The Rhodium Market

Critical Minerals and The Energy Transition

Navigating the Rhodium Market

Rhodium is an ultra-rare, silvery-white metal valued for its extraordinary catalytic efficiency, high reflectivity, and resistance to corrosion and high-temperature degradation. As a core member of the platinum group metals (PGMs), rhodium is essential to emissions control technologies, high-reliability electronics, and advanced coatings used in defence and space systems. Its primary use in automotive catalytic converters, to reduce nitrogen oxides (NOₓ) in three-way catalysts, makes it indispensable to meeting the world’s most stringent air quality standards. Despite its minute volume usage, rhodium’s critical function, extreme price volatility, and near-total dependence on South African by-product supply elevate it to strategic mineral status. With limited substitution potential and rising demand from clean mobility and aerospace sectors, rhodium plays a vital role in supporting regulatory compliance, supply chain resilience, and national security imperatives. SFA (Oxford)'s explores many of rhodium’s end-uses, highlighting its growing relevance in the transition to a connected, secure, and sustainable global economy.

Rhodium price news and insights

The UK’s 2025 Critical Minerals Strategy

1 December 2025 | Franklin Avery, Ismet Soyocak

The UK just launched its most elaborate critical minerals strategy to date, setting firm targets and funding to reshape supply chain security.

Platinum Group Metals Market Report – Q3 2025

30 September 2025 | Beresford Clarke

Platinum’s rally—short-term or structural shift? SFA’s Quarterly Report covers key drivers, industry impacts, and price risks to 2028.

Iridium’s outlook linked to hydrogen economy wariness

21 October 2024 | SFA (Oxford) & Heraeus

Chinese heavy-duty vehicle platinum demand could be ready for a rise

7 October 2024 | SFA (Oxford) & Heraeus

Where does the palladium market go from here?

23 September 2024 | SFA (Oxford) & Heraeus

The Chinese car market in 2024 – PHEVs, subsidies and palladium

19 August 2024 | SFA (Oxford) & Heraeus

An introduction to rhodium

Rhodium demand and end-uses

Rhodium, a rare and high-value member of the platinum group metals (PGMs), is critical to emissions control, industrial catalysis, and specialised electronics. With exceptional resistance to corrosion, outstanding catalytic activity for nitrogen oxide (NOx) reduction, and thermal stability at high temperatures, rhodium is indispensable in several advanced applications. As governments strengthen emissions standards and global industries prioritise high-efficiency, low-footprint technologies, rhodium continues to gain importance as both a critical input and a constrained resource.

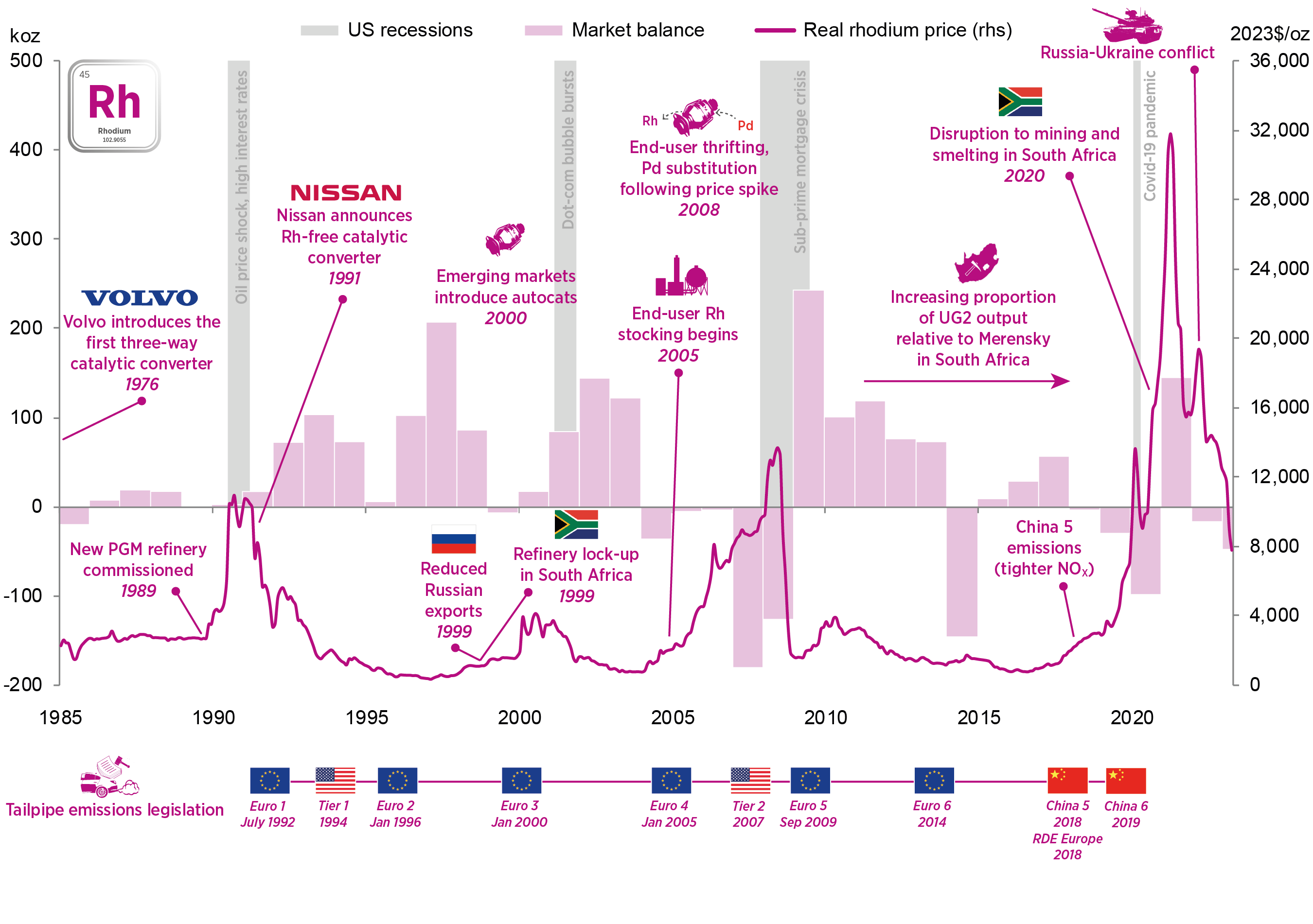

The dominant end-use for rhodium is in automotive catalytic converters, where it is used almost exclusively to reduce nitrogen oxides (NOx) in gasoline-powered vehicles through the selective catalytic reduction process. Typically alloyed with palladium and platinum, rhodium acts as the key component in three-way catalysts, especially in systems designed to meet the most stringent tailpipe regulations such as Euro 6d, China VI, and US Tier 3. Although used in small quantities, typically measured in parts per million, its effectiveness at extremely low loadings has made rhodium an irreplaceable material for compliance with ultra-low emission standards. The rise of hybrid vehicles and extended internal combustion engine (ICE) lifespans in developing markets continues to underpin demand.

While rhodium is not used directly in fuel cells or hydrogen electrolysers, it plays a supporting role in the hydrogen economy. Rhodium-platinum alloys are sometimes used in electrodes and thermocouples within high-temperature hydrogen systems. Rhodium's high melting point and oxidation resistance also make it suitable for coating or alloying components in reforming units and hydrogen production reactors operating in extreme environments.

In the chemical sector, rhodium is used in several high-value catalytic processes. These include the hydroformylation of olefins to aldehydes, used in plastics and detergents, the hydrogenation of alkenes and ketones, and the production of acetic acid via carbonylation. Rhodium catalysts are especially prized for their selectivity and stability, making them valuable in the fine chemical and pharmaceutical industries. Despite their cost, the high efficiency and recoverability of rhodium-based catalysts ensure continued use in batch and continuous processing environments, particularly where product purity is critical.

Rhodium also finds use in high-reliability electronics and optical components. It is used in electrical contacts, relays, and connectors that must maintain conductivity and corrosion resistance over long operating cycles. In the semiconductor sector, rhodium’s reflectivity and stability under ion bombardment make it suitable for niche sputtering targets and lithographic applications. It is also used in specialised thermocouples, often alloyed with platinum, for high-temperature measurement in industrial furnaces and aerospace systems.

In jewellery and decorative applications, rhodium is widely used as a plating material for white gold and silver items, providing a bright, tarnish-resistant finish. Although this use represents a small proportion of total demand, it remains important to the luxury goods sector, particularly in North America and East Asia. Rhodium-plated components are also found in watchmaking, high-end writing instruments, and premium automotive detailing.

In defence and aerospace, rhodium is employed in high-stress electrical components, heat shields, and reflective coatings, particularly in space-facing instrumentation and satellite systems. Its chemical inertness, combined with mechanical strength at elevated temperatures, makes it valuable in propulsion, thermal control, and vacuum systems. Rhodium alloys and coatings help ensure performance reliability in environments exposed to ionising radiation and extreme thermal cycling.

Rhodium is also used in a range of niche and emerging technologies. It plays a role in high-precision optics, UV-reflective coatings, and catalytic filtration systems. Experimental applications include use in fuel reforming, concentrated solar power systems, and as a dopant or alloying agent in advanced materials for quantum and spintronic devices. Although these uses remain small in volume, they highlight rhodium’s exceptional physicochemical properties and potential in high-tech innovation.

Rhodium’s unique role in ultra-low emissions compliance, aerospace systems, and strategic electronics is increasingly being recognised in the context of national security and critical minerals policy. Its high value, extreme scarcity, and near-total reliance on by-product recovery from platinum and nickel mining, primarily in South Africa and Russia, make rhodium particularly vulnerable to geopolitical and supply chain disruptions. With few if any viable substitutes in automotive and aerospace-grade applications, governments are beginning to consider rhodium’s inclusion in national stockpiles and critical raw materials strategies. Strengthening recycling infrastructure, refining capacity, and supply transparency will be central to reducing systemic risk and securing access for defence, mobility, and clean technology supply chains.

Investment demand for rhodium exists but is less institutionalised than for gold, platinum, or palladium. Due to its extreme price volatility and illiquidity, rhodium is typically accessed through physically backed products such as bars or coins, or through industrial exposure by way of recycling and refining operations. Periods of constrained supply, particularly from South Africa, combined with inflexible primary production, have driven speculative interest and strategic stockpiling in recent years.

Rhodium supply

Rhodium supply is among the most concentrated and constrained of all the platinum group metals (PGMs), with over 80 percent of primary production originating from South Africa. The majority is sourced as a co-product from the Merensky Reef, UG2, and Platreef zones of the Bushveld Complex. Russia contributes a smaller but still significant portion, primarily through Norilsk Nickel’s operations in the Norilsk-Talnakh region, while minor quantities are produced in Zimbabwe, Canada, and the United States. This extreme concentration creates acute supply chain vulnerabilities, particularly given the geopolitical risks and operational fragility associated with key producing regions.

Primary rhodium is almost exclusively recovered as a by-product of platinum and palladium mining. In South Africa and Zimbabwe, rhodium occurs in low concentrations, typically less than 0.1 gram per tonne, and is extracted through integrated PGM refining flowsheets. Because rhodium production is tied to the volume and economic viability of platinum and palladium output, its supply cannot be easily increased in response to price or demand shocks. This inherent inflexibility contributes to the metal’s price volatility and cyclical tightness.

Secondary rhodium supply is derived primarily from the recycling of spent automotive catalytic converters, where rhodium is recovered alongside platinum and palladium. These open-loop systems use a combination of smelting, leaching, and solvent extraction techniques to separate and purify rhodium from multimetal scrap. Rhodium recovery is also possible from glass industry catalysts, nitric acid gauzes, and electronic components, although these sources contribute a smaller share. With growing interest in circular economy solutions, recycling currently accounts for approximately 20 to 25 percent of global rhodium supply.

South Africa’s dominance in primary rhodium supply presents significant strategic challenges. The country’s mining sector is impacted by deep-level geology, frequent power outages, labour disputes, and regulatory uncertainties. Russia’s rhodium exports, although smaller in volume, are increasingly subject to geopolitical pressure and sanctions, raising concerns about market access and trade flows. In Zimbabwe, political risk and infrastructure constraints continue to deter foreign investment in PGM expansion. These factors underscore the importance of strengthening secondary supply chains and building out refining capabilities in more stable jurisdictions.

Environmental considerations are also reshaping the rhodium supply landscape. Deep underground mining in South Africa is highly energy-intensive and water-dependent, with mounting ESG scrutiny from investors and regulators. Improved waste management, emissions controls, and responsible sourcing verification are becoming essential to meet the sustainability requirements of downstream consumers in the automotive and electronics sectors. Initiatives such as third-party certification schemes and blockchain traceability are gaining traction to enhance transparency.

Given rhodium’s indispensable role in emissions reduction and its absence of effective substitutes in catalytic converters, securing sustainable and transparent supply has become a priority for automakers, catalyst manufacturers, and policy institutions. Recycling offers a partial buffer against supply shocks, but variability in collection rates, processing efficiency, and end-of-life traceability limits near-term impact. In the longer term, supply security will depend on diversifying refining access, reducing dependency on high-risk jurisdictions, and incentivising closed-loop recovery across industrial applications.

As demand for rhodium continues to rise in line with tightening vehicle emissions regulations and expanding use in defence and space electronics, coordinated efforts will be required to stabilise this critical supply chain. Enhanced urban mining, global stockpile management, and forward-looking investment in low-impact refining technologies will be central to managing the volatility and strategic risk associated with rhodium availability.

Current primary rhodium producers

Rhodium substitution

In automotive catalytic converters, rhodium is used almost exclusively to reduce nitrogen oxides (NOₓ) through the selective catalytic reduction function within three-way catalyst systems. It is typically alloyed with palladium and platinum in gasoline vehicles to meet stringent tailpipe emissions standards. While alternative PGMs can replicate certain catalytic functions, no material matches rhodium’s NOₓ conversion efficiency under real-world conditions. Substituting rhodium with platinum or palladium requires significant changes in catalyst design and may result in reduced durability, lower peak efficiency, or non-compliance with regulations such as Euro 6d, China VI, or US Tier 3. Although research has explored advanced perovskites, zeolites, and base-metal catalysts for NOₓ reduction, these alternatives typically lack thermal stability and rapid light-off characteristics required for automotive environments.

In industrial catalysis, rhodium is used in several high-value processes such as acetic acid production (formerly via the Monsanto process), hydroformylation of olefins, and selective hydrogenation. While iridium and ruthenium can replace rhodium in some catalytic cycles, they often require more extreme reaction conditions or lead to increased side-product formation. In the Cativa process, iridium has successfully displaced rhodium for acetic acid synthesis, but this remains one of the few large-scale commercial substitutions. In pharmaceutical and fine chemical production, base-metal catalysts have shown promise in laboratory-scale synthesis, though commercial implementation is constrained by process reliability, intellectual property barriers, and regulatory constraints on drug intermediates. As such, rhodium’s high turnover frequency, selectivity, and ease of recovery continue to justify its use in precision catalysis.

In electronics, rhodium is used in high-performance electrical contacts, relays, and connectors that require excellent corrosion resistance and conductivity across extended duty cycles. Silver-palladium alloys, gold-plated contacts, or conductive polymers can substitute in some applications, particularly where cost sensitivity outweighs extreme reliability. However, in aerospace, defence, and automotive-grade systems, substitution may reduce signal integrity, lifespan, or thermal resilience. In emerging fields such as lithography and ion-beam sputtering, rhodium’s reflectivity and resistance to ion erosion make it uniquely suited for coating and masking components. Substitutes in these niche applications remain experimental and application-specific.

In glass manufacturing, rhodium is used in high-temperature alloys for bushings and stirrers alongside platinum. While platinum-rich alloys can partially substitute, rhodium improves mechanical strength and oxidation resistance. Removing rhodium entirely from these systems would likely reduce component lifetime and glass purity, particularly in optical or LCD applications. Substitution with advanced ceramics or oxide-reinforced metal composites has not yet achieved widespread industrial adoption due to thermal expansion mismatches and degradation under molten conditions.

In the jewellery sector, rhodium is widely used as a plating material for white gold and silver items. While not structurally essential, it provides a bright, corrosion-resistant finish that is difficult to replicate. Alternatives such as ruthenium and platinum can be used for decorative coatings but differ in colour tone and durability. Consumer expectations, aesthetic trends, and branding also influence the acceptability of substitutes. In cost-sensitive markets, rhodium-free coatings are gaining popularity, although they often require more frequent reapplication.

In defence and space applications, rhodium is employed in precision electrical systems, infrared reflectors, and high-stress thermal components. Alternatives such as platinum-iridium alloys, ceramic coatings, or refractory metals may perform adequately in specific roles, but few materials offer rhodium’s unique combination of chemical inertness, reflectivity, and electrical stability under radiation and vacuum conditions. Substitution typically requires system-level changes, additional shielding, or qualification testing, making it impractical for mission-critical systems. As space programmes and secure communications platforms grow more complex, demand for rhodium’s specialised performance continues to rise.

Rhodium also plays a role in catalytic filters, UV-reflective optics, and potential next-generation technologies such as solar thermochemical hydrogen production and quantum-grade materials. Substitution in these areas remains highly experimental and is often limited by durability and purity thresholds.

Overall, rhodium substitution is constrained by its extreme catalytic efficiency, corrosion resistance, and thermal stability. While certain applications permit partial or functional substitution using other PGMs, base metals, or ceramics, complete replacement often entails compromises in performance, longevity, or compliance. In many sectors, especially automotive emissions control and high-reliability electronics, reducing rhodium loading through catalyst optimisation or reclaiming metal via closed-loop recycling offers a more viable path than full substitution. With rhodium supply tightly constrained and prices volatile, industrial strategies must balance substitution, material efficiency, and secure sourcing to maintain long-term system performance.

Rhodium price in context, 1985 to 2023

Rhodium market balance

| koz | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025f | |

| Primary rhodium supply | |||||||||

| Regional | |||||||||

| South Africa | 625 | 640 | 475 | 670 | 595 | 575 | 575 | 550 | |

| Russia | 75 | 80 | 80 | 75 | 75 | 75 | 75 | 80 | |

| Zimbabwe | 40 | 40 | 45 | 40 | 45 | 45 | 45 | 45 | |

| North America | 20 | 20 | 20 | 20 | 15 | 20 | 15 | 15 | |

| Other | 10 | 10 | 10 | 5 | 5 | 5 | 5 | 5 | |

| Total | 770 | 790 | 630 | 815 | 735 | 720 | 715 | 695 | |

| Rhodium autocatalyst demand | |||||||||

| Gross Rh autocatalyst demand | 915 | 1,020 | 935 | 925 | 925 | 935 | 880 | 865 | |

| Rh autocatalyst recycling | 335 | 350 | 325 | 360 | 325 | 275 | 270 | 285 | |

| Net Rh autocatalyst demand | 580 | 670 | 610 | 565 | 600 | 660 | 610 | 585 | |

| Industrial rhodium demand | 95 | 100 | -15 | 50 | 25 | 130 | 130 | 125 | |

| Other rhodium recycling | 2 | 2 | 2 | 3 | 3 | 2 | 3 | 3 | |

| Gross rhodium demand | 1,010 | 1,125 | 920 | 975 | 950 | 1,070 | 1,010 | 990 | |

| Rhodium recycling | 340 | 355 | 330 | 360 | 330 | 275 | 275 | 285 | |

| Net rhodium demand | 675 | 770 | 590 | 615 | 620 | 790 | 735 | 705 | |

| Rhodium market balance | |||||||||

| Rhodium balance (before ETFs) | 100 | 20 | 35 | 200 | 110 | -75 | -20 | -10 | |

| Rhodium ETFs (stock allocation) | -50 | -15 | -10 | -5 | 0 | 0 | 0 | ||

| Rhodium balance after ETFs | 145 | 35 | 45 | 205 | 115 | -75 | -20 | -10 | |

| Rhodium price history | |||||||||

| Rhodium price (USD/oz) | 1,107 | 2,219 | 3,096 | 11,200 | 15,477 | 6,640 | 4,637 | ||

| Rhodium price (GBP/oz) | 856 | 1,670 | 3,064 | 8,679 | 12,485 | 5,369 | 3,629 | ||

| Rhodium price (EUR/oz) | 975 | 1,886 | 3,500 | 9,745 | 14,663 | 6,148 | 4,287 | ||

| Rhodium price (CNY/oz) | 7,449 | 14,747 | 27,128 | 76,778 | 103,657 | 46,541 | 33,371 | ||

| Rhodium price (ZAR/oz) | 14,757 | 29,651 | 56,736 | 182,407 | 251,503 | 121,362 | 84,919 | ||

| Rhodium price (JPY/oz) | 124,122 | 245,435 | 425,105 | 1,191,458 | 1,211,880 | 916,482 | 702,497 | ||

Source: SFA (Oxford). Updated May 2025.

Linked rhodium market reports

SFA (Oxford) provides regular bespoke market intelligence reports on rhodium as well as in-depth studies on recycling, metal flows and price setting.

Meet the PGM team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Dr Ralph Grimble

Operations Director

Dr Jenny Watts

Critical Minerals Technologies Expert

Jamie Underwood

Principal Consultant

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Ismet Soyocak

ESG & Critical Minerals Lead

Oksan Atilan

Consulting Automotive Analyst

Alex Biddle

Senior Mining Analyst

Thomas Shann Mills

Senior Machine Learning Engineer

Franklin Avery

Commodity Analyst

David Mobbs

Head of Marketing

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.