Price forecasting & incentive pricing

Battery Raw Materials

Price risk mitigation for battery metals

As the world moves towards a cleaner and greener future, electric vehicles (EVs) are becoming increasingly popular. The demand for battery metals such as lithium, nickel, and cobalt is increasing, with supply and price volatility becoming critical concerns for all players in the value chain. At SFA (Oxford), we provide tailored and reliable short- to long-term price forecasts for these essential materials. Our forecasts are supported by extensive supply and demand databases and can provide valuable insights into market trends, pricing dynamics, and potential price movements. This information can help to inform sales and procurement strategies, minimise risks and maximise profits across the battery metals supply chain.

Price forecasting for producers

Are you a raw material producer looking to optimise your operations and secure funding for new projects? SFA can provide you with the accurate short- to long-term price forecasts you need to make informed decisions. By using our extensive supply and demand databases, you can gain a clear understanding of future market conditions and adjust your production planning and financing decisions accordingly.

Our price forecasting can help you negotiate better contracts with precursor and battery manufacturers. By having access to reliable pricing information, you can confidently negotiate terms and conditions that are more favourable for your business, increasing your competitiveness in the market. With SFA as your partner, you can optimise your operations and maximise profits while minimising risks.

Price risk management for precursor manufacturers

Partnering with SFA (Oxford) for tailored price forecasting services can help your treasury and procurement teams make informed decisions about precursor manufacturing in the growing battery metals market. Our accurate short- to long-term price forecasts for essential battery metals like lithium, nickel, and cobalt can help you optimise your operations and secure funding for new projects. By partnering with us, you can gain a competitive edge in the precursor manufacturing market and negotiate better contracts with raw material producers, increasing your profitability and sustainability. Contact us today to learn more about how we can help your treasury and procurement teams with our forecasting services.

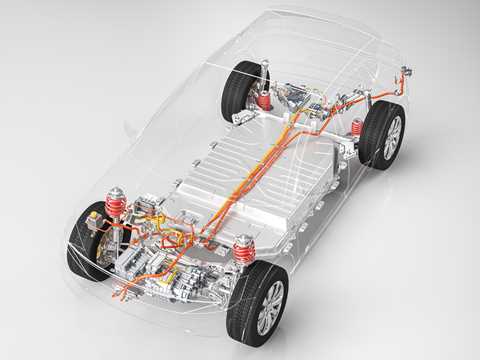

Optimising price risk for battery manufacturers

SFA's accurate short- to long-term price forecasts for crucial battery metals such as lithium, nickel, and cobalt can help battery manufacturers make informed procurement decisions, allowing you to purchase raw materials at the right time and at the best price, thereby minimising costs and increasing competitiveness in the dynamic battery metals market. By partnering with SFA, you can leverage our forecasting services to negotiate better contracts with raw material producers and precursor manufacturers, ensuring your supply chain is secure, and your operations are optimised for profitability.

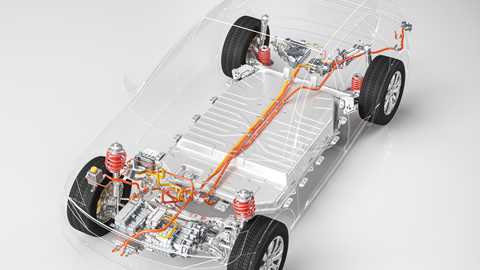

Price risk management for automakers to support EV uptake

For procurement and treasury departments, managing price risk is a key consideration when it comes to securing the necessary battery metals for EV production. SFA's price forecasting services can provide valuable insights into commodity purchasing risk, enabling these departments to make informed procurement decisions and minimise costs. By utilising our accurate price forecasts, procurement and treasury teams can plan for the future and mitigate potential price volatility, ensuring a reliable and affordable supply of these essential materials. This can help to optimise procurement strategies, minimise risks, and increase the competitiveness of EVs in the market.

In addition, our price forecasting can help support EV uptake by providing transparency in commodity purchasing risk. Let SFA help you make informed decisions about purchasing the necessary battery metals at the right time and the best price, ensuring a reliable and affordable supply of these essential materials. This can help to drive down the cost of EVs, making them more accessible to consumers and accelerating the transition to a cleaner and more sustainable future.

Case studies

Ask us for our latest price forecasts and scenarios

Contact one of our team for more details.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Jamie Underwood

Principal Consultant

Daniel Croft

Commodity Analyst

Thomas Chandler

Principal Lithium Supply Analyst

Lakshya Gupta

Senior Market Analyst: Battery Materials and Technologies

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Ismet Soyocak

ESG & Critical Minerals Lead

David Mobbs

Head of Marketing

Other consulting solutions

Explore other services our clients use regularly.

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.