGM jewellery and consumer demand — commissioned by a major PGM fabricator

Long-term supply outlook for the retail PGM sector

SFA (Oxford) undertook a detailed commentary and analysis on demand for platinum and palladium for the manufacture of jewellery, as well as an analysis of large and small bars and noble coins.

Global drivers for fuel cell adoption — commissioned by a fuel cell component manufacturer

Fuel cell market assessment

Fuel cell market study with a specific focus on drivers of adoption and applications, and opportunities in private and public transport.

Jewellery marketing investment appraisal

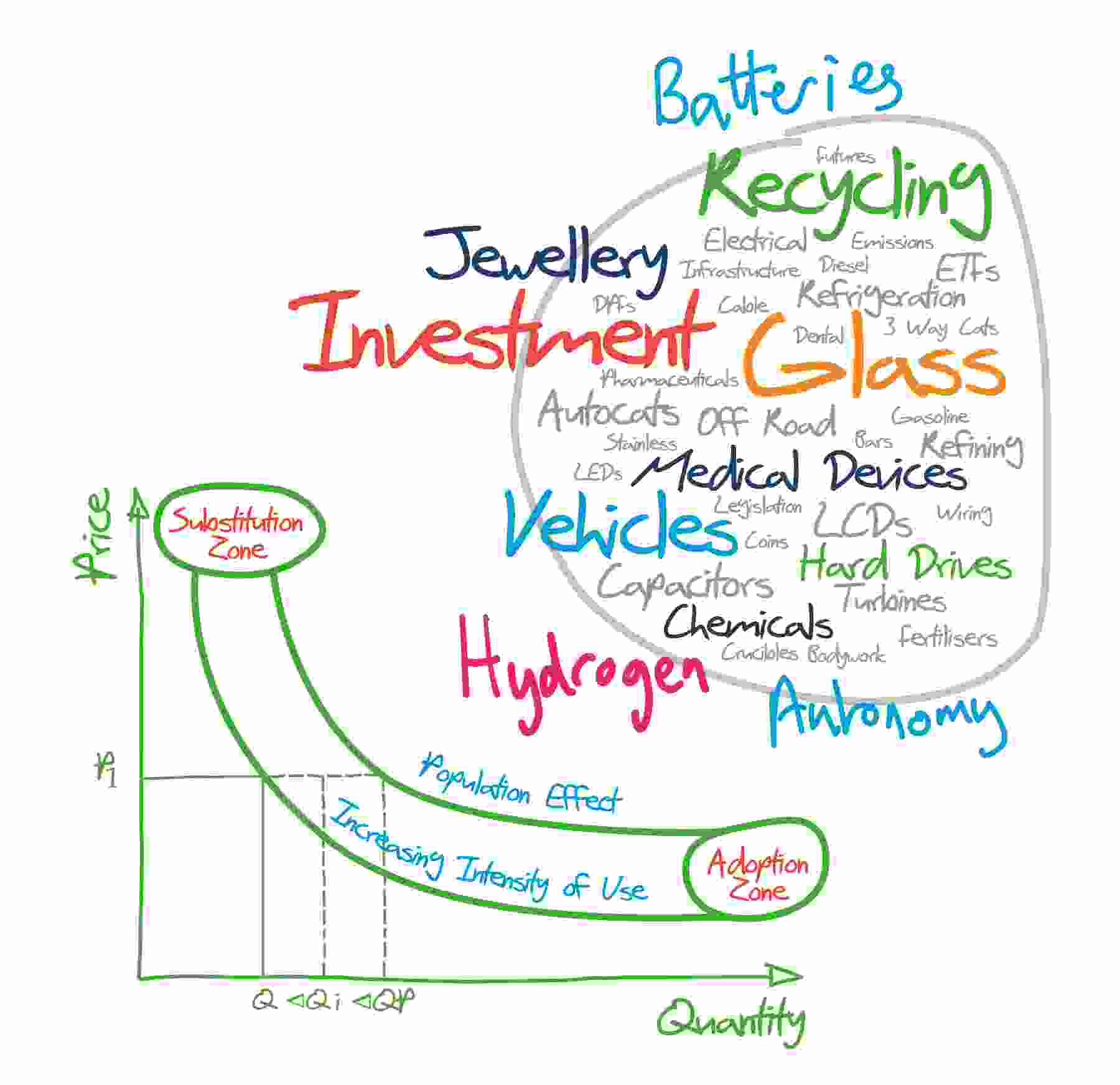

Global investment appraisal

The SFA (Oxford) team provided insight on metal price demand elasticity, so as to illustrate the dynamics that impact manufacturers and retailers’ decisions regarding their platinum business.

The report highlighted the margins that apply in the jewellery pipeline from mine to the customer (retailer) to identify levels of marketing investment that can be achieved (net profit, net profit margin, and gross profit margin).

The pipeline was mapped by market, outlining the flow of platinum from importers and refiners through to consumers.

Strategic metals assessment to support tomorrow’s hydrogen economy — commissioned by a consortium of technological leaders

Hydrogen market assessment

SFA (Oxford) provided a detailed report and presentation to a consortium of fuel cell technology companies, major automakers, energy providers, technology companies, and manufacturers on the long-term supply security of platinum and iridium to support a budding hydrogen economy.

Identifying new demand opportunities for PGMs — commissioned by major PGM producers

Commercial evaluation of the fuel cell value chain

Analysis of fuel cells, with a specific focus on technological feasibility, commercial potential, legislative support and market drivers, ownership of IP/licensing as well as company supply chains and commercial arrangements.

Tomorrow’s hydrogen opportunity — commissioned by a client

Evaluation of the hydrogen economy

SFA (Oxford) provided an independent assessment of the hydrogen economy, fuel cell technologies, green hydrogen production economics, supply chains, and major players to help assess investment opportunities.

PGM customers in the hydrogen economy — commissioned by a client

New customer targets

SFA (Oxford) identified and evaluated key PGM customers in the hydrogen economy, a good long-term hedge for PGMs as autocatalyst use declines, and potentially secure demand for iridium and ruthenium.

Development of mineral rights portfolios

Global investment appraisal

Comprehensive strategic appraisals of global exploration projects have been completed by SFA (Oxford) on behalf of an investor.

Enhanced Investment Memorandum

Linking the use of PGMs in strategic applications with favourable investment returns

SFA (Oxford) assisted in the production of an Investment Memorandum (IM) for a client, providing clear insight into the benefits of PGM, how the use of PGM in innovative new technologies is rising.

Gold marketing intelligence

Gold cost study

SFA (Oxford) provided gold market intelligence to hedge funds on a quarterly basis, including macroeconomic developments, price forecasts, and market fundamentals. SFA’s analysts have managed databases, researching and compiling detailed production and cost data on over 340 gold mines and projects.

Contextualising prospects for the hydrogen economy — for a Family Wealth Office

Hydrogen market assessment

Market evaluation including assessing how technology shifts, legislative changes, and environmental issues will impact markets, and evaluation of niche applications in new end-uses and the long-term sustainability of these applications.

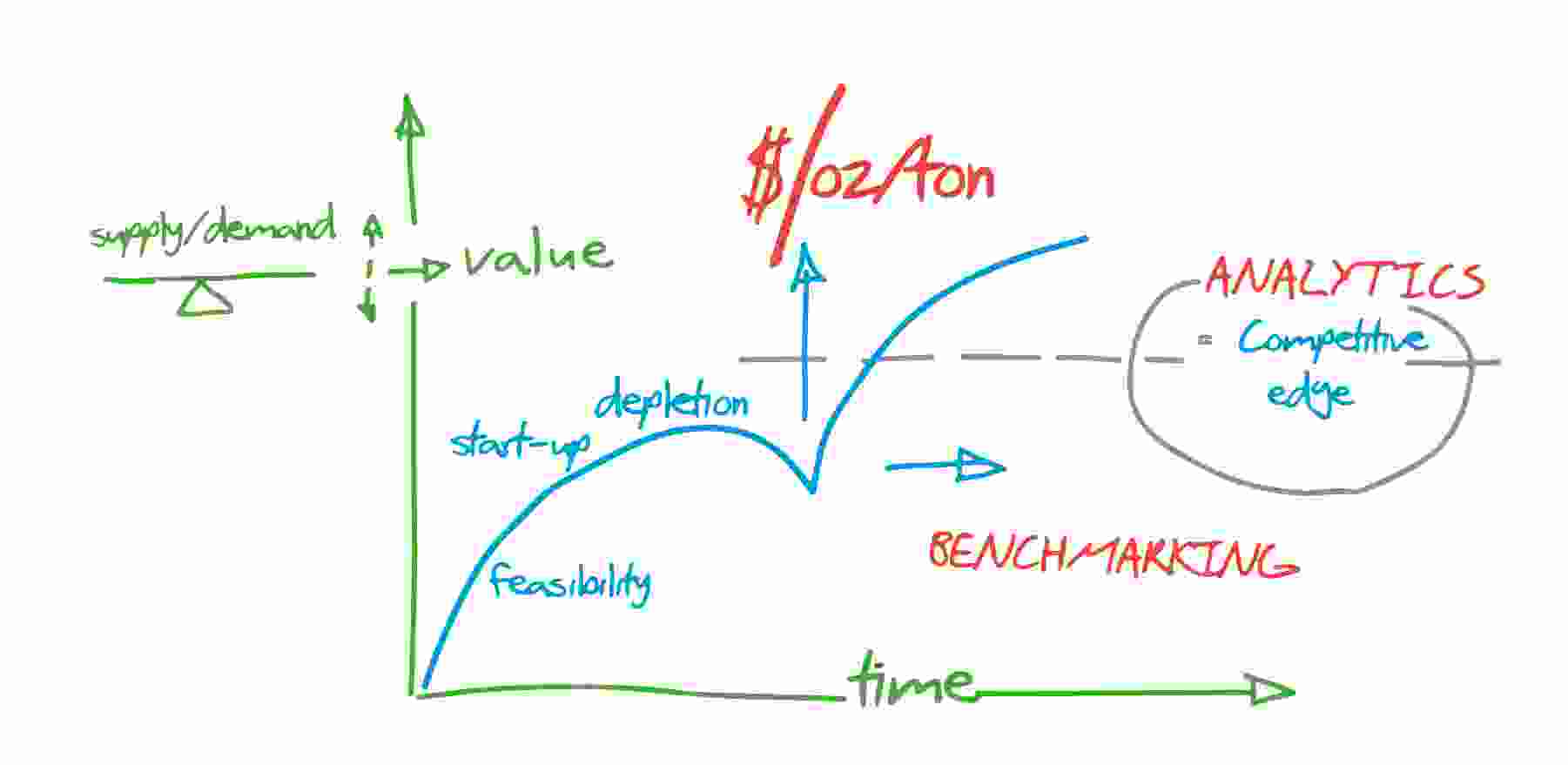

Economic appraisal

In-depth analysis of spent autocatalyst recycling and value chain

SFA (Oxford) provided an independent view of the PGM value chain for spent autocatalyst recycling, highlighting the indicative cost and value addition at each stage (removal, collection, pre-processing, smelting, and refining).

The recycling sector

A guide for the new entrant

The SFA (Oxford) team completed an overview and evaluation of opportunities within the PGM recovery/recycling sector, defining the barriers to entry confronting a newcomer to the sector, identifying the main players in the value chain, and forecasting regional collection rates and volumes of spent autocatalysts, as well as appraising other market sources of secondary PGMs.

Investment/disinvestment

Strategic options review for a major PGM recycler

SFA (Oxford) assisted in the derivation of a high-level, practicable, and viable scaling-up of business strategy (or disinvestment case). Detailed PGM market intelligence was provided, covering primary and secondary supply and demand. The review contextualised assets/ operations against those of local peers and global competitors, and offered an independent view on the metal price dynamics of platinum-group markets, so as to determine a robust window of economic opportunity for the company’s PGM business.

Asset divestment

Due diligence study on a PGM recycling operation for a major conglomerate

SFA (Oxford) carried out an indicative financial evaluation, taking into account volume, revenue, and cost projections, whilst also considering proposed value accretive options.

Economic appraisal

Business valuation of a major PGM recycler

SFA (Oxford) assessed the overall competitiveness of a refinery involved in recycling by conducting a benchmarking exercise, comparing the plant to other global refineries, and considering the following factors: recoveries, operating costs, location, quality of assets, and external and internal negotiated tolling terms.

We conducted a market valuation, considering all relevant qualitative and quantitative factors of the existing operation, on a standalone basis, and identified and analysed the operation’s value, determining the net asset value versus sale options.

A year-long study on the Chinese jewellery market

A full regional appraisal of platinum jewellery, including the value chain, players, metal movements, and influences on demand

A multi-faceted econometric model was developed to quantify platinum jewellery demand evolution now and in the future. The study involved on the ground interviews with jewellery industry players (fabricators, wholesalers and retailers). Demographic influences were also accounted for to ultimately plot platinum demand scenarios for tomorrow.

Let's discuss your project

Contact one of our team for more details.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Other PGM consulting solutions

Explore other services our clients use regularly.

Augmented mine business planning and risk analysis

SFA has significant experience in reviewing mine business plans, identifying production risks and reviewing costs down to a half-level basis.

PGM mergers, acquisitions, and corporate defence

Clients have used SFA to provide the analytical link with banks and financial institutions to support PGM investment decision-making and provide market support.

IPO market chapters and PGM feasibility studies

SFA has supported numerous client listings by providing an independent view of the PGM markets to help secure capital from potential investors.

Peer-group benchmarking and margin analysis

Our PGM peer-group benchmarking is unrivalled, providing you with a detailed understanding of which assets are outperforming and which are most at risk.

Mine optimisation and cost benchmarking

SFA realises cost synergies for PGM clients across company operations to help raise margins and improve production efficiency benchmarks.

Covid-19 PGM market analysis and scenarios

With extensive experience covering the PGM markets and industry fundamentals, SFA can provide you with our latest market outlook and the window of scenarios.

Human capital and organisational planning

The SFA team has completed many labour workforce projects, analysing demographic trends, forecasting future labour requirements across mining operations.

PGM strategy, planning and Board support

SFA is a trusted advisor to Board members and senior management of significant stakeholders and provides regular assistance to strategy and planning efforts.

PGM price forecasting and project incentive pricing

SFA can provide accurate short-, medium- and long-term PGM price forecasts to support your business plans and contract negotiations.

PGM markets and supply risk dashboards

SFA provides regular data flows of mine supply and metallurgical pipelines, basket prices, mine economics, and PGM demand to assist strategic decision-making.

Metallurgical processing and commercial options

SFA has extensive experience in assessing clients' advanced mineral processing offtake options and evaluating indicative commercial terms.

'Black-box' PGM and macro scenario modelling

Clients approach SFA to run their own supply and macro modelling demand inputs to see the impact this has on the medium- to long-term PGM market balances.

PGM investor Board packs and roadshows

SFA supports its clients on global roadshows to assist on capital raisings and converse with fund managers, institutional investors and family wealth officers.

Black swan events and PGM market impacts

The SFA team is constantly providing rich insights for its clients on structural events moving the PGM markets, particularly when the situation continues to change.

Corporate ESG strategy and PGM stewardship

SFA works closely with value chain players to understand how materially significant ESG issues can be integrated into their wider company strategy.

Cradle-to-grave ESG recycling studies

SFA's analysis of environmental footprints from recycled material in terms of greenhouse gases, waste generation and processing is helping secure new investments.

Peer-group ESG benchmarking for PGMs

SFA's benchmarking of PGM producers on material ESG factors generates high-resolution insights for sustainability-conscious investors.

Macroeconomics and precious metals

For many years, SFA's extensive expertise in analysing the changing dynamics of global economies, financial markets and precious metals has enabled us to deliver bespoke research to enhance your next strategy.

Automotive powertrains and PGM demand

SFA delivers detailed insights into the effects of new automotive technologies on PGM demand for light-duty, heavy-duty, off-road and fuel cell vehicles to meet government emission targets.

The future of cities and mobility solutions

SFA has advised mobility companies with their strategies, providing global or local industry context, benchmarking competitors, creating industry scenarios and identifying new opportunities.

PGM purchasing and new customer targets

SFA has explored the purchasing dynamics between market participants, the complexity of the associated price web factors for platinum, palladium and rhodium, providing definitive answers to commercial questions.

Emerging technologies – opportunities and threats

SFA is constantly monitoring the evolution of emerging technologies and threats to new metal substitution. Let us cut through the noise, and highlight the short to long-term price risk impacts for your business.

PGM catalyst and chemicals market intelligence

SFA is equipped to provide detailed regional insights of the major players, market shares, demand volumes, and market value for automotive, chemical and petrochemical catalysts, and smaller industrial markets.

Long-term PGM recycling value chain assessments

SFA's discreet work with recyclers gives us unique market insights, for the major regions of the USA, Europe, China and Japan. We also closely monitor jewellery recycling, electronic scrap and spent catalysts.

Jewellery pipeline mapping and econometrics

SFA has mapped jewellery pipelines, examined costs and margins, quantified future demand levels, and analysed the competitor landscape of fabricators, wholesalers, and retailers for future investment decision-making.

PGM trade flows and stock reconciliation

SFA analyses the physical movements of PGMs for demand-side and supply-side participants, how futures contracts are priced and traded, and quantifies above-ground PGM stocks from key sectors.

Closed and open-loop PGM market evaluation

SFA can provide you with the most insightful 360-degree research covering the secret closed-loop market sectors by quantifying installed capacities, system losses and top-up requirements by company and sector.

Formulating regional trading desk strategies

SFA has significant experience mapping regional and localised end-use markets for PGMs to assist clients in discovering new trading opportunities and client targets by volume and sector.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.