The Platinum Market

Critical Minerals and The Energy Transition

Navigating the Platinum Market

Platinum is a dense, ductile, and highly corrosion-resistant metal that forms the backbone of numerous strategic technologies and industrial processes. As a member of the platinum group metals (PGMs), its unique physicochemical properties, including exceptional catalytic efficiency, biocompatibility, and thermal stability, make it indispensable across clean energy systems, chemical production, automotive emissions control, and advanced electronics. Beyond its traditional associations with jewellery and investment, platinum has emerged as a critical enabler of global decarbonisation goals, national defence capabilities, and frontier innovation in aerospace and medical applications. The metal’s scarcity, geopolitical concentration of supply, and high recycling potential further elevate its importance in the context of critical raw material policy. As governments and industries seek to build secure, circular, and low-carbon economies, platinum is increasingly viewed not merely as a luxury asset but as a strategic material essential to the resilience of energy, transport, and digital infrastructure. SFA (Oxford) explores the many end-uses of platinum, highlighting its growing relevance in a world defined by energy transition, technological competition, and supply chain realignment.

Listen to the latest platinum podcast

SFA's PGM experts, Dr Jenny Watts and Alex Biddle discuss the latest challenges and opportunities facing the PGM market.

Platinum price news and insights

The UK’s 2025 Critical Minerals Strategy

1 December 2025 | Franklin Avery, Ismet Soyocak

The UK just launched its most elaborate critical minerals strategy to date, setting firm targets and funding to reshape supply chain security.

Platinum Group Metals Market Report – Q3 2025

30 September 2025 | Beresford Clarke

Platinum’s rally—short-term or structural shift? SFA’s Quarterly Report covers key drivers, industry impacts, and price risks to 2028.

Iridium’s outlook linked to hydrogen economy wariness

21 October 2024 | SFA (Oxford) & Heraeus

Chinese heavy-duty vehicle platinum demand could be ready for a rise

7 October 2024 | SFA (Oxford) & Heraeus

Where does the palladium market go from here?

23 September 2024 | SFA (Oxford) & Heraeus

The Chinese car market in 2024 – PHEVs, subsidies and palladium

19 August 2024 | SFA (Oxford) & Heraeus

An introduction to platinum

Platinum demand and end-uses

Platinum, one of the most versatile and valuable of the platinum group metals (PGMs), plays a critical role across a wide spectrum of industrial, technological, and investment applications. Its unique physical and chemical properties, including a high melting point, excellent catalytic behaviour, and exceptional resistance to corrosion, enable diverse end-uses that span clean energy, healthcare, automotive systems, defence, electronics, and space technologies. As global economies shift toward decarbonisation, digitalisation, and enhanced national resilience, platinum’s value as a strategic industrial material continues to rise.

The single largest end-use for platinum remains automotive catalytic converters, where it serves as a key component in reducing nitrogen oxides, carbon monoxide, and hydrocarbons in vehicle exhaust gases. Although palladium dominates gasoline catalysts, platinum remains essential for diesel vehicles and is increasingly important in heavy-duty systems, particularly in jurisdictions with tightening emissions regulations. The rise of hybrid and plug-in hybrid vehicles has also extended platinum’s relevance in transitional powertrains. Looking ahead, regulatory pressure for cleaner internal combustion systems, particularly in developing markets, is likely to underpin baseline platinum demand even as full electrification progresses.

Beyond autocatalysts, platinum is vital in the hydrogen economy, particularly in proton exchange membrane (PEM) fuel cells and electrolysers. It serves as both an anode and cathode catalyst, due to its unparalleled activity and stability in acidic environments. While iridium is used in the oxygen evolution reaction (OER) side of PEM electrolysis, platinum is indispensable on the hydrogen evolution side (HER). As countries expand green hydrogen infrastructure, demand for high-purity platinum is expected to increase significantly, especially in off-grid power, fuel cell electric vehicles (FCEVs), and backup energy storage. These developments are driving a strategic rethink of PGM supply chains, with governments and industry increasingly supporting localised refining, closed-loop recycling, and stockpiling to secure future availability.

In the chemical sector, platinum acts as a catalyst in the production of nitric acid, silicone, and benzene derivatives. Platinum gauzes, typically alloyed with rhodium, are deployed in ammonia oxidation during nitric acid manufacture, a critical process in fertiliser production. These gauzes operate at extreme temperatures and require periodic recovery and replacement, feeding closed-loop recycling systems. Maintaining continuity of supply for this industrial segment is essential for global food security and fertiliser value chains, particularly in an era of climate-related agricultural volatility.

The glass industry employs platinum alloys in high-temperature crucibles, bushings, and stirrers, particularly for producing glass fibre and LCD glass. Platinum’s resistance to deformation and contamination at elevated temperatures ensures the purity and consistency of optical and technical glass products. These components are also heavily recycled after end-of-life, often on-site or via specialist processors. As glass manufacturing expands into areas such as solar PV and advanced optical applications, the reuse and traceability of platinum alloy components are becoming vital considerations for both cost efficiency and ESG compliance.

Platinum’s medical applications are both longstanding and expanding. It is biocompatible, making it suitable for pacemakers, neurostimulators, catheters, and dental alloys. It is also used in cancer treatments, most notably in the chemotherapy drug cisplatin, which disrupts DNA in cancer cells. Newer platinum-based anti-tumour agents are under development for broader oncological uses. The reliability and safety of platinum in clinical settings ensure its continued use across next-generation implantables and drug delivery systems. In the context of global health system resilience, supply security for medical-grade platinum is attracting increased attention from governments and pharmaceutical suppliers alike.

In electronics, platinum is used in thermocouples, hard disks, and spark plugs. It also serves as a barrier layer in semiconductors, especially in high-temperature and high-reliability applications. Its role in emerging microelectronics and memory storage technologies continues to be explored, particularly where miniaturisation demands superior conductivity and chemical stability. As the world moves towards more electrified and digitally integrated systems, demand for high-purity platinum in advanced components is forecast to rise steadily. Efforts to reduce material losses during component manufacture and to recover platinum from electronic scrap are gaining momentum within the circular electronics industry.

Platinum has growing strategic value in the defence and aerospace sectors. In defence, platinum is used in a range of high-reliability systems including missile guidance units, electromagnetic shielding, hardened communication systems, and infrared sensors. Its stability and conductivity make it suitable for harsh environments and extended-lifetime applications, especially in electronic warfare systems and advanced propulsion platforms. As military platforms evolve to include more autonomous, electrified, and sensor-heavy technologies, platinum will play a crucial role in ensuring durability and performance in mission-critical environments. The secure sourcing and recycling of PGMs for defence is increasingly recognised as a national security imperative.

In aerospace and spaceflight, platinum and its alloys are deployed in thruster components, fuel systems, and temperature sensors for spacecraft and satellites. Hydrazine monopropellant thrusters, widely used in orbital manoeuvring and attitude control systems, rely on platinum catalysts to initiate and sustain the decomposition reaction. These platinum-based catalysts offer unmatched reliability in vacuum conditions, where in-situ maintenance is not possible. Platinum is also used in thermocouples, structural coatings, and other heat-resistant components vital to both crewed and uncrewed missions. Its resistance to oxidation and performance under extreme thermal cycling make it indispensable in launch systems, re-entry vehicles, and deep space exploration. As satellite constellations, lunar programmes, and commercial space ventures expand, demand for aerospace-grade platinum materials is expected to rise. Securing refining capacity and recycling routes for aerospace-grade PGMs will be vital to the resilience of the global space supply chain.

Platinum also retains investment and jewellery demand, especially in Asia. While less price-volatile than gold, it is subject to cyclical swings driven by industrial use. Exchange-traded funds (ETFs), coins, and bars are channels for investor exposure. Meanwhile, the jewellery sector, particularly in China and India, drives significant tonnage, with platinum prized for its rarity, purity, and enduring finish. Investment demand tends to spike during periods of geopolitical tension or industrial disruption, providing a counterbalance to physical offtake. As ESG and traceability standards gain importance in the luxury sector, recycled platinum is emerging as a competitive differentiator for ethically branded jewellery products.

Platinum supply

Platinum supply is geographically concentrated, with South Africa by far the dominant producer, accounting for over 70 percent of global primary output. Russia follows as the second-largest source, with smaller contributions from Zimbabwe, Canada, and the United States. Additional minor production occurs in countries such as Colombia, Finland, and Australia. This concentration highlights the strategic vulnerability of platinum supply chains, particularly given the geopolitical and ESG risks associated with key producing regions.

Primary platinum is extracted from mafic and ultramafic igneous complexes, notably the Bushveld Complex in South Africa and the Norilsk-Talnakh region in Russia. These geological formations yield platinum as part of a wider suite of platinum group metals (PGMs), alongside palladium, rhodium, iridium, ruthenium, and osmium. Platinum is typically recovered as part of a polymetallic concentrate during the mining of PGM-bearing ores, with nickel, copper, cobalt, and gold often produced as co-products or by-products depending on the mineralogy and metallurgical flowsheet.

Platinum is also obtained from secondary sources through open-loop and closed-loop recycling. The largest volume comes from spent automotive catalytic converters, where platinum is recovered alongside palladium and rhodium using pyro- and hydrometallurgical techniques. Industrial catalysts used in the glass, chemical, and petroleum sectors also contribute significantly to supply, particularly through well-established closed-loop systems. High-purity recycled platinum is critical for specialised applications, such as PEM fuel cells and medical devices, where contamination must be strictly controlled.

Geopolitics plays a decisive role in shaping platinum supply, particularly due to South Africa’s recurring challenges with electricity shortages, labour unrest, and regulatory uncertainty. Russia’s production, dominated by Norilsk Nickel, faces increasing scrutiny due to sanctions and restricted access to refining and financial infrastructure. Zimbabwe, while rich in PGM resources, faces investment and infrastructure barriers that limit production growth. These factors heighten interest in developing stable refining hubs and diversifying sources of secondary platinum through enhanced recycling and urban mining.

Environmental regulations are also reshaping the platinum supply landscape. Although PGM mining is less toxic than other extractive industries, it remains energy- and water-intensive, particularly in deep-level South African operations. Stricter ESG requirements are prompting companies to invest in low-impact processing technologies, improve water stewardship, and certify responsible sourcing. These efforts are necessary to meet growing demand from sustainability-driven sectors, including green hydrogen and clean mobility, which increasingly require transparent and low-carbon supply chains.

As platinum demand rises across automotive, hydrogen, medical, defence, and electronics applications, securing reliable and responsible supply has become a strategic priority. Recycling will play a larger role in mitigating supply risk, reducing environmental impact, and supporting circular economy objectives. However, secondary supply alone cannot fully offset the volatility and concentration risks inherent in the primary production landscape, reinforcing the need for coordinated efforts to strengthen and diversify the global platinum supply chain.

Current primary platinum producers

Platinum substitution

For catalytic converters, platinum can be partially substituted with palladium and rhodium, depending on engine type and emissions requirements. In gasoline engines, palladium has largely displaced platinum due to cost advantages and adequate catalytic performance. However, in diesel systems and heavy-duty applications, platinum remains superior for oxidising nitrogen oxides and carbon monoxide under lean-burn conditions. Substitution with palladium or rhodium may compromise long-term thermal stability and catalytic efficiency, particularly in high-temperature or sulphur-rich environments.

In chemical catalysis, such as nitric acid production or silicone manufacturing, platinum catalysts are difficult to replace without sacrificing yield, selectivity, or process integrity. Some research explores the use of base metal catalysts or modified ceramics, yet these alternatives often degrade faster or require more frequent replacement. Consequently, while partial substitution is technically possible, it typically introduces higher operational costs, reduced process stability, or elevated environmental burdens due to lower recyclability.

For PEM fuel cells and electrolysers, platinum’s role is increasingly scrutinised due to cost and supply risks. Efforts to substitute platinum at the hydrogen electrode with lower-cost materials like nickel, molybdenum, or carbon-based catalysts have shown promise in laboratory settings, particularly under alkaline conditions. However, under the acidic conditions required for PEM systems, platinum remains unmatched for catalytic activity and corrosion resistance. Reducing platinum loading per unit through alloying or catalyst support engineering is currently more viable than full substitution.

In jewellery, platinum can be substituted with white gold, palladium, or high-grade silver alloys to achieve a similar aesthetic. Yet, these alternatives often lack the same hypoallergenic properties, durability, and weight, making platinum irreplaceable for premium segments. Substitution may also reduce consumer perception of luxury and value, limiting its use to cost-sensitive markets.

For medical devices, including pacemaker leads and chemotherapy drugs like cisplatin, substitution options are constrained by biocompatibility, toxicity, and performance standards. Titanium and certain polymers can replace platinum in structural implants or connectors, but for electrical conductivity and drug efficacy, platinum remains essential. Alternative metallodrugs are under development, though clinical adoption depends on long-term safety and regulatory approval.

In aerospace and defence systems, platinum’s use in sensors, thermocouples, and propulsion components reflects its reliability under extreme conditions. While ceramic coatings and refractory metals can substitute in some thermal shielding applications, they lack platinum’s combined chemical inertness, catalytic properties, and conductivity. As such, substitution often requires design changes or trade-offs in performance.

Overall, platinum substitution remains highly application-specific. While partial displacement is feasible in select sectors, complete replacement often entails compromises in durability, efficiency, or regulatory compliance. For most industrial and strategic applications, reducing platinum content through efficiency gains or recycling remains more practical than eliminating its use altogether.

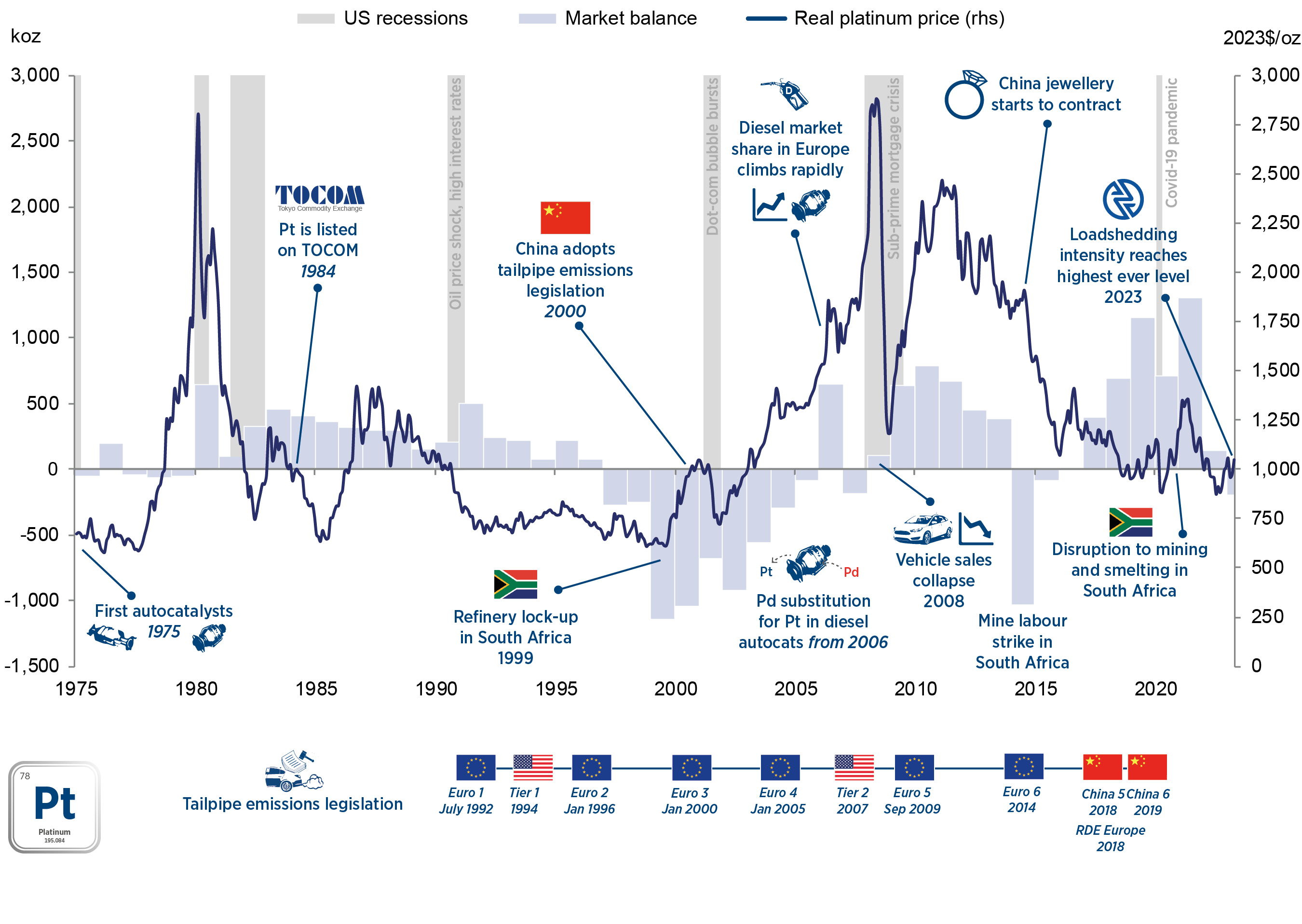

Platinum price in context, 1975 to 2023

Platinum market balance

| koz | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | |

| Primary platinum supply | |||||||||

| Regional | |||||||||

| South Africa | 4,470 | 4,405 | 3,260 | 4,715 | 3,975 | 3,935 | 3,945 | 3,775 | |

| Russia | 665 | 710 | 700 | 640 | 655 | 670 | 670 | 680 | |

| Zimbabwe | 465 | 460 | 480 | 470 | 490 | 520 | 505 | 500 | |

| North America | 345 | 350 | 330 | 265 | 250 | 265 | 260 | 220 | |

| Other | 180 | 185 | 175 | 125 | 130 | 120 | 120 | 120 | |

| Total | 6,130 | 6,105 | 4,950 | 6,220 | 5,490 | 5,520 | 5,500 | 5,295 | |

| Platinum demand and recycling |

|||||||||

| Platinum autocatalyst demand | |||||||||

| Gross Pt autocatalyst demand | 3,120 | 2,870 | 2,440 | 2,805 | 2,995 | 3,435 | 3,330 | 3,565 | |

| Platinum autocatalst recycling | 1,420 | 1,495 | 1,310 | 1,425 | 1,280 | 1,080 | 1,070 | 1,100 | |

| Net Pt autocatalyst demand | 1,700 | 1,370 | 1,130 | 1,385 | 1,715 | 2,355 | 2,255 | 2,465 | |

| Platinum jewellery demand | |||||||||

| Gross Pt jewellery demand | 2,245 | 2,090 | 1,560 | 1,780 | 1,455 | 1,360 | 1,350 | 1,325 | |

| Platinum jewellery recycling | 505 | 500 | 410 | 400 | 250 | 245 | 290 | 295 | |

| Net Pt jewellery demand | 1,740 | 1,595 | 1,150 | 1,380 | 1,205 | 1,115 | 1,060 | 1,030 | |

| Industrial platinum demand | 2,115 | 2,150 | 2,085 | 2,260 | 2,305 | 2,240 | 2,230 | 2,220 | |

| Hydrogen platinum demand | 70 | 40 | 15 | 20 | 20 | 60 | 70 | 95 | |

| Other platinum recycling | 30 | 30 | 30 | 45 | 40 | 40 | 45 | 40 | |

| Gross platinum demand | 7,550 | 7,150 | 6,095 | 6,885 | 6,780 | 7,095 | 6,980 | 7,205 | |

| Platinum recycling | 1,955 | 2,025 | 1,755 | 1,865 | 1,570 | 1,365 | 1,410 | 1,440 | |

| Net platinum demand | 5,595 | 5,125 | 4,345 | 4,995 | 5,205 | 5,730 | 5,570 | 5,765 | |

| Platinum market balance | |||||||||

| Platinum balance (before ETFs) | 535 | 980 | 605 | 1,220 | 285 | -210 | -70 | -470 | |

| Platinum ETFs (stock allocation) | -240 | 990 | 495 | -275 | -565 | -80 | 270 | ||

| Platinum balance after ETFs | 775 | -10 | 110 | 1,495 | 845 | -130 | -340 | -470 | |

| Platinum price history | |||||||||

| Platinum price (USD/oz) | 948 | 879 | 864 | 884 | 961 | 967 | 956 | ||

| Platinum price (GBP/oz) | 737 | 658 | 677 | 688 | 778 | 777 | 748 | ||

| Platinum price (EUR/oz) | 842 | 744 | 772 | 774 | 912 | 894 | 883 | ||

| Platinum price (CHF/oz) | 934 | 859 | 858 | 829 | 996 | 869 | 842 | ||

| Platinum price (CNY/oz) | 6,046 | 5,805 | 5,92 | 6,091 | 6,461 | 6,839 | 6,876 | ||

| Platinum price (ZAR/oz) | 12,620 | 11,579 | 12,488 | 14,458 | 15,699 | 17,825 | 17,506 | ||

| Platinum price (INR/oz) | 59,954 | 60,833 | 65,449 | 80,538 | 75,475 | 79,793 | 79,942 | ||

| Platinum price (JPY/oz) | 106,347 | 96,998 | 94,166 | 94,371 | 125,939 | 135,554 | 144,805 | ||

Source: SFA (Oxford). Updated May 2025.

Linked platinum market reports

SFA (Oxford) provides regular bespoke market intelligence reports on platinum as well as in-depth studies on recycling, metal flows and price setting.

Meet the PGM team

Trusted advice from a dedicated team of experts.

Henk de Hoop

Chief Executive Officer

Beresford Clarke

Managing Director: Technical & Research

Dr Ralph Grimble

Operations Director

Dr Jenny Watts

Critical Minerals Technologies Expert

Jamie Underwood

Principal Consultant

Rj Coetzee

Senior Market Analyst: Battery Materials and Technologies

Ismet Soyocak

ESG & Critical Minerals Lead

Oksan Atilan

Consulting Automotive Analyst

Alex Biddle

Senior Mining Analyst

Thomas Shann Mills

Senior Machine Learning Engineer

Franklin Avery

Commodity Analyst

David Mobbs

Head of Marketing

How can we help you?

SFA (Oxford) provides bespoke, independent intelligence on the strategic metal markets, specifically tailored to your needs. To find out more about what we can offer you, please contact us.